Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Union Plus is a non-profit organization that offers exclusive benefits and services to union members and their families. The organization was founded by the AFL-CIO in 1986, and since then, it has been providing a wide range of services to over 13 million union members and their families. In this article, we will provide a detailed review of Union Plus, including its pros and cons, services, and FAQs. The company advertises its services at unionplus.org.

Best Debt Consolidation Companies

Read Reviews – Compare Prices – Save Money

Union Plus Summary

There are many reasons why someone might take out a loan, whether it’s to cover unexpected expenses or consolidate debt. With so many lenders available, it can be difficult to decide where to turn. Union Plus is one option that has recently been getting a lot of attention. But is this lender the right choice for you? Here is a closer look at what they have to offer so you can make an informed decision.

Here are a few key points that stood out from our investigation of their website and terms and conditions.

- Loans are made and serviced by First National Bank of Omaha.

- The APR for your loan will be determined based on a number of factors, including creditworthiness. Generally, the APR will fall somewhere between 5.99% and 15.99%.

- Not everyone will qualify for the lowest interest rate.

- You may receive a 0.25% interest rate discount by enrolling in AutoPay.

- The terms of repayment for your loan will be based on the APR and loan term for which you qualify.

- There are a few restrictions on what you can use a loan for. You can’t use it for postsecondary educational expenses or tuition, or to consolidate post-secondary educational loan debt.

Pros and Cons:

Pros:

- Exclusive Benefits: Union Plus offers exclusive benefits and services to its members, including discounts on travel, shopping, and entertainment.

- Financial Assistance: The organization provides financial assistance to its members, including loans, grants, and scholarships.

- Health and Wellness: Union Plus offers health and wellness programs, including dental and vision care, prescription drug discounts, and mental health services.

- Legal Services: The organization provides legal services to its members, including free consultations and discounted rates on legal representation.

- Retirement Planning: Union Plus offers retirement planning services, including pension and annuity options, as well as financial counseling and education.

Cons:

- Limited Membership: Union Plus is only available to union members and their families, which means that not everyone can access its services.

- Limited Coverage: While Union Plus offers a wide range of services, some of its programs have limited coverage, and not all services are available in all areas.

- Limited Resources: Union Plus is a non-profit organization, which means that its resources may be limited, and it may not be able to offer the same level of services as other organizations.

Union Plus Services:

Union Plus offers a wide range of services to its members, including:

- Travel: Members can get discounts on travel, including airfare, car rentals, and hotels.

- Shopping: Members can get discounts on shopping, including clothing, electronics, and home goods.

- Entertainment: Members can get discounts on entertainment, including movies, theme parks, and sports events.

- Financial Assistance: Union Plus offers financial assistance to its members, including loans, grants, and scholarships.

- Health and Wellness: Members can get access to health and wellness programs, including dental and vision care, prescription drug discounts, and mental health services.

- Legal Services: Members can get access to legal services, including free consultations and discounted rates on legal representation.

- Retirement Planning: Members can get access to retirement planning services, including pension and annuity options, as well as financial counseling and education.

What is Union Plus, and what services does it offer?

Union Plus is a non-profit organization founded by the AFL-CIO in 1986 to provide exclusive benefits and services to union members and their families. The organization offers a wide range of services, including travel discounts, shopping discounts, entertainment discounts, financial assistance, health and wellness programs, legal services, and retirement planning services.

The travel discounts include deals on airfare, car rentals, and hotels, while the shopping discounts offer discounts on clothing, electronics, and home goods. Members can also enjoy discounts on entertainment, including movies, theme parks, and sports events.

Financial assistance includes access to loans, grants, and scholarships. Health and wellness programs provide dental and vision care, prescription drug discounts, and mental health services. Members can also access legal services, including free consultations and discounted rates on legal representation. Retirement planning services offer pension and annuity options, financial counseling, and education.

Overall, Union Plus is a comprehensive resource for union members who are looking for exclusive benefits and services that can help them and their families save money, stay healthy, and plan for the future.

How can I become a member of Union Plus, and what are the eligibility criteria?

