Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Are you struggling to keep up with your bills? Are you feeling overwhelmed by your debts? Gold West Financial may be able to help. Gold West Financial is a company that offers debt consolidation services. They claim to be able to help you get out of debt quickly and easily. But is Gold West Financial a scam, or is it legit? In this blog post, we will take a closer look at Gold West Financial and see what it has to offer. We will also discuss whether or not Gold West Financial is a scam, and whether or not it is the right choice for you.

Gold West Financial is not a lender. They are a company that matches you with different lenders. This means they will take your information and then try to find a lender willing to give you a loan. The problem is that many customers complained that getting approved for a loan through Gold West Financial could be challenging.

In many cases, people who use their services complained they ended up getting bait and switch offers. This means that they are offered a loan with terms that are much worse than they expected.

So, is Gold West Financial a scam? It depends on how you look at it. If you are simply looking for a company to help you find a lender, then Gold West Financial may be a good choice. Just be sure to read the terms and conditions carefully before you agree to anything.

2.0 out of 5.0 stars2.0

Gold West Financial Pros and Cons

Here are Gold West Financial cons and pros.

- One con is that they match you with different lenders, which can be confusing and frustrating.

- Another con is that they’ve been accused of using bait and switch tactics, promising one thing and then delivering something else.

- Finally, their fees are high compared to other companies.

So while Gold West Financial may be able to help you get a loan, there are other options out there.

What is Gold West Financial?

Gold West Financial is a financial services company that matches you with different lenders. They provide you with options and terms so that you can find the best fit for your needs. You can use their online tools to compare different lenders and find the one that works best for you.

