Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

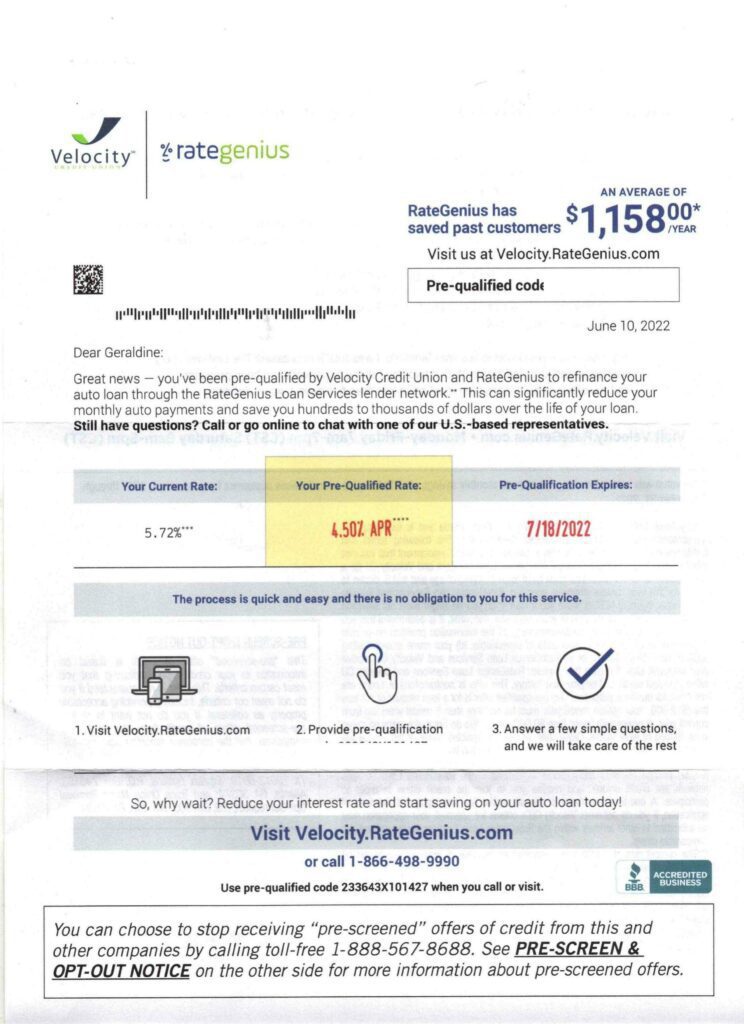

Velocity Credit Union was originally chartered in 1947 as Austin Municipal Federal Credit Union. In 1998, they changed their name to Austin Metropolitan Financial Credit Union (AMFCU) to better reflect their change in membership. In January 2003, they again changed their name to Velocity Credit Union to more accurately reflect their mission and values. It offers a wide range of financial products and services to suit your needs. The company advertises its service at velocitycu.com.

Velocity Credit Union Summary

When you need a loan, knowing which lender to turn to can be difficult. With so many options available, it’s important to do your research to find the one that best suits your needs. Velocity Credit Union is one option that has gotten a lot of attention lately. But is this lender right for you? Here’s a closer look at what they have to offer so you can make an informed decision.

After taking a close look at Velocity Credit Union’s website and terms and conditions, we found some interesting information. Here’s what we discovered.

This credit union is federally insured by the National Credit Union Administration.

- Personal Loans from $500 to $40,000 are available.

- Loan terms are up to 60 months.

- It offers APRs as low as 10.49%.

- Rates and terms are subject to change without notice.

- All fees are subject to change.

- Payment per $1,000 is $21.50 with the lowest rate.

- Your interest rate, term, and payment will be determined when they process your loan application.

- Your annual percentage rate (APR) will be based on your individual credit rating score that is obtained from a credit reporting agency.

What is Velocity Credit Union?

Since January 2003, Velocity Credit Union has been providing financial services to Texans. With over $922 million in assets and 88,000 members, they claim to be one of the largest credit unions around. Their community charter is open to anyone that lives or works in the five-county area (Travis, Hays, Williamson, Bastrop, Caldwell). Personal loans from velocity Banking can be used for a number of purposes, including home improvement, debt consolidation, emergency expenses, and more.

Velocity Credit Union is a financial institution with multiple locations. You can reach them by phone at (512) 469-7000.

Velocity Credit Union is not accredited by the Better Business Bureau (BBB), but it does have an A- rating from the organization. The credit union has an average of 8 customer reviews and 30 complaints closed in the last 3 years. As a result, the company has a pretty low rating from customers, with a 1.13 star out of 5.

How does Velocity Credit Union work?

At Velocity Credit Union, they offer loans for a variety of purposes – from buying a car or remodeling your home, to covering life’s little surprises. With low, fixed rates and convenient payment options, they may help you get the financial support you need. You can apply online in just a few minutes.

How to qualify for Velocity Credit Union?

There are many factors that go into whether or not you will qualify for a Velocity Credit Union loan. Credit history, employment history, and debt-to-income ratio are all important qualifying factors. The best way to see is to apply for the type of Velocity Credit Union loan you’re interested in and find out quickly whether you qualify.

