Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

The Florida Credit Union was originally chartered in 1954 as the Alachua County Teachers’ Credit Union. It was created to serve the financial needs of teachers working in the Alachua County School System. After its first annual meeting in 1955, the credit union began expanding its membership to include other educational groups in the area.

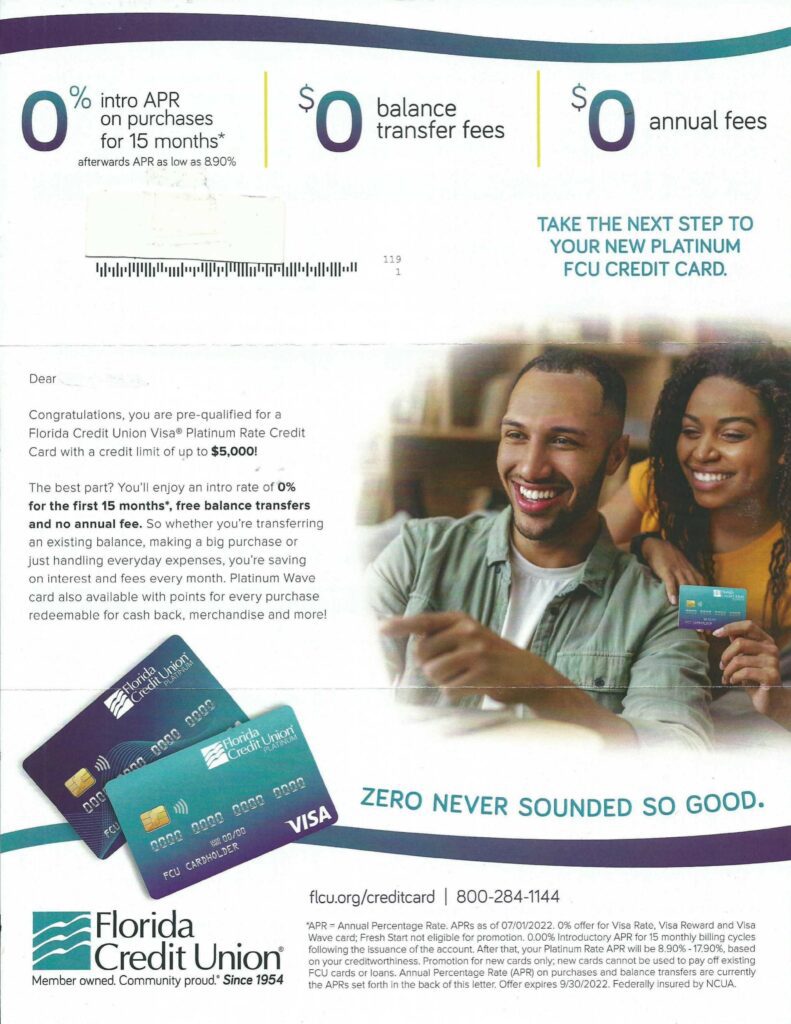

FCU is a credit union that serves members in North and Central Florida. They offer products and services that help their members reach their financial goals. It’s owned by its members and profits go back to its members in the form of better rates, and advanced technology.

The company advertises its services at flcu.org.

Florida Credit Union Summary

When it comes to taking out a loan, there are a lot of options available. But with so many lenders out there, it can be hard to know where to turn. Florida Credit Union is one of many credit unions that has been getting a lot of attention recently. In this article, we’ll take a closer look at what they have to offer so you can make an informed decision about whether or not this lender is right for you.

Some interesting things came to light when investigating their website and terms and conditions. Here are a few key points that stood out.

- The annual percentage rate (APR) for a loan ranges from 10.171% to 17.000%.

- Loan terms range between 36 to 60 months.

- Loan amounts are between $3000 and $5000

- The specific rate and term will be dependent upon your credit rating.

- Rates and terms are subject to change without prior notice.

- There is a $100 application fee.

What is Florida Credit Union?

The Florida Credit Union was established in 1954 as a state-chartered credit union for teachers. Today, it offers valuable banking solutions including checking accounts, savings accounts, personal loans, money market accounts, auto loans, and mortgages.

The Better Business Bureau has given the credit union an A+ rating with 8 customer reviews and 31 complaints closed in the last three years. On average, customers have given the company a 1-star out of 5-star rating due to having a lot of negative reviews.

How does Florida Credit Union work?

Credit unions are a great way to get financial services without having to pay high fees. Florida Credit Union claims to be one of the strongest credit unions in the state, and being a member means that you are a co-owner. This means that its members benefit from lower fees on products and services, lower costs on loans, and higher rates on savings and CDs.

Florida Credit Union Loan Officers are available by phone 24 hours a day, 7 days a week. You can call your local FCU branch to get your loan application started if you decide on them.

How to qualify?

You can join Florida Credit Union (FCU) easily and without any membership fees but it does have an application fee when you sign up for the loan. All you need to do is open an online savings account with a balance of $5. This deposit buys you one share of ownership in FCU!