To become a member of Union Plus, you must be a current or retired union member or a family member of a union member. The eligibility criteria may vary depending on the union, but in general, you must be a member in good standing with your union and have paid your dues.

If you meet the eligibility criteria, you can visit the Union Plus website and sign up for membership. You will need to provide proof of your union membership or relationship to a union member, such as a union card or a letter from the union.

Once you have been approved for membership, you will have access to all the benefits and services offered by Union Plus. You can log in to your account on the Union Plus website to access your benefits, find discounts, and apply for financial assistance.

Overall, becoming a member of Union Plus is a straightforward process if you are a union member or related to one. The organization is committed to providing exclusive benefits and services to union members and their families, and membership is a valuable resource for anyone looking to save money, stay healthy, and plan for the future.

What are the benefits of being a Union Plus member?

There are many benefits to being a Union Plus member. Here are some of the most notable ones:

- Exclusive Discounts: Union Plus offers exclusive discounts to its members on a wide range of products and services, including travel, shopping, and entertainment.

- Financial Assistance: Members can access loans, grants, and scholarships to help them with various expenses, such as education, housing, and emergency needs.

- Health and Wellness: Members can access a variety of health and wellness programs, including dental and vision care, prescription drug discounts, and mental health services.

- Legal Services: Members can access legal services, including free consultations and discounted rates on legal representation.

- Retirement Planning: Members can access retirement planning services, including pension and annuity options, financial counseling, and education.

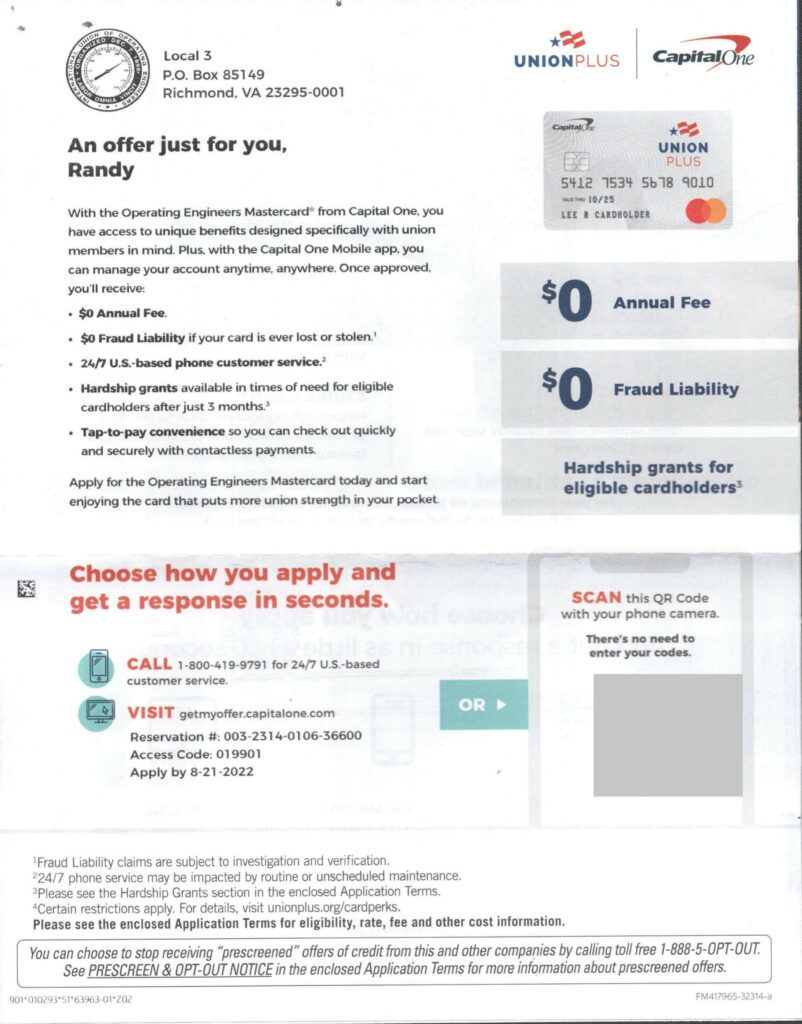

- Union Plus Credit Card: Members can apply for the Union Plus Credit Card, which offers cashback rewards and other benefits.

