Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

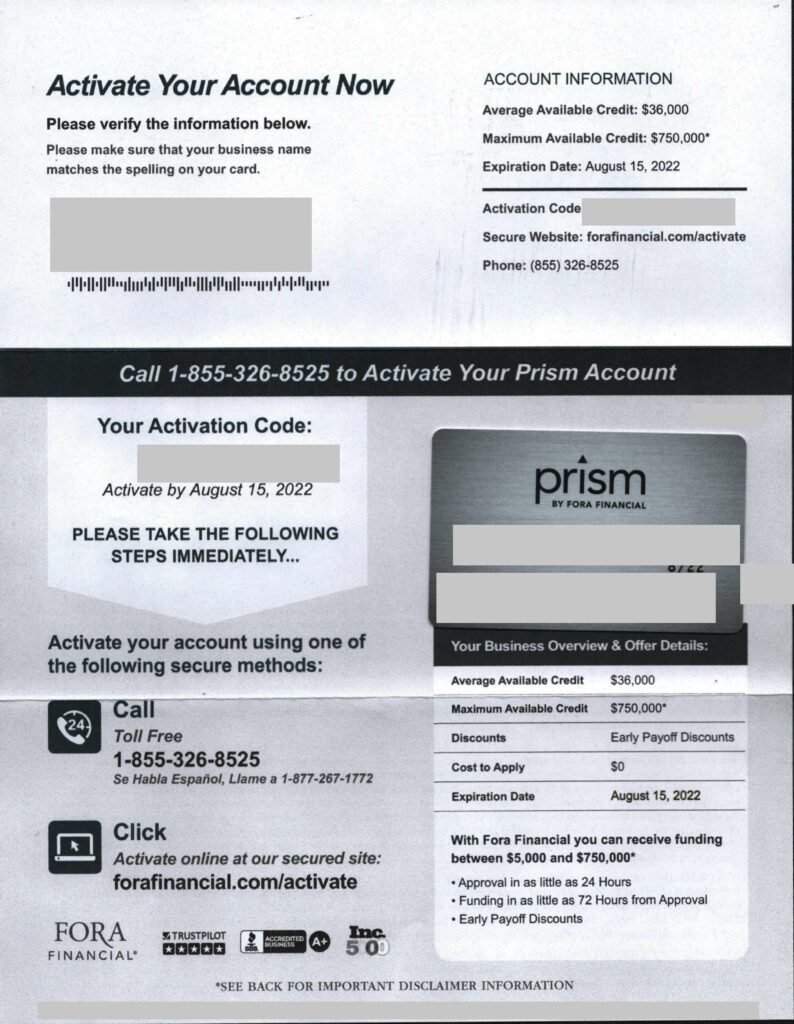

Fora Financial is an online lender that offers short-term financing options, such as merchant cash advances and term loans, for businesses with variable cash flow or who prefer short-term solutions. For those who require a loan of a longer duration, it may be more advantageous to research other small business loan alternatives. The company advertises its services at forafinancial.com.

Fora Financial Business Loans Summary

It’s essential to explore all the possibilities when looking for a business loan. One of the most popular options is Fora Financial, but is it the best option for you? To determine if they are a suitable lender, you need to know what services they provide. This article examines their services in detail, so you can make an informed decision as to whether or not Fora Financial is the right lender for your loan requirements.

We have now finished an in-depth review of the firm’s website and regulations. Here are some key results we discovered.

- It offers loan amounts ranging from $5,000–$750,000.

- It has repayment terms from 4 to 15 months.

- The Factor rate ranges from 1.1–1.9.

- Your business is charged a factor rate, not interest, as with a traditional term loan.

- Instead of making monthly payments as you would with a term loan, your business makes daily payments.

What is Fora Financial?

Fora Financial is an online lender based in New York that provides small-business loans and merchant cash advances to businesses. This can be a great option for businesses that require short-term working capital or who might not qualify for traditional bank financing. Fora Financial’s term loans have a high maximum loan amount, however, the interest rate is charged as a factor rate making a comparison to other lenders hard.