You can join FCU online, you can call our Contact Center at 1-800-284-1144, or visit one of their branches in Belleview, DeLand, Gainesville, Lake City, Ocala, or Starke.

Florida Credit Union BBB Reviews

The Better Business Bureau has accredited the credit union since 2014 and it has an A+ overall rating. On average, there have been 8 customer reviews and 31 complaints closed in the last 3 years. As a result, customers have given the company a 1-star rating on the BBB.

Here are some Florida Credit Union reviews:

Lucie R 09/18/2022

I have been a member of Florida Credit Union for 10+ years. I’ve been going through a bit of a hard time. I had a small loan with FCU and decided to pay off my current loan and apply for another loan to get my husband’s car fixed just as I’ve done in the past with no problem. Like a dummy, I pay off the loan only to get denied now I’m in a worst place than I started. I’m not sure why I was denied as this would have been my 3rd loan with them and I’ve always paid them off early. We get over that hurdle. I’m in need of surgery and just needed a little bit of cash to get me to my next payday because the hospital surprised me with an additional fee I did not know of since I already paid my doctor over $1,000 just for the surgery but now the hospital wanted $956 (health insurance is trash) We apply for a $500 payday loan and was denied although in the past we’ve gotten them on many occasion a few years back when my credit was actually bad. They say credit unions are for the people but that is no longer the truth, at least not this one. After the pandemic, you already have money to get any help. How will your customers be able to make it out of the trenches if they can’t even get a helping hand? People who have done business with you for years only to be turned away. If I have no money you will happily charge me a fee but not help to avoid that from happening.

Lisa V. 06/15/2022

I’ve had the worst experience with FCU for years and was finally able to refinance. Since I’ve refinanced for 3 months I’ve asked them to send my new finance company electronically my title or email me a release lien letter to send to the **** After calling them for months I called today 5 times. I was hung up on and laughed at. I’m pregnant and on bed rest. Still, nothing has been resolved.

Ken M 05/12/2022

OMG, Talk about getting nowhere and chasing your tail. Don’t bother applying with this Credit Union. Also, Stay away from supervisor Heather! She will leave you stuck with your online application and then tell you to visit one of their local branches to fill out an application. Their online application is a complete dead end!

Florida Credit Union FAQs

How much does Florida Credit Union charge?

Florida Credit Union offers different annual percentage rates (APRs) for loans. Loans have APRs as low as 10.171% or APRs as high as 17.000%. The length of the loan also varies, with terms ranging from 36 to 60 months. There is usually a $100 application fee.

Payment Example: A $5,000 loan at 9.75% for 60 months would have an APR of 10.607%, a monthly payment of $107.73, and finance charges of $1,464.02, for a total payment amount of $6,464.

Are there any pre-payment penalties?

Unlike some bigger credit unions, Florida Credit Union is a financial institution that does not charge prepayment fees, so you can pay off your loan early without any penalties. This makes it a great option for borrowers who want the flexibility to pay off their loans on their own terms.

How does Florida Credit Union affect your credit?

When you’re considering taking out a loan, there are a few things you should know about how the process can affect your credit score. Many lenders will do a soft credit check at the start to give you an idea of what interest rates and loan terms you might qualify for. This won’t affect your credit score. However, once you decide to move forward with the actual loan application, the lender will need to do a hard credit inquiry to get a full view of your credit history and offer you final rates. These hard inquiries can lower your credit score. So before you apply for a loan, make sure you understand how the process can impact your credit.

How to cancel Florida Credit Union?

Before taking out a personal loan, be sure that you are confident in your decision. Once the money is transferred into your account, you will not be able to reverse or cancel the transaction. Therefore, it is important to be certain from the beginning to avoid any complications later on.

Are you struggling to make ends meet? Here are some helpful tips to get you back on track.

You don’t have to be a financial expert to get your finances in order. Just follow these simple steps and you’ll be on your way to a bright future.

- First, create a budget and stick to it. This will help you stay on track and make better spending decisions.

- Another great tip is to speak with a financial advisor. They can help you understand your options and develop a plan that works for your unique circumstances.

- Last but not least, don’t worry too much about debt. Other financial institutions are willing to work with customers to create a more manageable payment plan. So reach out to their customer service team for more information.

Is Florida Credit Union legit or a scam?

The Florida Credit Union has been in business for many years and offers a variety of financial services. However, while the Better Business Bureau gives them an A+, customers have only given them a 1-star out of 5-star rating.

Before taking out a loan, it is important to consider multiple factors such as interest rates and repayment terms. Thoroughly research different lenders and compare their rates to ensure you are getting the best deal possible. Additionally, be sure to read Florida Credit Union reviews in order to make the most informed decision and avoid taking out a loan that will be difficult to afford.

Do you know flcu.org? Leave your experience and review below!

Thank you for reading!