Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

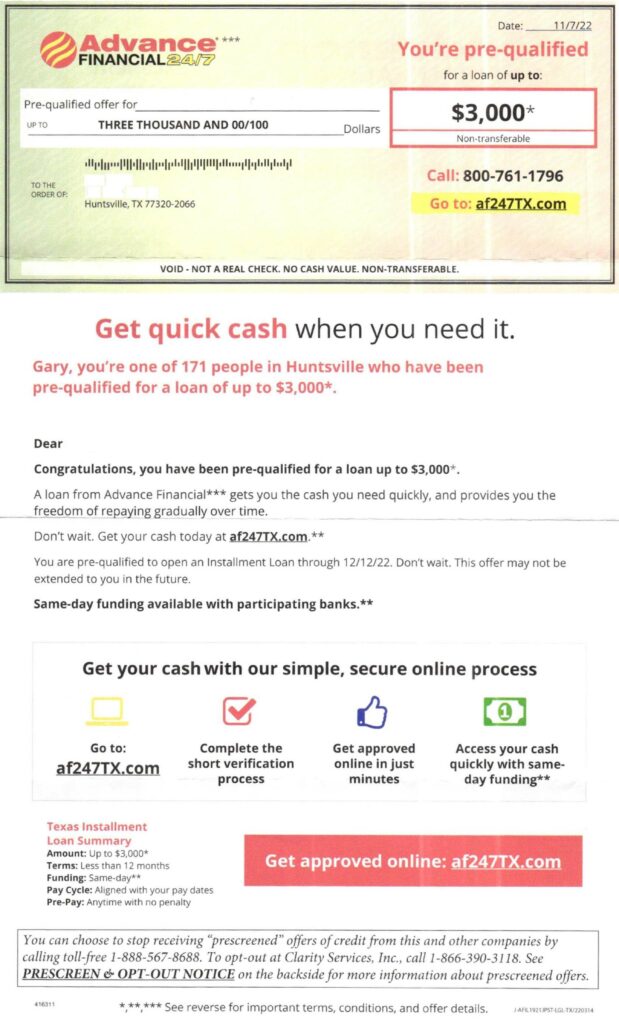

Advance Financial FLEX Loan, is a convenient, flexible way to borrow money. Founded in 1998 and based in Nashville, TN, Advance Financial is a direct lender that is available in 12 states across the USA. The FLEX Loan is designed to help you cover unexpected expenses and can be repaid in full or in installments. The company advertises its services at af247.com.

Advance Financial Summary

When exploring the option of a personal loan, it is essential to investigate your choices. Advance Financial is a favored lender, but is it the most suitable for your specific requirements? To make an educated decision, you should be aware of the services offered by Advance Financial. This article offers a comprehensive examination of their services so that you can make a well-informed decision about whether Advance Financial is the ideal lender for your business loan.

We have now finished a thorough investigation of the organization’s website and regulations. Here are some noteworthy discoveries we discovered.

- It offers a fixed APR that ranges from 240% APR up to 360% APR.

- The loan amount ranges between $25 to $4000.

- It will typically approve (or deny) a line of credit application within 48 hours and fund personal lines of credit within 1 business day of approval.

- It also provides check cashing services, Free bill pay, wire transfers, Netspend Cards, and free money orders.

Advance Financial Flex Loan Pros and Cons

Pros

- Fast approval process: Advance Financial’s online application process is quick and easy. You can get approved for a Flex Loan in just a few minutes.

- No credit check required: Unlike traditional lenders, Advance Financial doesn’t require a credit check. This means that even if you have bad credit, you can still qualify for a Flex Loan.

- Flexible repayment options: The Flex Loan can be repaid in full or in installments, depending on your preference. This gives you the flexibility to choose a repayment plan that works best for you.

- Low fees: Advance Financial charges lower fees than other lenders in the industry. This can save you money in the long run.

- Extended hours of operation: Advance Financial is open 24/7, so you can apply for a loan at any time of the day or night.

Cons

- Limited availability: Advance Financial is only available in 12 states across the USA. If you don’t live in one of these states, you won’t be able to apply for a loan.

- High-interest rates: While the fees are lower than other lenders, Advance Financial’s interest rates are still relatively high. This means that you’ll end up paying more interest charges over time.

