Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

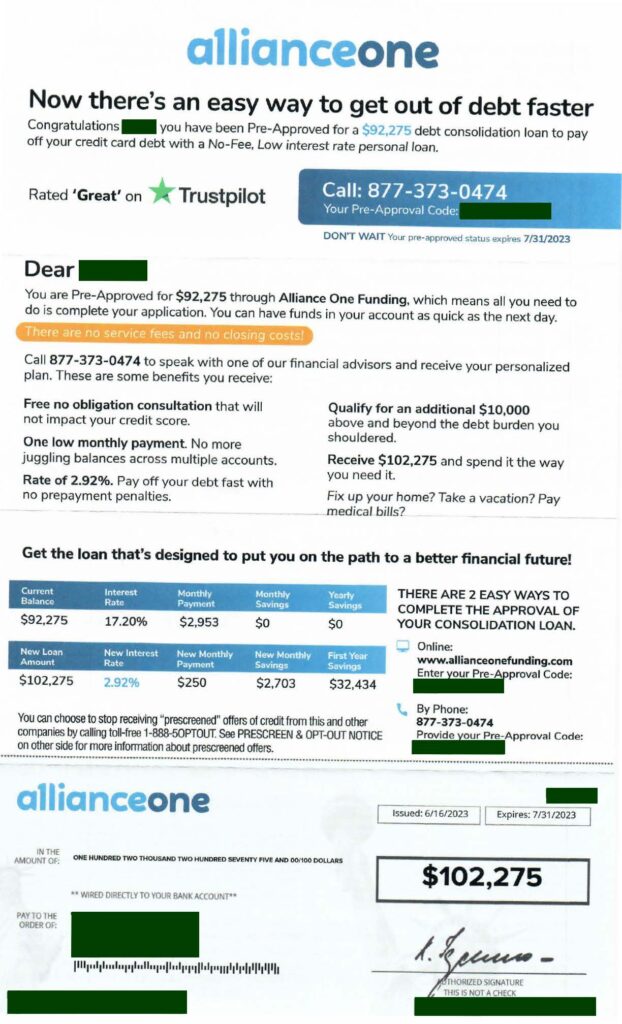

Alliance One Funding Debt Consolidation Mailer

- Have you received direct mail from Alliance One Funding pre-approving you a 2.92 percent interest rate?

- Did it come along with a check for over $100,000?

- Did it offer you savings of over $2,700 per month?

- Did you have your very own personalized reservation code?

- Is your credit not as great as it once was?

- Does it seem too good to be true?

Something To Think About

The “discount rate” is the interest rate the Federal Reserve charges banks for short-term loans. Today, the discount rate is 5.25 percent, whereas one year ago, it was 1.75 percent. If you were pre-approved for a loan at 2.92 percent, you would be paying less interest than the banks are paying the US Treasury to borrow their own money.

Navigating the world of financial services can often feel like walking through a minefield, especially when it comes to debt relief companies. One of the companies that you might come across on your financial journey is Alliance One Funding. But how do you ascertain if this company is a legitimate source of debt relief or simply another scam? In this review, we critically examine Alliance One Funding, providing insights into its operations, reputation, and credibility to help you make an informed decision.

Alliance One Funding Summary

Can Alliance One Funding Help You Get Out of Credit Card Debt?

Alliance One Funding markets itself as a lending company that offers personal loans to assist individuals in becoming debt-free. They claim to offer very lower interest rates, a simple application process, and custom-tailored consolidation plans. The website provides testimonials, loan examples, and a range of APR based on credit rating. Users can schedule free consultations and receive special offers.

As part of our investigation into their website and terms and conditions, we discovered some interesting facts. Let’s start with the fine print below:

The company does not lend money or engage in any lending activities. They are not a bank or financial institution. A customer’s loan amount, term, and APR may vary based on credit determination and state law. Minimum loan amounts vary by state. You may not receive credit from a Lender if, after applying, they find that you no longer meet the requirements. Annual Percentage Rates (APR) range from 2.92% to 24.99%.

Is Alliance One Funding Legit or a Scam?

There are mixed reviews available online about the company, with some clients expressing satisfaction with their services while others have raised complaints. It’s essential to understand that the presence of negative reviews does not necessarily denote a scam, but potential clients should exercise caution. Always check the company’s accreditations, read through their terms and conditions, and consider seeking independent financial advice before making any decisions.

Alliance One Funding Reviews

Alliance One Funding BBB Reviews

We were unable to locate a BBB file on Alliance One Funding. That is not a positive sign.