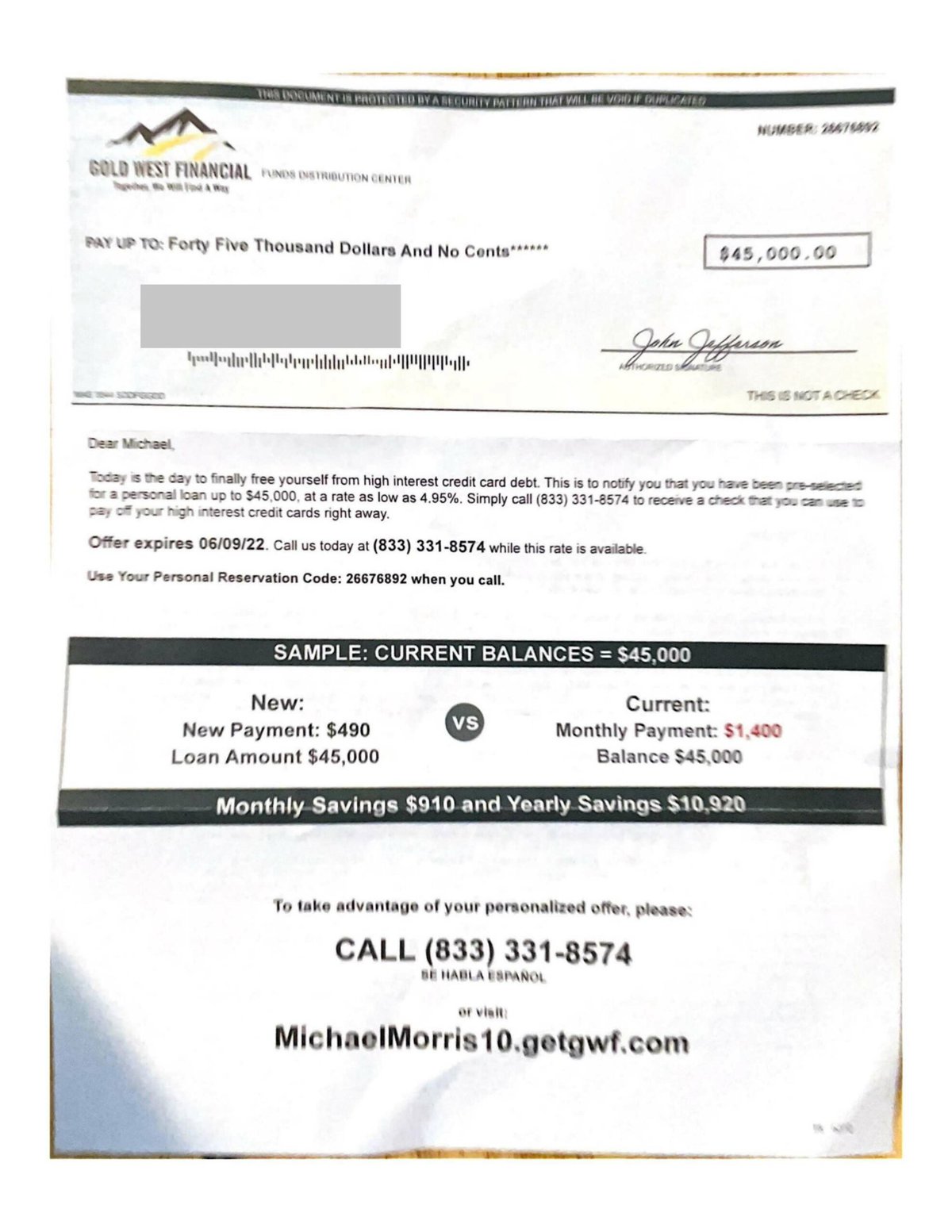

However, Gold West Financial has been luring customers with direct mail, advertising low-interest rates, then pressuring customers into signing up for products with much higher rates. Make sure you understand all the terms and conditions of your loan before signing anything.

What is Debt Consolidation?

Debt consolidation is the process of combining multiple debts into a single loan. This can be done by taking out a new loan to pay off existing debts, or by transferring balances from multiple credit cards to a single card. Debt consolidation can help simplify your monthly payments and reduce the total amount of interest you pay on your debts.

If you’re struggling to keep up with multiple debts each month, debt consolidation may be a good option for you. By consolidating your debts into one loan, you’ll only have to make one monthly payment instead of several. This can make it easier to stay on top of your payments and avoid falling behind on any of your debts. Additionally, debt consolidation can sometimes help you get a lower interest rate on your debts, which can save you money over time.

If you’re considering debt consolidation, be sure to do your research and compare different options before deciding on a plan. There are both advantages and disadvantages to consolidating your debts, so it’s important to find the right solution for your situation. You may also want to speak with a financial advisor to get help assessing your options and choosing the best course of action for your finances.

How Does Debt Consolidation Work?

Consolidating your debt can simplify your monthly payments and get you a lower interest rate, but there are also some risks involved. Here’s what you need to know about consolidating your debt:

When you consolidate your debt, you’re essentially taking out one large loan to pay off all of your other debts. This can be done by transferring all of your debts into one credit card, taking out a personal loan, or working with a debt consolidation company. There are many benefits to consolidating your debt, including simplifying your monthly payments, getting a lower interest rate, and paying off your debt faster. However, there are also some risks involved in consolidating your debt.

For example, if you consolidate your debts into one loan with a lower interest rate but have a longer repayment period, you may end up paying more interest overall. Additionally, if you miss payments on your consolidated loan, you could damage your credit score.

It’s important to understand how it works and what the benefits and risks are.

What are the risks of Debt Consolidation?

Debt consolidation can be a great way to get your finances back on track. However, there are some risks involved. Here are a few things you should keep in mind before consolidating your debt:

- You could end up paying more in interest. If you consolidate your debt into one loan with a higher interest rate, you could end up paying more in interest over time.

- You could miss payments and damage your credit score. If you consolidate your debt into one payment, it can be easy to miss a payment if you’re not careful. This can damage your credit score and make it harder to get approved for loans in the future.

- You could end up saddling yourself with even more debt. If you consolidate your debt and then continue to spend recklessly, you could end up with even more debt than you started with.

Make sure you understand the risks involved. It’s not a decision to be made lightly. However, if done correctly, it can help you get your finances back on track. Talk to a financial advisor to see if debt consolidation is right for you.

How does Gold West Financial work?

Gold West Financial is not a lender but instead matches you with different lenders who may be able to give you the loan you need.

When you submit an inquiry form on their website, Gold West Financial will collect some basic information from you. This includes your name, contact information, and the amount of money you need to borrow.

Once they have this information, they will reach out to different lenders on your behalf. These lenders may or may not offer you a loan, and if they do offer one it may not be at the best terms possible. However, by using Gold West Financial you will have a better chance of getting the loan you need.

While Gold West Financial does not guarantee that you will get a loan, they may be able to help if you have had trouble getting approved for one in the past. If you are interested in using their services, be sure to read over their terms and conditions carefully before proceeding. You can also contact them directly with any questions you may have.

How to qualify for a Gold West Financial debt consolidation loan?

In order to qualify for a loan through Gold West Financial, you must have good credit and a steady income. If you don’t have good credit or a steady income, you may still be able to qualify for a loan if you have collateral.

It all depends on Gold West Financial’s network of lenders that they work with. Each lender has its own set of qualifications that you must meet in order to be approved for a loan.