- Union Plus Mortgage: Members can access the Union Plus Mortgage program, which offers competitive rates and discounts on closing costs.

- Union Plus Auto Buying Service: Members can use the Union Plus Auto Buying Service to purchase a new or used car at a discounted price.

- Union Plus Heating Oil Program: Members can save money on heating oil with the Union Plus Heating Oil Program.

- Union Plus Scholarship Program: Members’ children and grandchildren can apply for the Union Plus Scholarship Program, which offers scholarships ranging from $500 to $4,000.

Being a Union Plus member provides access to a variety of benefits and services that can help union members and their families save money, stay healthy, and plan for the future.

How does Union Plus compare to other similar organizations?

Union Plus offers benefits and services that are similar to other organizations that serve union members and their families. However, Union Plus is unique in that it is exclusively available to union members and their families, whereas other organizations may offer similar services to the general public.

One of the most notable similarities between Union Plus and other organizations is the discounts they offer. Many organizations provide discounts on travel, shopping, and entertainment, but Union Plus offers exclusive discounts that are not available to the general public.

Similarly, many organizations provide financial assistance, health and wellness programs, and retirement planning services, but Union Plus offers these services exclusively to union members and their families.

One way in which Union Plus stands out from other organizations is through its legal services. Union Plus provides free consultations and discounted rates on legal representation, which can be a valuable resource for union members who need legal assistance.

Overall, Union Plus compares favorably to other organizations that serve union members and their families, as it provides exclusive benefits and services that are tailored to the needs of union members.

How does Union Plus ensure the quality of its services?

Union Plus ensures the quality of its services in several ways.

First, the organization partners with reputable providers and vendors to offer its benefits and services. Union Plus only works with companies that have a proven track record of providing quality products and services.

Second, Union Plus regularly reviews its benefits and services to ensure that they meet the needs of its members. The organization uses feedback from members and other stakeholders to improve its offerings and make changes when necessary.

Third, Union Plus has a dedicated customer service team that is available to assist members with any questions or concerns they may have. The organization takes customer service seriously and strives to provide a high level of support to its members.

Fourth, Union Plus is a non-profit organization that is committed to serving its members. The organization operates in the best interests of its members and is not motivated by profit. This ensures that the organization is focused on providing quality services rather than generating revenue.

Finally, Union Plus has a strong reputation for providing quality services to its members. The organization has been serving union members and their families for over 35 years and has earned the trust and loyalty of its members. This reputation is a testament to the quality of the services offered by Union Plus.

Union Plus BBB Reviews

As Union Plus is not accredited or endorsed by the Better Business Bureau (BBB), there are limited customer reviews available on the BBB website. However, there are many reviews of Union Plus available on other websites and forums, which can provide a more balanced view of the organization.

Overall, Union Plus has received positive reviews from its members. Customers have praised the organization for its exclusive discounts, financial assistance, and health and wellness programs. Many customers have noted that they have saved a significant amount of money by using the organization’s services, particularly travel discounts and shopping discounts.

Customers have also praised Union Plus’s customer service, noting that the organization is responsive and helpful when they have questions or issues.

However, some customers have reported issues with the organization, such as difficulty accessing benefits or problems with customer service. These negative reviews are in the minority, however, and most members report a positive experience with Union Plus.

Overall, while there may be some negative reviews of Union Plus, the majority of members have had a positive experience with the organization and report that its services and benefits are valuable and useful.

Here are some reviews:

I refinanced my mortgage through Wells Fargo and received a $300 Union Plus Performance Plus Award Card and could not find a retailer that would accept it. Macy’s and Home Depot were on the list of places where I could use the card, but they would not accept it. After contacting Union Plus and they said they would reimburse me, but that it would take a while, but this never happened. They fill my email with promotions multiple times a month. I gave up on the money, but I wanted to share my experience.

Robert M

05/06/2022

My experience with Union Plus is like signing up for cable service. Once you sign up, they repeatedly mail you offers for loans and life insurance – the same ones over and over again. There is no way to be removed from the mailing list. Their FAQs tell you to “click here” to be removed but there is no link to click on. You can not reach someone over the phone as it is all automated. They do not respond to any emails. I have advised all of my colleagues against registering for an account with Union Plus.