- Penalty fees: If you miss a payment or are late with a payment, you may be charged penalty fees. These fees can add up quickly and make it harder for you to repay your loan.

- Limited loan amounts: The maximum loan amount you can receive from Advance Financial is $4,000. If you need more than this, you’ll need to look for another lender.

- No face-to-face interaction: Since Advance Financial is an online lender, you won’t be able to meet with a loan officer in person. This can be a disadvantage if you prefer face-to-face interaction.

Services Offered by Advance Financial

Advance Financial offers a variety of financial services, including:

- Flex Loans: Personal loans that can be repaid in full or in installments.

- Installment Loans: Loans that are repaid over a fixed period of time, with regular payments.

- FLEX Line of Credit: A line of credit that can be used as needed.

- Title Loans: Loans that are secured by your vehicle.

- Check Cashing: The ability to cash checks at any Advance Financial location.

- Prepaid Cards: Reloadable prepaid cards that can be used anywhere Visa is accepted.

- Money Orders: A safe and secure way to send money.

- Bill Payment: The ability to pay bills online or in-store.

- Western Union: The ability to send and receive money via Western Union.

- Netspend: A prepaid debit card that can be used anywhere Mastercard is accepted.

What is Advance Financial?

Advance Financial FLEX Loans and cash advance online are offeredin ten different states in the US and also operates 85 locations in Tennessee. Their online platform and physical stores can give customers instant access to up to $4,000. States: Alabama, California, Delaware, Idaho, Kansas, Missouri, North Dakota, Tennessee, Utah, and Virginia.

Advance Financial currently has a C- rating with the Better Business Bureau and is not accredited. This is due to an average of 40 Customer Reviews and 168 complaints over the past three years, resulting in a 1-star out of 5-star rating from customers. This is an indication that customers have had negative experiences with the company, and that the company needs to address these issues in order to improve its rating and accreditation.

How does Advance Financial work?

Advance Financial is a financial services company that offers a range of services including cash advances, payday loans, installment loans, bill pay, money transfers, prepaid debit cards, and check cashing. To use the services, customers simply need to visit an Advance Financial store, online, or by phone. At the store, customers can complete a loan application and if approved, they can receive the funds they need.

Online, customers can apply for a loan, check their loan status, and manage their loan. By phone, customers can speak with customer service representatives who can answer any questions. You can use these personal loans for debt relief, medical bills, or buying a new home.

How to qualify for Advance Financial?

Advance Financial FLEX Loan does not have a minimum annual income requirement for eligibility, though borrowers must be employed. The minimum age to be eligible is 18 or the state minimum, whichever is higher. U.S. citizens and permanent resident/green card holders can apply for the services offered by Advance Financial FLEX Loan.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

- Proof of income

- Driver’s license

- Proof of citizenship or residence permit

Advance Financial BBB Reviews

Advance Financial has a C- rating with the Better Business Bureau and is not accredited at this time. This poor rating is due to the average of 40 Customer Reviews and 168 complaints over the past three years, resulting in a 1-star out of 5-star rating from customers. These reviews and complaints are an indication that customers have had negative experiences with the company, and that Advance Financial needs to address these issues in order to improve its rating and accreditation. To increase customer satisfaction and improve their rating, Advance Financial should take the necessary steps to listen to their customers’ feedback and address their concerns promptly.

Here are some reviews:

The bottom line is NEVER using this company or any other like it. They prey on the working-class poor and loans can never really be paid off. Very poor judgment on my part to ever use this kind of high-interest loan company. I just want to warn anyone who feels the need to use them, DON’T. You will fully regret it. These types of loan companies should be illegal. My mother tried to warn me, but I was desperate and then life happens. You get a loan for 300$ and then eventually owe 6000$.

Dawn S

01/25/2023

Don’t know about the loans but don’t ever get the free money order from them if it’s stolen you have to pay a fee and then if someone cashed it illegally you will not get your money back.

Denise G

01/15/2023

I took out a $2,400 loan over a year ago to help me pay off some of my bills and catch up on them. I have paid back well over $2500 or more than that. By now I pay about $500 a month and I am on Social Security disability, I cannot get out from under this loan it is causing me so much stress and heartache. It is making me so sick to my stomach daily and monthly, I have a little boy that I have to take care of and all I was trying to do was catch up on my bills. I feel like I’m being taken advantage of. I feel I will never ever have those paid off because only a little bit goes to the principal every day and grows interested and by the end of the month when it comes time for me to pay it again it’s back up to about the $2400 that I borrowed. It seems like I will never ever pay it off. It just doesn’t seem right it should not be legal and I’m on Social Security disability. I’m just so sick over this.

