Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

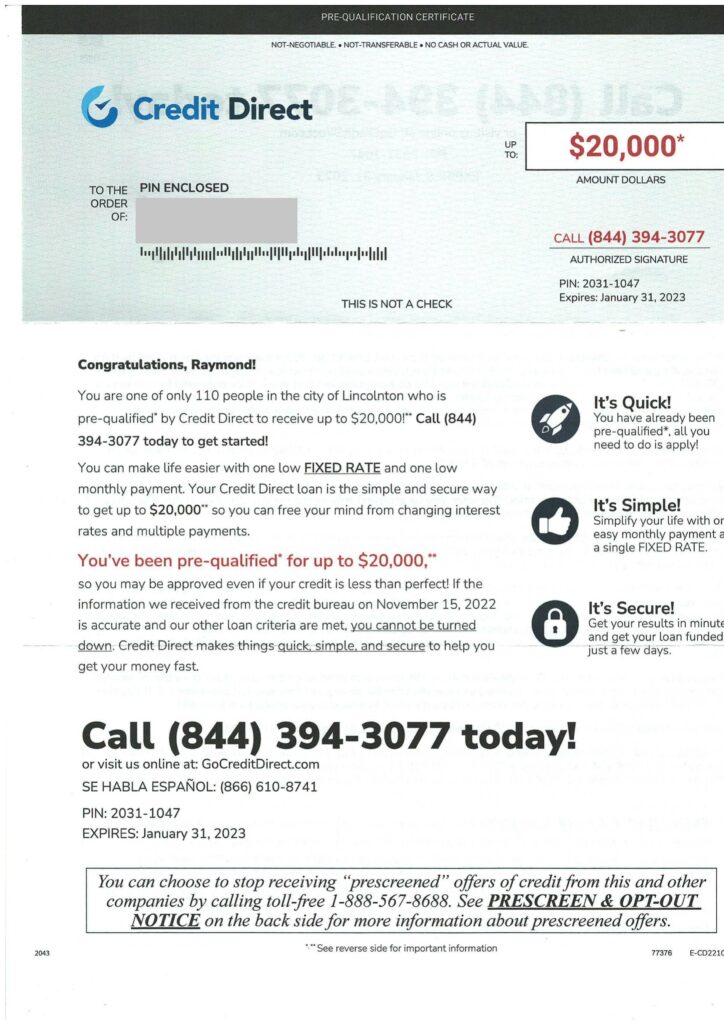

Delmarva Funding LLC offers a variety of financial assistance through its registered D/B/A, Credit Direct. As a lender, Delmarva Funding also works with a network of other lenders to provide affordable options for those in need. The company advertises its services at creditdirect.com.

Credit Direct Summary

There are many reasons why you might need a personal loan. Maybe you want to consolidate your debt, make home improvements, or just have extra cash on hand. Whatever your reason, there are plenty of lenders to choose from. So how do you know which one is right for you? Credit Direct is one option that has been getting a lot of attention lately. But is this lender right for you? Here’s a closer look so you can make an informed decision.

We did some digging and found some interesting things about their website and terms and conditions. Here are a few of the things that caught our attention.

- It offers fixed interest rates from 4.99% APR to 29.99% APR.

- Loan amounts range from $1,000 to $40,000.

- There are no administration fees.

- Loan repayment terms range from 12 months to 60 months.

- Loans through Credit Direct are private loans.

- The company reserves the right to change services, benefits, rates, and terms without notice.

What is Credit Direct?

Credit Direct is offered by Delmarva Funding LLC. Founded in 2012, Credit Direct is a US-based direct lender that offers loans in 13 states across the country. The company’s headquarter is located in Rockville, MD and you can reach them by calling (888) 730-9988.

At Credit Direct, they pride themselves on their A+ rating from the BBB. They have been accredited since 2016 and have an average of 40 customer reviews. They have also closed 1 complaint in the last 3 years.

How does Credit Direct work?

Credit Direct is a personal loan marketplace that offers loans to individuals seeking financial assistance for various purposes. Many Credit Direct reviews praise the company for its diverse loan options and debt consolidation services. Credit Direct operates in several states, including North Carolina, Oklahoma, and Pennsylvania, and offers loans up to the maximum loan amount allowed by state laws.

At CreditsDirect, they offer unsecured loans that you can apply for without affecting your credit score. Their simple online form only takes a few minutes to fill out, and you’ll be able to compare personalized offers in no time.

When applying for a loan with Credit Direct, applicants must submit their credit scores and credit reports to determine potential rates and loan offers. The application process is straightforward, with pre-qualifying options available to avoid a hard credit pull, which can affect your credit score. Once approved, funds are typically deposited directly into the borrower’s bank account.

Credit Direct’s website provides clear information on origination fees, monthly payment options, and potential rates, ensuring that there are no hidden fees throughout the entire process. The website also emphasizes that there are no prepayment penalties, giving borrowers the flexibility to pay off their loans early.

Credit Direct offers loans for a variety of purposes, including major purchases, unexpected expenses, medical bills, debt consolidation, and even auto loans. The loan term and interest rate can vary based on the borrower’s financial situation and credit history.

Credit Direct’s application process allows for a soft pull, which does not affect the borrower’s credit score, to provide more loan options. However, if the borrower decides to move forward with a loan, a hard credit pull will be conducted, which will affect their credit score.

You can expect to receive your funds within 48 to 72 hours after your application is approved and completed. Direct deposit into your bank account is the most common method of receiving funds, though other options are available.

How to qualify for Credit Direct?

It is not necessary to have a minimum credit score to apply for a Credit Direct loan. Instead, they take into account other factors that show your ability to repay the loan, which gives you a better chance of being approved.

In order to apply, you will need a social security number. At this time they cannot accept a tax ID.

Once you have accepted a pre-qualified loan offer, there are a few things you’ll need to have on hand to complete your application and accept the loan. At a minimum, you’ll need:

- 2 months of bank statements (all pages)

- 1 month of ALL pay stubs

- Your most recent W2

- A copy of your government-issued ID (like a driver’s license or passport)

Credit Direct BBB Reviews

Credit Direct is a company that is proud of its A+ rating from the BBB. It has been accredited since 2016 and has an average of 40 customer reviews. It has also closed 1 complaint in the last 3 years.

Here are some reviews:

I’ve been working with Credit Direct for about 3 weeks now and it had been absolutely challenging. For starters, when requesting documentation they use Google Drive, and when they ask for multiple documents it does not allow them to add additional attachments to the same section. Proceeding that if there is a request from Credit Direct, I have not received a call regarding what it was regarding. The phone number provided to me was practically non-existent as well. After 10 attempts at different times throughout the day, I would not able to reach anyone. The process should have been simple and yet it has been frustrating. This would be my last working with a company that manages this way.

Fabian L

10/27/2022

Doug was easy to work with and very informative. He was responsive and followed up.

Jon W

09/03/2022

Literally. No one ever answers the phone. Does it always go to? Doug’s desk? yet I’ve gotten voicemails and emails from like 4 different dudes all with the same number. When I answer the phone they hang up. So I dunno. It seems like they build you up thinking you have offers only to get let down.

Mark B

05/26/2021

Credit Direct FAQs

How much does Credit Direct charge?

Credit Direct offers fixed interest rates from as low as 4.99% APR to as high as 29.99% APR. Loan repayment terms range from 12 months all the way up to 60 months. Loan amounts can be anything from $1,000 to $40,000. And there are no administration fees!

Are there any pre-payment penalties?

At Credit Direct, there are no prepayment penalties for those who choose to pay off their loan faster than originally scheduled.

Credit Direct’s application process and wide range of loan options make it a reliable choice for individuals seeking personal loans. With no hidden fees and the ability to pre-qualify without affecting credit scores, Credit Direct is an option for those in need of financial assistance.

How does Credit Direct affect your credit?

When you’re considering taking out a loan, the lender will usually do a soft credit pull to give you an idea of the interest rates and terms you may qualify for. This won’t have any impact on your credit score.

However, once you’ve decided to go ahead with the loan application, they’ll need to make a hard credit inquiry to get a complete view of your credit history and offer you final rates. These hard inquiries will lower your credit score and are common when applying for loans.

Credit Direct’s student loan and credit card debt consolidation services have been particularly helpful for many customers looking to improve their financial situations. With multiple lenders available, borrowers can choose the best loan option for their needs.

How to cancel Credit Direct?

Before submitting your personal loan application, be sure of your decision. Once the loan amount is credited to your account, it cannot be reversed or canceled. Therefore, it is important to carefully consider all factors before applying for a personal loan. This will help avoid any cancellations or changes down the line.

Are you struggling to make ends meet? Here are some tips that could help you get back on track.

- Creating and sticking to a budget is a great way to stay on track.

- Another option is to speak with a financial advisor who can help you understand your options and develop a plan that works for your unique circumstances.

- And finally, don’t worry too much if you’re already in debt. Many companies are willing to work with customers to create a more manageable payment plan. So reach out to their customer service team for more information.

Is Credit Direct legit or a scam?

In 2012, Credit Direct was founded. The company has been in business for 10 years and employs around 2 people. Although the company is well-established, we don’t have enough customer reviews to give a reliable rating of their user experience or customer service.

There are a few things to keep in mind before taking out a loan. First, make sure to explore all of your options and compare rates. Reading customer reviews can help you choose the best option. Second, be sure you can afford the loan payments before making a decision. This way, you can avoid any financial trouble down the road.

Do you know creditdirect.com? Leave your experience and review below!

Thank you for reading!