Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

There are a lot of Texan Credit Corporation reviews out there. So, is Texan Credit Corporation legit or a scam? That’s what we’re going to explore in this article. Texan Credit Corporation is an installment and signature loans company that has been around since 2007. They offer loans to people with bad credit, no credit, or who are self-employed. In this Texan Credit Corporation review, we’ll take a closer look at the company and help you decide if it’s the right choice for you.

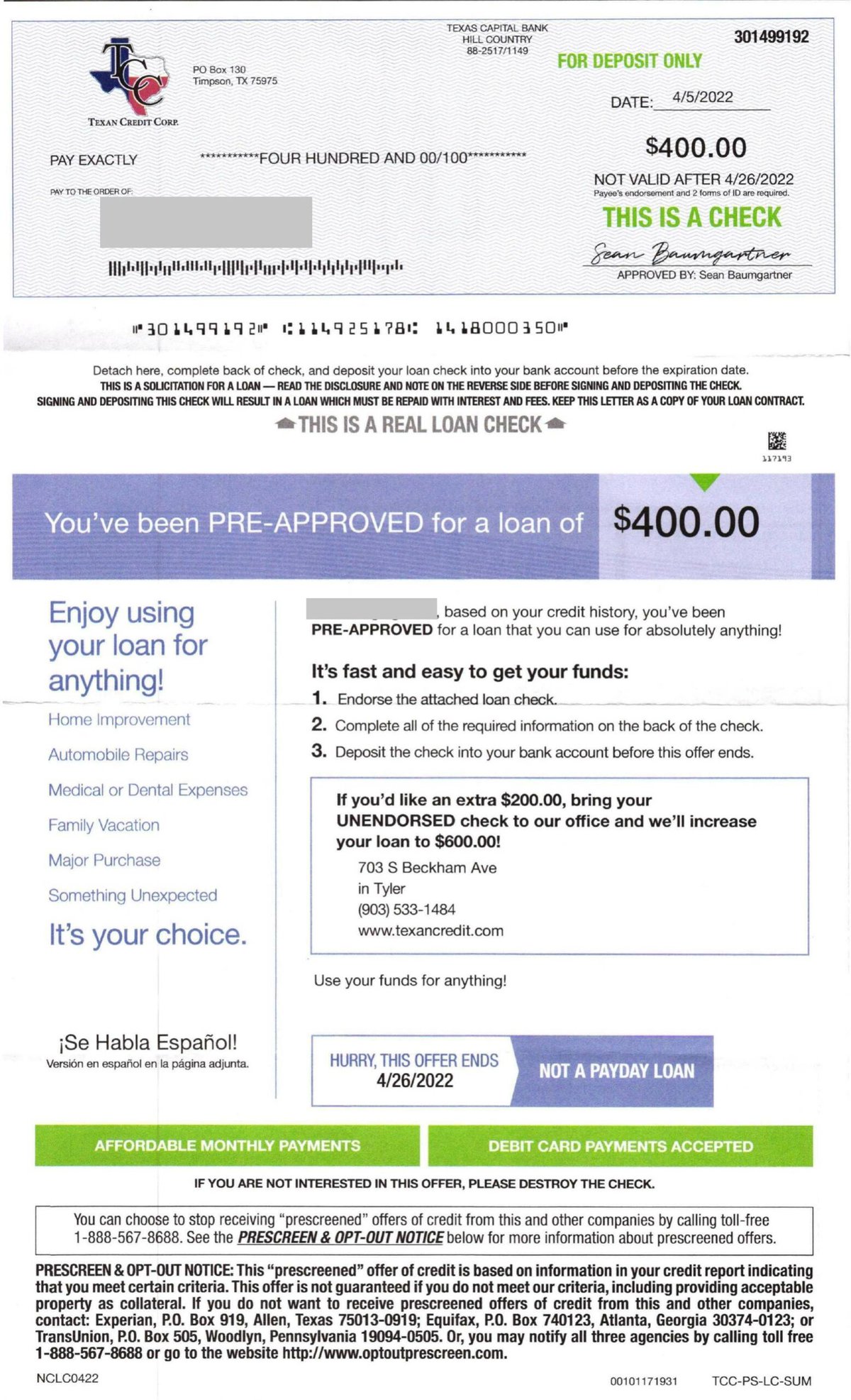

Texan Credit Corporation has been accused of bait and switch tactics. They advertise one thing and then try to sell you something else. For example, they might advertise a loan for people with bad credit, but when you apply, they only offer you a higher interest rate loan. This is a common tactic used by predatory lenders to take advantage of people with bad credit.

There are also a lot of negative reviews about Texan Credit Corp online. People have complained about high-interest rates, hidden fees, and unprofessional customer service. However, it’s important to remember that not all reviews are created equal. Some people may be more likely to leave a negative review than a positive one.

However, there are a lot of red flags that should make you think twice about doing business with this company. If you’re considering taking out a loan from Texan Credit Corporation, we recommend that you explore other options first.

2.0 out of 5.0 stars2.0

Texan Credit Corporation pros and cons

There are a lot of things to consider when you’re looking for a loan, and one of the companies you may come across is Texan Credit Corporation. They offer both installment and signature loans, but there have been accusations of bait and switch tactics. And if you look at their reviews, a lot of them are negative.

So what are the pros and cons of working with Texan Credit Corporation? Let’s take a look.

One of the pros is that they offer both installment and signature loans. This means that you can choose the type of loan that best suits your needs. Installment loans are good for people who need a larger amount of money and can make regular payments over time. Signature loans are more flexible, and you can use them for a variety of purposes.

It also has convenient loan locations all over Texas.

However, there are some drawbacks to working with Texan Credit Corp. One of the biggest is that they have been accused of bait and switch tactics. This means that they may lure you in with the promise of low-interest rates, but then try to switch you to something else. This can be very frustrating, and it can end up costing you more money in the long run.

Another downside is that their customer service reviews are mostly negative. This means that if you have any problems with your loan, it may be difficult to get them resolved. And finally, their interest rates are on the high side.

Make sure you understand the terms of your loan and research the company thoroughly before you agree to anything. That way, you can be sure that you’re getting the best possible deal.

What is Texan Credit Corporation?

Texan Credit Corporation offers loan programs like installment and signature loans. However, many customers have complained of being baited and switched by the company. This has led to a negative reputation for Texan Credit Corporation.

This company claims to make the entire loan process simple, but it’s hard for them to offer a budget friendly payment plan.

Personal loan companies are not always transparent about their terms and conditions. It’s important to read the fine print carefully before signing any agreement. And if you do take out a loan with them, make sure to keep meticulous records so that you can hold them accountable if they try to bait and switch you.

How does Texan Credit Corporation work?

Texan Credit Corporation is a personal loan company. The company promises low-interest rates and easy repayment terms but instead charges high fees and interest rates.

Additionally, Texan Credit Corporation has been accused of predatory lending practices, such as requiring customers to renew their loans before paying off their original loans. These practices make it difficult for customers to get out of debt.

As a result, many people end up paying more than they should for their loans, making it impossible to pay bills.

If you’re considering taking out a personal loan from Texan Credit Corporation, be sure to do your research first and understand all the terms and conditions.

How many employees does Texan Credit Corporation have?

Texan Credit Corporation has 51 to 200 employees.

How do you qualify for Texan Credit Corporation?

Texan Credit Corporation, a registered trademarks, is a personal loan company that offers loans to qualified applicants. To qualify for a loan from Texan Credit Corporation, you must meet the following qualifications:

- Be at least 18 years old

- Have a valid Social Security number

- Be a resident of the United States

- Have a steady income

- Have good credit history.

If you meet these qualifications, you can apply for a personal loan from Texan Credit Corporation. The application process is simple, and you can get your money as soon as 48 hours. If you have any questions contact their customer services.

What kind of loans does Texan Credit Corporation offer?

Texan Credit Corporation offers installment and signature loans, as well as credit-based installment loans. However, the terms and conditions of these loans are often unfair to borrowers. For example, the interest rates on these loans are typically very high, and the repayment periods are often quite short. This can make it very difficult for borrowers to repay their loans on time, which can lead to late fees and other penalties.

What is the interest rate on Texan Credit Corporation?

As of right now, the interest rates on personal loans with Texan Credit Corporation are incredibly high. In fact, many people have complained that the rates are too high and have taken their business elsewhere. If you’re considering taking out a loan with this company, be sure to shop around first and compare rates.

How do you pay back Texan Credit Corporation?