Barbara J.

12/30/2022

Advance Financial FAQs

How much does Advance Financial charge?

Advance Financial FLEX Loan offers a convenient and accessible option for obtaining a line of credit. Their fixed APR product ranges from 240% to 360%, with no origination fee or cash advance fee. This makes it an attractive option for those seeking quick access to funds. Furthermore, Advance Financial typically approves (or denies) applications within 48 hours and funds personal lines of credit within 1 business day of approval, making it a fast way to get the money you need.

How to apply for Advance Financial?

Applying for Advance Financial is easy. All you need to do is visit their website and fill out the online form. Once you have completed the form, you will need to provide proof of your income, identity, and other necessary documents. After submitting your application, they will review your information and make a decision on whether or not to provide you with a loan. If approved, you will be able to access your funds as soon as the next business day.

How does Advance Financial affect your credit?

Advance Financial can have a positive or negative effect on your credit score depending on how you use the service. If you make payments on time and in full, then it can help to improve your credit score. On the other hand, if you make late payments, incur multiple fees, or allow your balance to become too high, then it can negatively affect your credit score. It’s important to remember that any type of loan or credit line can impact your credit score, so it is essential to use Advance Financial responsibly in order to maintain a healthy credit score.

How to cancel Advance Financial?

Taking out a personal loan is a serious decision that should not be taken lightly. Before any loan amount is disbursed, it is important to research all loan options and study the terms and conditions of the loan in order to make sure it is the right decision for your situation. Once the loan amount is credited, it cannot be reversed, and you become responsible for paying back the loan with interest. Therefore, it is essential to be sure that taking out a loan is the right decision before applying.

Are you struggling to make ends meet? Here are some helpful tips to get you back on track.

Are you feeling the financial strain? It can be difficult to make ends meet when you’re dealing with a tight budget. But there are some helpful tips you can use to get back on track.

The first step is to create a budget. This will help you track your spending and make sure you’re sticking to your financial goals. Make sure to include all necessary expenses, such as rent, utilities, and groceries, as well as your discretionary spending. Once you’ve created your budget, you can start to find ways to reduce your expenses and save money.

Cutting down on unnecessary spending is a great way to save money. Consider forgoing the morning coffee run and making coffee at home instead. You can also look for ways to save on groceries, such as buying in bulk or using coupons.

Another way to save money is to reduce your debt. If you’re paying interest on credit cards, try to pay them off as quickly as possible. You may also want to consider consolidating your debt into a single loan with a lower interest rate.

If you’re still struggling to make ends meet, consider looking for ways to increase your income. This could involve taking on a part-time job, freelancing, or even selling items you no longer need.

It’s important to remember that you’re not alone in your financial struggles. With the right strategies, you can get back on track. So take the time to create a budget, reduce your expenses, and pay off your debt. You’ll be back on your feet in no time.

Is Advance Financial legit or a scam?

Advance Financial is a well-established company that has been in business for 25 years, however, its C- rating with the Better Business Bureau reflects a need for improvement. This rating is due to the average of 40 customer reviews and 168 complaints over the past three years, leaving Advance Financial with a low 1-star out of 5-star rating from customers. This is a clear indication that Advance Financial needs to address customer concerns in order to improve its rating and accreditation. To achieve this, the company should take the necessary steps to listen to their customers’ feedback and address their concerns promptly.

When considering a personal loan, it is important to do your research to find the best provider. This includes reading customer reviews, verifying the lender’s credentials and experience, and making sure that the terms and conditions are clear and reliable. Taking the time to evaluate these aspects will ensure that you get the best loan provider and loan for you. Doing the necessary due diligence will pay off and make sure you get the best deal.

Do you know af247.com? Leave your experience and review below!

Thank you for reading!

1 Comment

Predatory lending at its finest and should be shut down. Interest (279%) is applied daily to your loan making it impossible to pay it down. DO NOT TAKE A LOAN OUT WITH ADVANCE FINANCIAL 24/7!