Velocity Credit Union BBB Reviews

As far as credit unions go, Velocity Credit Union is not too shabby. It has an A- rating from the Better Business Bureau (BBB), and an average of 8 customer reviews. In the last 3 years, it has had 30 complaints closed. Consequently, its customers have given it a 1.13 star out of 5 rating, which is bad.

Here are some reviews:

Emma L. 09/16/2022

If I could give zero stars I would. Do not use Velocity for your banking needs if you need your money. First, I put cash into the atm months ago looked at my account balance the next day and it didn’t show I had deposited anything. Called they said they had to audit their machine and it would take 2 weeks. I did end up getting it but I am not wealthy and really couldn’t afford to wait. Last week, I had multiple transactions go through two times, and I overdraft. They waived the $5 fee when I called but wouldn’t fix the double charges.

Then this week my available balance is half of what is reflected in the online transactions both through the app and their website. When I called, for the second time in as many weeks, the representative started reading off my transactions that already went through saying there was no mistake when clearly there was. I have been with velocity for 6 or 7 years and have never had an issue with this but now it’s constant and I am over it. If you depend on your money to be in a safe and reliable establishment do not use velocity. I am pulling my money out first thing tomorrow morning but I am having anxiety leaving it in even THAT long. Velocity, you had one job and you’ve failed SPECTACULARLY.

Then this week my available balance is half of what is reflected in the online transactions both through the app and their website. When I called, for the second time in as many weeks, the representative started reading off my transactions that already went through saying there was no mistake when clearly there was. I have been with velocity for 6 or 7 years and have never had an issue with this but now it’s constant and I am over it. If you depend on your money to be in a safe and reliable establishment do not use velocity. I am pulling my money out first thing tomorrow morning but I am having anxiety leaving it in even THAT long. Velocity, you had one job and you’ve failed SPECTACULARLY.

Mark 02/09/2021

This company has the absolute worst customer service. I have spent well over 5 hours just trying to access my account online. Each time I call the people are very unfriendly and unwilling to help. It seems their only goal is to make the process so painful that you do not call back. I am so thankful to be moving my business elsewhere.

Initial Complaint

05/16/2022Complaint Type: Billing/Collection IssuesStatus: AnsweredMore info

I am attempting to pay off a loan. Velocity Credit credit union sent the wrong payoff amount to my new bank. When all was finally resolved they backdated the second payoff amount to the initial payoff statement and pulled $106.69 out of my payoff amount as interest. The reason my loan was paid off almost a month late was that they provided my new bank with an incorrect statement to pay off the loan. I am requesting they refund me the $106.69 + $129.75 (of other overpayments they owe me) for a total of $236.44 of overpayments. They are refusing the amount and only paying $129.75.

Velocity Credit Union FAQs

How much does Velocity Credit Union charge?

At Velocity Credit Union, they offer some of the most competitive APRs in the industry. Their loan terms are also very flexible, ranging from 12 to 60 months. However, rates, terms, and fees are subject to change without notice.

Are there any pre-payment penalties?

At Velocity Credit Union, there are no prepayment penalties for those who choose to pay off their loan faster than originally scheduled.

How does Velocity Credit Union affect your credit?

Before you apply for a loan, it’s a good idea to check your credit score and see what interest rates and terms you may qualify for. This is done by doing a soft credit pull, which doesn’t affect your credit score at all.

However, once you decide to go ahead with the loan application, the lender will do a hard credit inquiry to get a full view of your credit history and offer you final rates. These hard inquiries are common whenever you apply for loans and will lower your credit score, so be aware of that before applying.

How to cancel Velocity Credit Union?

Before you apply for a personal loan, it’s important to be absolutely certain of your decision. Once the funds have been dispersed into your account, there is no way to cancel or reverse the transaction. So be sure you’re completely comfortable with your choice before moving forward. This will help you avoid any cancellations or changes down the line.

Having trouble making ends meet? Here are some tips that could help you get back on track.

There are a few key things you can do to get your finances on track.

- First, create and stick to a budget. This will help you stay mindful of your spending and help ensure that you are using your money in the best way possible.

- Another option is to speak with a financial advisor. They can help you understand your unique financial situation and develop a plan that will work for you.

- And finally, don’t worry too much about debt. Many companies are willing to work with customers to create a more manageable payment plan. So reach out to their customer service team for more information.

Is Velocity Credit Union legit or a scam?

Established over 75 years ago, Velocity Credit Union offers financial assistance to residents in the state of Texas. Although the company has an A- rating from the BBB, it is not accredited by the organization. Unfortunately, this company has a 1-star rating out of 5 stars from customer reviews. The company has more complaints and negative reviews than positive ones.

Loans can be a great way to finance big purchases or consolidate debt, but it’s important to do your research before signing on the dotted line. Compare interest rates and customer reviews to make sure you’re getting the best deal possible. This way, you can avoid taking out a loan that you can’t afford.

Do you know velocitycu.com? Leave your experience and review below!

Thank you for reading!