Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Acceptance Financial: Debt Relief Loans

First Things First!

Remember – if I post a copy of any direct mail piece you email to e[email protected], I will send you $50. I am looking for direct mail offers with suspiciously low-interest rates. Just remember – I have to post the exact image you send me and I can only pay out the $50 to the first person who sends me a copy. I want to thank all of those who have been emailing me to keep the $50 and just continue with my good work.

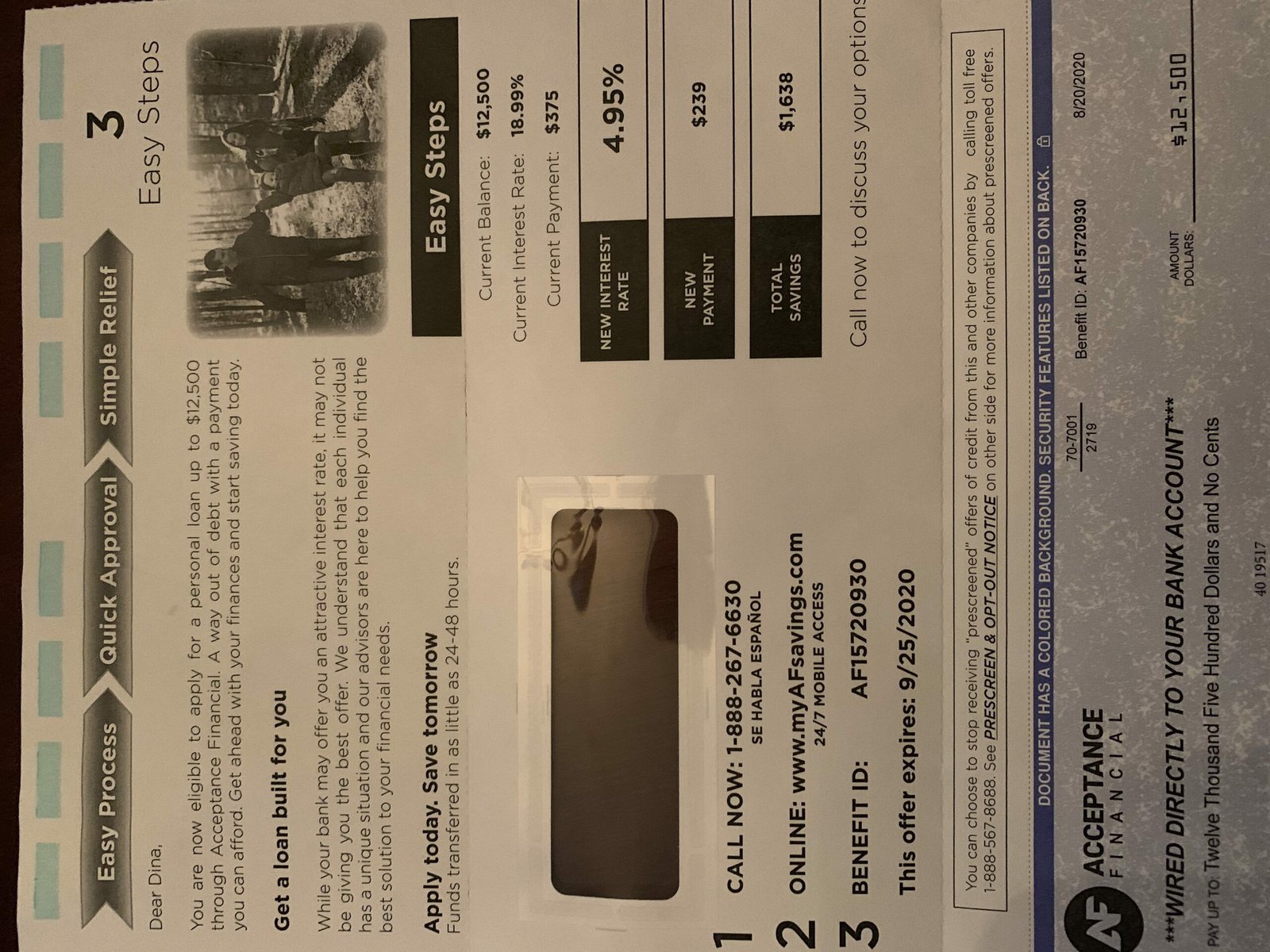

Is Acceptance Financial a legitimate company? You probably received a mailer with a personalized reservation code offering you a pre-approved loan with a below 5% interest rate to consolidate your credit card and other high-interest debt.

And off you go looking for reviews.

1.0 out of 5.0 stars1.0

Is it Legit or a Scam?

Acceptance Financial is another bait and switch.

They lure you in by sending you direct mail with a “personalized reservation code” and a low 4%-5% interest rate to consolidate your high-interest credit card debt. Acceptance Financial doesn’t tell you that you need excellent credit to qualify for a loan with that low-interest rate (which you have been supposedly pre-approved for).

crixeo.com awarded Acceptance Financial a 1-star rating (data collected and updated as of October 7, 2020). We hope the information below will help you make an educated decision on whether to do business with Acceptance Financial.

- Acceptance Financial is not a lender.

- The fine print at the bottom of the Acceptance Financial website states, “You received this offer because you met certain criteria for creditworthiness. Although Acceptance Financial is not a lender and does not engage in the business of lending, we have working relationships and contacts with a network of independent lenders (“Lenders”) who may be able to provide you with credit.

- It appears that Acceptance Financial is operating a typical bait and switch scheme. They lure you in by sending you direct mail with a “personalized reservation code” and a low 2.5%-4.5% interest rate to consolidate your high-interest credit card debt.

- It isn’t too evident that you need excellent credit to qualify for a loan with that low 2.92% interest rate (which you have been supposedly pre-approved for).

Reviews and Ratings

Acceptance Financial doesn’t have a profile with the BBB. They only have reviews on Trustpilot. We were able to find one bad review, stating this company was a rip-off. Most of the reviews are positive, however, it seems like customers are invited to make a review early in the process, so they don’t reflect what really happened during the negotiation.

Acceptance Financial Reviews

Find below some of the very recent Acceptance Financial Bad Reviews:

Trustpilot Customer – May 11, 2020 – 1.0 out of 5.0 stars1.0

THIS IS A RIP OFF

THIS IS A RIP OFF. YOU WILL GET THE RUN AROUND TO GET YOUR MONEY BACK. YOU WILL NOT HAVE CONTROL OVER THE MONEY IN THE ACCOUNT. A LAW FIRM TAKES THE MONEY THEN WON’T RETURN YOUR CALLS. Useful Share

Why Do We Focus On Acceptance Financial’s Negative Reviews?

We urge you to do your own research and due diligence on any company, especially when dealing with your personal finances. The positive reviews seemed a little bit too generic. We do not imply that Acceptance Financial Reviews are fake. We have no information to suggest that. However, we do urge you to pay attention to what consumers are saying in their very detailed complaints and reviews and put them side by side with the positive ones to evaluate the quality of authenticity for yourself.

We wish you luck and invite you to take a look at Crixeo’s

Best Debt Consolidation Reviews of 2024.

No Comments

Visitor Rating: 4 Stars

Visitor Rating: 4 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars