Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Crown Street Funding Review: Debt Relief Loans

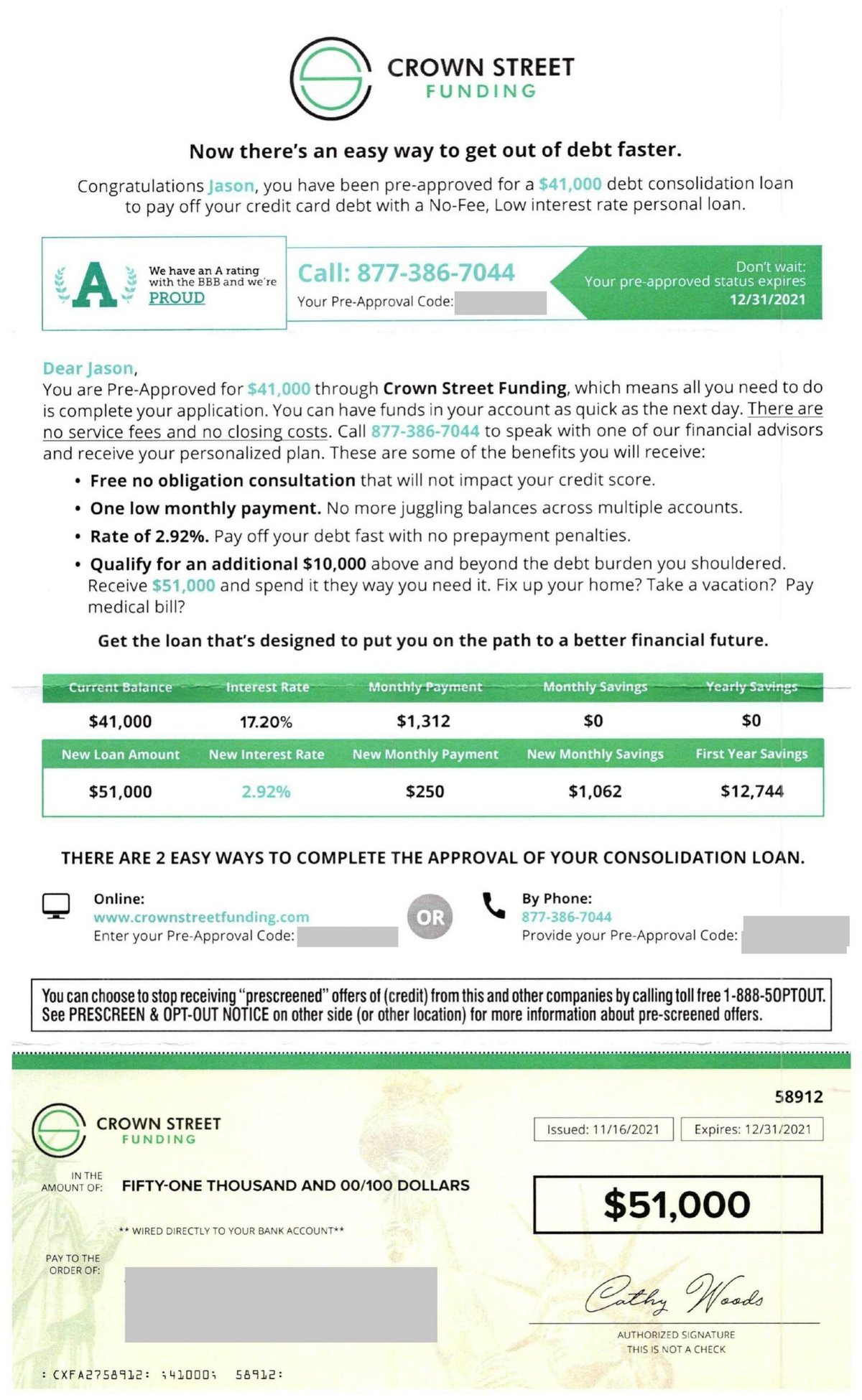

Have you received a pre-approved offer from Crown Street Funding?

Did your pre-approved offer include a pre-approval code as if you were personally selected for this offer?

Did your pre-approved offer state: “Your pre-approved for $41,000 through Crown Street Funding”

Did your pre-approved offer include a check for $51,000?

Did your pre-approved offer show your interest rate being reduced from 17.2% to 2.92% APR?

Did your pre-approved offer show your new monthly payment being reduced from $1300 to $250?

Who is Crown Street Funding? They aren’t a lender. They appear to be a lead generator primarily selling to debt settlement companies.

Seems a little good to be true?

And off you go looking for reviews.

Is Crown Street Funding Legit or a Scam?

crixeo.com awarded Crown Street Funding a 2-star rating (data collected and updated as of December 27, 2021). We hope the information below will help you make an educated decision on whether to do business with then company.

- Crown Street Funding is not a lender.

- It appears that Crown Street Funding is operating a typical bait and switch scheme – but not for themselves – for their lead buyers. They lure you in by sending you direct mail with a offering a ridiculous 2.92% interest rate to consolidate your high-interest credit card debt.

- Crown Street Funding doesn’t tell you that you need excellent credit to qualify for a loan with that low-interest rate (which you have been supposedly pre-approved for).

- We are curious to find out how many of the consumers that were mailed this offer actually qualify for 2.92% interest.

Crown Street Funding Reviews

According to the Better Business Bureau, Crown Street Funding is less than one year old. Upon further review, there is already one negative review on Trustpilot which states:

Gave Me Nothing But A Run Around [star rating = “1.0”]

Gave me nothing but a run around. Got all my info and never got back to me. i called them 3x and they would say they will get back to me. Nobody ever did. Its a joke and fake. Don’t fall for it, I was made a fool today.

We urge you to do your own research and due diligence on any company, especially when dealing with personal financial needs such as debt consolidation or debt relief.

We wish you luck and invite you to take a look at Crixeo’s Best Debt Consolidation Reviews of 2024.

No Comments

Visitor Rating: 3 Stars