Currently, Fora Financial holds an A+ rating with the Better Business Bureau and has had its accreditation since 2011. The firm has amassed 12 Customer Reviews and 8 closed complaints in the past 3 years. Consequently, customers have given the company a 2 out of 5-star rating.

How does Fora Financial work?

Fora Financial provides business owners with the opportunity to receive loans of up to $750,000, which must be paid back over a period between four to fifteen months. Nevertheless, it is important to be aware that there are distinctions

Instead of an interest rate, your business will be charged a factor rate with a term loan. This factor rate is presented as a single digit, ranging from 1.1 to 1.9. Therefore, if you borrow $10,000 with a factor rate of 1.5, the total cost of the loan will be $10,000 x 1.5, or $15,000.

Rather than paying back the loan in monthly installments, your business is required to make daily payments. It may be possible to receive a discount on the total cost of the loan if you pay it back before the specified time period.

How to qualify for Fora Financial?

Applying for a business loan can be a daunting process, but understanding the requirements and preparing beforehand can increase the chances of approval. Lenders will typically require information from an applicant’s credit profile and other factors that demonstrate the ability to repay the loan, such as business revenue.

Meeting the requirements won’t guarantee approval, but they can give you a better understanding of what the lender is looking for. Additionally, lenders may also consider the type of business and its potential for success, the amount of loan requested, and the applicant’s personal or business assets. It’s important to do your research and make sure that a business loan is a right fit for you before applying.

Personal Credit Score

It is suggested that a credit score of at least 500 is necessary to be considered for a loan with Fora Financial; however, they do not divulge their exact minimum credit score requirement. Furthermore, businesses can’t have any open bankruptcies or dismissed bankruptcies within the past year.

Time in Business

Fora Financial is more lenient than other lenders in terms of the amount of time a business must be operating in order to be eligible for both its Merchant Cash Advances and short-term loans, needing only six months of operation instead of the usual one to two years.

Annual Revenue

Organizations looking to receive a Merchant Cash Advance must have a minimum of $5,000 in monthly credit card sales, whereas entities looking for short-term loans must have minimum monthly gross sales of $12,000.

Fora Financial BBB Reviews

Fora Financial has been accredited with the Better Business Bureau since 2011 and has earned an A+ rating. Over the past three years, customers have submitted 12 reviews and 8 complaints, resulting in a 2 out of 5-star rating.

Here are some reviews:

Khila J. 04/22/2022

VERY POOR EXPERIENCE. They’re a bait & switch company. They offer you one thing and then you call you back the next day with a lower offer. My rep ** asked me more questions about who else I was applying with than he asked about my actual business. They were using me for competitor research more than they were trying to help me get funding. I got much better service and much better loan offers from companies like ****** Go with one of them instead.

Da H 09/20/2021

Anytime I am presented with an offer letter from an unknown company I call my bank. I received a letter from Fora with my bank information on it and the amount I was approved for the Covid release. This is a way to gain information from a potential customer that is eager for the funds. I don’t operate like that. I do extensive research. Skepticism always lead me to the BBB as well and I am happy that I did. If you can’t get a business loan with your bank or a reputable lender do not settle for the unknown.

Barbara M 09/08/2021

After months of trying to get approved, I was approved and funds were supposed to be deposited the next day. I am qualified for all their requirements. Only to be told they could not deposit because I had already received a loan from someone else which is not true. They have all my private personal and financial information. I trusted them for some reason, ********************************* the agent seemed legit, I would like to think he was. Based out of NY. I applied for many loans elsewhere this last 3 months as a small business trying to survive Covid…and was never approved, but I was approved for a small loan of $6,000 from Fora, and then they told me this today. This is not true, false. I never have received a loan from anyone. That sent up red flags to me. I am finding out there are probably only like 3-5 top BBB-certified lenders online that are legit. The rest are just getting our financial and identity information to sell on the black web driver’s license and all. Oh well, I guess a ton of lenders now can make money off of my personal financial information. This was 100% a scam.

Fora Financial FAQs

How much does Fora Financial charge?

Fora Financial implements a flat fee (known as a factor rate) for both of its business loan offerings. These factor rates vary from 1.1 to 1.9. The total cost of the loan can be determined by multiplying the loan amount by the factor rate.