The most common qualifications with direct lenders are :

- A regular source of income

- An active bank account

- A Social Security Number or Taxpayer Identification Number

- Be at least 18 years old (19 in Alabama)

If you meet all of the qualifications above, then you should have no problem qualifying for a loan through Gold West Financial. All you need to do is fill out their online application and provide the required information. Once you’re approved, the lender will deposit the money into your account and you can use it to pay off your debts.

What kind of debt consolidation program does Gold West Financial offer?

Gold West Financial works with a network of lenders. They do not offer any specific debt consolidation program. However, their network of lenders may be able to help you find a consolidation program that suits your needs.

The problem is that Gold West Financial is not a lender. This means that they may not have your best interests in mind. They may bait you by telling you that you qualify for a certain program, but then switch you to another program with higher interest rates.

It’s important to do your research. Make sure you understand all of the terms and conditions before signing up for any program. Otherwise, you could end up paying more in interest and fees than you would if you just stuck with your original lenders.

How much does Gold West Financial charge?

Gold West Financial is not a lender, so there are no hidden fees or costs associated with their services.

Remember that the actual direct lender may charge origination fees, high-interest rates, and fees. Doing your research on the front end can save you a lot of money down the road.

What is the minimum credit score for a Gold West Financial debt consolidation loan?

The minimum credit score for a Gold West Financial debt consolidation loan is 640. However, keep in mind that the minimum credit score is just one factor that lenders look at when considering a loan application. Other factors include your income, employment history, and debts. So even if your credit score is below 640, you may still be able to qualify for a Gold West Financial debt consolidation loan but it will come with high interest rates.

How does Gold West Financial affect your credit?

When you apply for a personal loan with Gold West Financial’s network lenders, they will do a hard pull on your credit report. This hard pull can lower your credit score by a few points. Additionally, if you make late payments on your loan or credit card, this will also negatively impact your credit score.

Be sure to check your credit score beforehand and make sure you understand the potential impact on your credit. By doing so, you can be proactive about managing your credit and ensuring that Gold West Financial doesn’t negatively affect your score.

How to cancel Gold West Financial?

If you’re looking to cancel your Gold West Financial account or loan, there are a few things you’ll need to do. First, you’ll need to contact your lender’s customer service and request that your account be closed. Once that’s been done, you’ll need to make sure that all outstanding balances with your lender are paid in full. Finally, you’ll need to send a written notice of cancellation to Gold West Financials’ corporate office.

With all that being said, let’s take a look at how to cancel Gold West Financial step-by-step.

The first thing you’ll need to do is contact your direct lender’s customer service and request that your account be closed. Once you’ve made contact with customer service, they’ll be able to help you close your account and cancel your loan.

The next thing you’ll need to do is make sure that all outstanding balances with your lender are paid in full. This means any remaining principal, interest, fees, or other charges that may be due.

Once you’ve paid off your loan in full, you’ll need to send a written notice of cancellation to Gold West Financial’s corporate office. The notice should include your name, address, phone number, and account number. You can send the notice via certified mail so that you have proof of delivery.

Gold West Financial BBB Reviews

Gold West Financial BBB Reviews show that they have an A+ rating with the BBB. However, they are not accredited by the BBB. Gold West Financial has been in business for two years and has a rating of two and a half out of five stars on the BBB website. The BBB website shows that there are no complaints filed against Gold West Financial.

Here are some Gold West Financial BBB Reviews:

Harry M 11/17/2021

1.0 out of 5.0 stars1.0Said they would help with loans and a credit card through the bank…. made payments while getting letters from the bank. which they claimed they would take care of. Never did anything, filed with the Attorney General to get a refund( which is only 75% of the payment), and now trying to fix what they messed up at the bank. Stay away from them

Barbara B 07/01/2021

★★★★★

Quick and convenient service. Many great options. Saved money! Excellent experience!

Donald D 05/21/2021

1.0 out of 5.0 stars1.0Fraud. They said they offer consolidation loans. I agreed to allow access to my personal info on the basis of a loan. I asked prior to that if this was for credit negotiation and they said no, I was applying for a loan. They called back the next day to tell me I didn’t qualify for this pre-approved loan and wanted to enroll me in credit negotiation.

Is Gold West Financial Legit or a Scam?

Gold West Financial is not a lender but has been accused of bait and switch by some alarming negative reviews. The company has a 2 1/2 star rating with the Better Business Bureau, and there are many complaints about their poor customer service.

In addition, Gold West Financial is not accredited by the BBB.

If you’re considering doing business with Gold West Financial, you may want to read other customers’ reviews. There are many other companies out there that can offer you debt resolution services with better reviews. Do your research and choose a company that has a good reputation.

What are your thoughts on Gold West Financial? Have you had any experiences with them? We’d love to hear from you in the comments!

Thanks for reading!