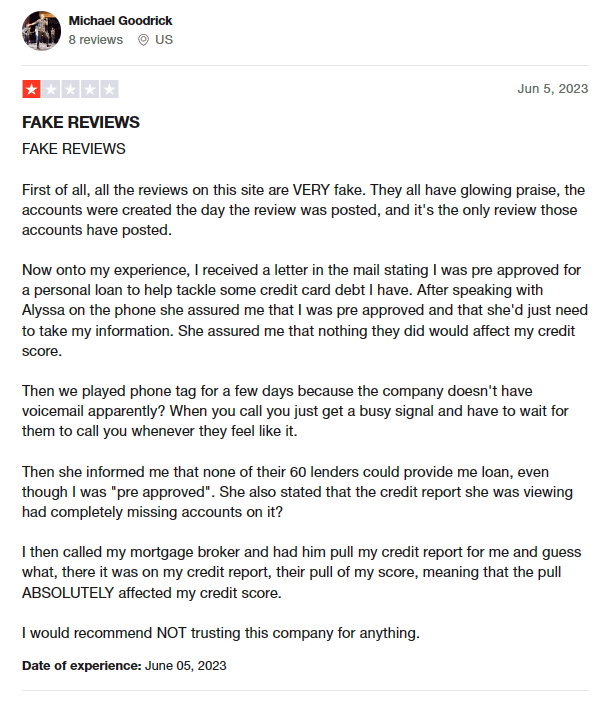

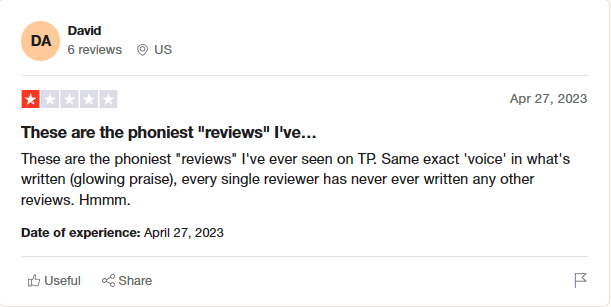

Alliance One Funding Trustpilot Reviews

Trustpilot features customer reviews of Alliance One Funding, a loan agency. There are a total of 12 reviews, with an average rating of 3.5 stars. Some reviews express skepticism about the authenticity of the positive reviews, noting similarities in writing style and the lack of previous reviews from the accounts. One reviewer had a negative experience, mentioning issues with communication, discrepancies in credit reports, and the negative impact on their credit score. Several positive reviews highlight the professionalism, cooperation, and helpfulness of Alliance One Funding in providing loans and debt relief services. Below are the two most recent reviews from Alliance One Funding:

What is Alliance One Funding?

Alliance One Funding claims to be a financial service company that specializes in offering debt relief solutions to individuals and businesses. They provide a range of services, including credit card debt consolidation programs, personal loans for debt consolidation, financial consultation services, and a smooth enrollment process that leads to a finalized payment plan. They employ finance managers that state that their main goal is to help clients reduce their debt, improve their credit, and achieve financial freedom. Alliance One Funding also maintains that they work with a team of professional debt experts who assess their clients’ financial situation and create a personalized plan to address their specific needs and goals.

How does Alliance One Funding work?

According to the company’s website, Alliance One Funding works by providing financial solutions to individuals struggling with high-interest unsecured debt. These solutions often involve debt consolidation or debt settlement programs. The process begins with a free consultation where a professional evaluates the client’s financial situation and discusses suitable options. If the client decides to proceed with the recommended debt relief program, Alliance One Funding negotiates with creditors on behalf of the client, aiming to reduce the total amount owed or to consolidate multiple debts into a single, more manageable monthly payment. It’s important to note that while these programs can ease financial strain, they may also impact the client’s credit score.

How to qualify for Alliance One Funding?

The company’s website gives plenty of information on the company’s services:

Debt Relief Options

Alliance One Funding has a web page that discusses the following Debt Relief Options:

- Personal loans are available as a debt relief option and typically do not require collateral, but they have criteria such as credit score, debt-to-income ratio, and loan history.

- Home equity loans or lines of credit can be used for borrowing money, but they require high credit scores and are not easily accessible for those already in debt.

- Payday loans, although easily accessible regardless of credit scores, have high rates and fees and can lead to a cycle of never-ending debt.

- Credit cards can be used as a lending option for manageable purchases or emergency needs, but balance transfer rates can increase over time.

- Financial management software provides DIY tools for budgeting and financial information but may not offer personalized help for specific debt problems.

- Debt relief plans offer personalized solutions for eliminating debt, lowering monthly payments, and negotiating settlements with creditors, often without upfront or additional costs.

How it Works

Alliance One Funding has a page titled “Who Choose Us” and it discusses “How It Works.”

- Alliance One Funding offers unsecured personal loans with low interest rates and no prepayment penalties.

- They provide a free consultation with a representative who can offer options and answer questions without any obligation or hard credit inquiry.

- The financial team at Alliance One Funding creates personalized debt consolidation plans for customers.

- They emphasize in-person meetings to ensure accuracy and offer simple plans with one monthly payment to help customers achieve total debt freedom.

- Testimonials reflect positive experiences with Alliance One Funding, highlighting their professionalism and understanding of individual situations.

What We Offer

Alliance One Funding has a page titled “What We Offer”

- Alliance One Funding offers a one-stop shop for all borrowing needs, providing competitive interest rates and terms.

- Their experienced team aims to stop financial surprises, consolidate bills into one low monthly payment, and help customers avoid bankruptcy.

- They offer free consultations, risk-free plans, and no upfront fees or initial credit checks.

- Alliance One Funding emphasizes in-person meetings to finalize payment plans and ensures there are no prepayment penalties.

- Their services aim to lower lending stress, manage existing debt, pay off bills quickly, and eliminate harassing creditor calls.

FAQ

How long does Alliance One Funding take to approve?

Approval for a loan may take longer depending on how many additional documents are requested. Loan terms and conditions will be based on creditworthiness and state law.

How much does Alliance One Funding charge?

It’s not entirely clear how Alliance One Funding makes money. There are no mentions of fees anywhere on the site. It’s possible that they make money through referral fees, but that’s not explicitly stated.

How does Alliance One Funding affect your credit?

Credit scores can be a major source of stress for many people seeking loans. However, it’s important to remember that simply getting a consultation from a lender will not have any impact on your credit score. The only way your score could potentially be lowered is by actually taking out the loan and having the lender check your credit history as part of the process.

How to cancel your Alliance One Funding?

Before you decide to take out a personal loan, be aware that you will not be able to cancel or reverse the loan once the funds have been deposited. Be sure that you really need the loan and are comfortable with the terms and conditions before accepting.

No Comments

Visitor Rating: 4 Stars

Visitor Rating: 2 Stars

Visitor Rating: 3 Stars

Visitor Rating: 5 Stars