For instance, if you receive a loan of $100,000 at a factor rate of 1.5, then you would need to pay back a total of $150,000. The APR of this loan will depend on how quickly you repay it; the longer the repayment timeframe, the lower the APR.

| Loan amount | Factor rate | Repayment term | APR |

|---|---|---|---|

| $100,000 | 1.5 | 4 months | 152.08% |

| $100,000 | 1.5 | 8 months | 76.04% |

| $100,000 | 1.5 | 15 months | 40.55% |

How to Apply for a Fora Financial Business Loan?

If you would like to secure a business loan from Fora Financial, you will need to fill out a single-page application and submit the past three months of banking statements from your company. Fora Financial may request additional information such as a most recent bank statement, yearly profit and loss, taxes filed, and balance sheet. Nonetheless, numerous businesses are approved within a day.

Once given the go-ahead, make sure to have your driver’s license, a voided check, and evidence of business ownership ready. Supplying these items beforehand will help to expedite the funding process.

How do Fora Financial Business loans affect your credit?

Fora Financial Business loans can affect your credit in a positive way. By taking out a Fora Financial loan, you are demonstrating good creditworthiness and the ability to pay back the loan. Making payments on time will help improve your credit score and demonstrate to other financial institutions that you are a responsible borrower. Conversely, missed payments or late payments can have a negative impact on your credit score, so it is important to make sure that you make all payments on time if you take out a business loan from Fora Financial.

How to cancel Fora Financial?

When considering taking out a personal loan, it is essential to be aware that once the loan amount is disbursed, it is not possible to reverse it. Therefore, it is critical to be sure that a loan is a right decision before applying. Researching loan options and understanding the terms of the loan is important to make an informed decision and to ensure that you are making the best choice for your financial situation. If the loan amount is credited, you are responsible for paying it back with the applicable interest, so it is important to be sure that a loan is a right decision before applying.

Are you struggling to make ends meet? Here are some helpful tips to get you back on track.

Do you find yourself living paycheck to paycheck? Are you having difficulty making ends meet? It can be difficult to manage your finances and make sure you’re living within your means. If you’re having trouble staying financially afloat, here are some tips to help you get back on track.

First, create a budget. It’s important to keep track of your income and expenses so you can make sure you’re not spending more than you’re bringing in. Make a list of all your sources of income and all of your expenses. This will help you pinpoint areas where you can cut back and prioritize your spending.

Second, look for ways to save money. There are many ways to save money, from cutting out unnecessary purchases to finding more affordable options for everyday items. Consider shopping around for the best deals and looking for coupons or discounts.

Third, try to pay down your debt. If you’re carrying a lot of debt, it can be difficult to make ends meet. Prioritize paying off your highest-interest debts first and make sure you make all payments on time.

Fourth, look for additional sources of income. Consider taking on a side job or freelancing in your spare time. You may also be eligible for grants or scholarships to help you pay for school or basic living expenses.

Finally, don’t be afraid to ask for help. There are many resources available to help people who are struggling financially. Check with your local government or nonprofit organizations to see what assistance you may be eligible for.

If you’re having difficulty making ends meet, don’t panic. With some dedication and hard work, you can get back on track. Follow these tips and you’ll be on your way to financial stability in no time.

Is Fora Financial legit or a scam?

Fora Financial is a business that was founded in 2008 and is based in New York City. Since its inception, it has provided over $2 billion in working capital for small businesses and has been accredited with the BBB since 2011. Unfortunately, over the past three years, customers have submitted 12 reviews and 8 complaints, resulting in a very low rating of 2 out of 5 stars. This is concerning and it is important to investigate further to determine how Fora Financial can improve its services and customer satisfaction.

Before signing up for a business loan, it is essential to do your due diligence to ensure you are selecting the right lender. This includes looking at customer reviews, researching the company’s reputation, and confirming that the terms of the loan and services provided are clear and reliable. Taking the time to evaluate these criteria will ensure you end up with a loan provider and agreement that suits your business needs. Doing your research and double-checking the details will give you peace of mind and ensure you get the best loan for your business.

Do you know forafinancial.com? Leave your experience and review below!

Thank you for reading!