SC

10/28/2021

Union Plus Hardship Help Program

Union Plus offers a range of services to help its members through difficult times. Here are some of the services that Union Plus provides to assist members during hardships:

- Hardship Help: It provides hardship help for union members who are facing financial difficulties due to job loss, illness, or other circumstances. Members can access resources such as financial counseling, budgeting advice, and debt management assistance.

- Strike Benefits: It offers strike benefits to help union members who are on strike. These benefits can include cash payments, health care coverage, and other support.

- Layoff or Furlough Assistance: It provides assistance to union members who have been laid off or furloughed. This assistance can include job search assistance, financial counseling, and access to resources such as unemployment benefits.

- Mortgage Assistance: It offers mortgage assistance to help members who are struggling to make their mortgage payments. This assistance can include loan modifications, payment assistance, and counseling services.

- Save my Home Hotline: It provides a Save my Home Hotline that members can call for assistance with foreclosure prevention, loan modifications, and other issues related to housing.

- Credit Counseling: It offers credit counseling services to help members manage their debt and improve their credit scores. Members can access one-on-one counseling, debt management plans, and other resources.

- Bankruptcy Counseling Fee Waiver: It provides a fee waiver for bankruptcy counseling to help members who are considering bankruptcy. This waiver can save members hundreds of dollars in fees.

- Disaster Relief Grants: It offers disaster relief grants to help members who have been affected by natural disasters, such as hurricanes or floods. These grants can be used for expenses such as temporary housing, home repairs, and other needs.

- Hospital Grants: It provides hospital grants to help members who are hospitalized for an extended period. These grants can help cover expenses such as transportation, lodging, and meals for family members.

- Disability Benefits: It offers disability benefits to help members who are unable to work due to illness or injury. These benefits can include cash payments, health care coverage, and other support.

- Medical Bill Negotiating: It provides medical bill negotiating services to help members save money on their medical bills. Members can work with a professional negotiator to reduce their medical bills and save money.

Overall, it offers a variety of services to help members during difficult times. Whether it’s assistance with housing, debt management, or medical bills, it is committed to helping its members navigate the challenges of life and work.

The Union Plus Education Foundation is a non-profit organization that provides educational opportunities for current and retired labor union members and their families. The foundation offers scholarships to eligible students attending accredited colleges, graduate schools, community colleges, and technical or trade school. The scholarship awards are granted on the basis of academic ability and financial need.

The foundation has awarded millions of dollars in scholarship awards to participating union members and their families over the years. The scholarship award amounts vary depending on the program product, and are determined by impartial post-secondary educators.

The Education Foundation also partners with participating unions to offer education programs and resources to their members. The union plus program product is designed to help current and retired members, as well as their families, access post-secondary education opportunities that might otherwise be out of reach.

The Education Foundation is committed to supporting union families in their pursuit of post-secondary education. Whether it’s attending a community college, technical college, or accredited college or university, the foundation provides opportunities and resources to help students achieve their academic goals.

The Education Foundation is a vital resource for working families seeking higher education opportunities. The foundation offers scholarships to eligible students attending community colleges, and accredited colleges or universities. Scholarships are also available for graduate students pursuing higher degrees.

The partners with participating unions to offer education programs and resources to their members. The foundation’s phone customer service representatives are available to assist students and their families with the scholarship application process and answer any questions they may have.

The foundation’s evaluation criteria for scholarship awards include academic achievement, personal goals, and social awareness. Scholarship award ranges vary depending on the study program beginning and the level of education being pursued.

In addition to its traditional scholarship programs, it also offers scholarships for foster children and other children of working families. These scholarships provide opportunities for children who may face financial barriers to higher education.

The foundation’s scholarship applications are evaluated by impartial post-secondary educators. Individual winners are selected based on their academic achievements, personal goals, and social awareness.

Overall, it provides great deals to students pursuing higher education, including scholarships for graduate students, technical or trade school students, and those attending accredited colleges and universities. The foundation’s commitment to supporting working families and social awareness is a key part of its mission, and it serves as a valuable resource for those seeking opportunities in higher education.

Union Plus FAQs

How much does Union Plus charge for personal loans?

The interest rate on your loan will be determined by several factors, including creditworthiness and the term of the loan. However, rates will generally fall within the range of 5.99% to 15.99%. Enrolling in AutoPay may entitle you to a 0.25% interest rate discount.

The amount you will need to repay each month will depend on the APR and loan term for which you qualify. For example, on a 9.99% Fixed APR loan with 36 monthly payments, you would need to repay $32.26 per $1,000 borrowed. Or, on a 48 monthly payment loan, you would need to repay $25.36 per $1,000 borrowed.

Who can become a member?

Union Plus membership is available to current or retired union members, as well as their spouses, domestic partners, and dependent children. The eligibility criteria may vary depending on the union, but in general, you must be a member in good standing with your union and have paid your dues.

How much does it cost to join Union Plus?

There is no cost to join Union Plus. Membership is free for union members and their families.

How do I access Union Plus services?

Once you become a member of Union Plus, you can access the organization’s services through its website or mobile app. You can log in to your account to access your benefits, find discounts, and apply for financial assistance.

How do I find out about new Union Plus services and discounts?

It regularly communicates with its members through email, newsletters, and social media to inform them about new services and discounts. Members can also check the website for updates on new benefits and services.

What if I have a problem with a Union Plus service or benefit?

If you have a problem with a service or benefit, you can contact the organization’s customer service team for assistance. The team is available to answer questions and address any concerns you may have.

How does Union Plus protect my personal information?

This company takes the privacy and security of its members’ personal information seriously. The organization uses industry-standard security measures to protect members’ personal information and only shares information with its partners and vendors when necessary to provide its services.

Are there any pre-payment penalties?

It does not charge prepayment fees, so you can pay off your loan early without any penalties. This makes it a great option for borrowers who want the flexibility to pay off their loans on their own terms.

How does Union Plus affect your credit?

When you’re considering taking out a loan, understanding the process and what effect each step may have on your credit score is crucial. Many lenders will run a soft credit check upfront to get an idea of the interest rates and loan terms you could qualify for. This doesn’t affect your credit score.

However, once you decide to go ahead with the actual loan application, the lender will need to do a hard credit inquiry to get a full view of your credit history and offer you final rates. These hard inquiries can lower your credit score.

How to cancel Union Plus?

Personal loans can be a great way to get the money you need, but it is important to be sure of your decision before taking one out. Once the funds are dispersed into your account, you cannot reverse or cancel the transaction, so it is important to be certain upfront to avoid any problems later on.

Do you find yourself struggling to make ends meet? Here is some advice that may help you get back on track.

There’s no need to be a financial expert to get your finances in order. Just follow these simple steps and soon enough, your finances will be in good shape.

- Creating and sticking to a budget is crucial in maintaining healthy finances. This will help prevent overspending and make better spending decisions overall.

- Another great way to get your finances on track is by speaking with a financial advisor. They can help assess your current situation and offer helpful advice on how to move forward based on your unique circumstances.

- And finally, don’t sweat debt too much. Many companies are willing to work with customers to create a manageable payment plan. So reach out to their customer service team for more information.

Is Union Plus legit or a scam?

Since it was founded over 36 years ago, Union Plus has offered a variety of financial services to meet the needs of its customers. The company has an A- rating from the Better Business Bureau (BBB) but only has a 1-star rating out of 5 stars based on customer reviews.

Before taking out a loan, it is important to think about the interest rate and repayment terms. It can be helpful to research and compare rates from different lenders to find the best deal. Additionally, reading customer reviews can give you a better idea of which option might be best for you. By doing this, you can avoid taking out a loan that you cannot afford.

Do you know unionplus.org? Leave your experience and review below!

Thank you for reading!

1 Comment

I cannot find (or get) access to the discount code number for car insurance from this company. Very frustrating and a huge waste of time! I only get voicemails every time I call the help number. Is this a legit business or just an advertisement for Travelers insurance company???