You have two options: pay online or by phone. The problem is, that neither of these options is great. If you pay online, you’ll be charged a $15 convenience fee. And if you pay by phone, you’ll be charged a $30 processing fee. So basically, no matter how you pay back Texan Credit Corporation, you’re going to be charged a fee. And that’s not even taking into account the interest rate on the loan itself!

What happens if you don’t pay Texan Credit Corporation?

If you can’t pay back your personal loan from Texan Credit Corporation, they may report it to the credit bureaus. This could negatively impact your credit score and make it harder for you to get loans in the future. If you’re having trouble making payments, contact Texan Credit Corporation right away to discuss your options. They may be able to help you arrange a new payment plan that works better for you.

How does Texan Credit Corporation affect your credit?

Texan Credit Corporation is a personal loan company that offers loans to people with bad credit. If you have bad credit, Texan Credit Corporation may be one of the few places where you can get a loan. However, getting a loan from Texan Credit Corporation will likely come at a high cost.

Texan Credit Corporation will do a hard pull inquiry on your credit report when you apply for a loan. This hard pull inquiry will lower your credit score by a few points. Additionally, if you make any late payments on your loan, Texan Credit Corporation will report the late payments to the credit bureaus. These late payments will damage your credit score and may stay on your credit report for up to seven years.

How to cancel Texan Credit Corporation?

If you have an outstanding balance on your loan, you may be able to cancel the loan by contacting the company and requesting a cancellation. However, you will still be responsible for repaying the outstanding balance on the loan. If you are unable to repay the outstanding balance, you may be subject to collections activity.

If you have any questions about how to cancel Texan Credit Corporation or if you need assistance with canceling your loan, please contact their customer service.

Texan Credit Corporation BBB Reviews

Texan Credit Corporation has a B+ rating from the Better Business Bureau (BBB) and has been accredited since August 12, 2020. The company has been in business for 14 years and has had six complaints closed in the last three years, four of which were closed in the last 12 months.

The BBB website provides very little information about the complaints against Texan Credit Corporation. However, based on the number of complaints and their relatively recent dates, it appears that customer satisfaction is not a strong point for this company. They have a 1 star out of 5.

Here are some BBB reviews:

Complaint Type: Billing/Collection Issues

Status: Answered 07/07/2022

1.0 out of 5.0 stars1.0My complaint is with Texan Credit in *****, ***** on ****. I took out a loan for $1400 with a balance of $2000. I make all my monthly payments and I recently found out that my balance never went down and I called and spoke with manager ******* and asked her why my balance was higher than what was owed and she told me that when I renewed my amount went back to the original.

Ok so first of all, when they called me to ask if I wanted to renew, all they would tell me if I renewed I would just make smaller payments and not once did they mention that my amount would restart, not once otherwise I wouldnt renew period!! Who wants to restart their loan when we want to finish paying it off!! I see other people have complained about the same thing. They dont tell the customers that because they know they wont renew. I am so upset that my amount never went down and is still higher than what I owe.

I know I paid my amount off by now but because “i renewed” it restarted!!! This is not right by the company to do this to the customers. They need to explain the renewals to everyone!! Honestly, if they did, do you think everyone will renew? No!! They do this to make their quotas or commission. I will take this further if something is not done. I wanted to speak to the supervisor ******* but I have yet to get a call from him. Very unprofessional.

Complaint Type: Advertising/Sales Issues

Status: Resolved 10/18/2021

1.0 out of 5.0 stars1.0I became aware of this company on the weekend of July 4th. I had received a letter in the mail thanking me for being a customer.. i was obviously confused so i got a hold of someone on July 6th. I had found out that an individual had taken my information and had gotten a loan of $600 on June 22nd 2021.

I made it very clear to them that my identity had been stolen in June as I had a situation with ***** ***** and it got taken care of.. It was clear this wasn’t me as the bank acct the check was deposited to was not mine, the hand writing on the back of the check wasn’t mine, the signature did not match mine nor did the phone numbers given. I filed a police report with San Antonio police dpt ,I had to sign a few papers, I was told this would be taken care of… here we are October 2021… I’m still receiving late notices, and this is still being reported on my credit making my credit score go down tremendously.

Complaint Type: Problems with Product/Service

Status: Answered 01/07/2021

1.0 out of 5.0 stars1.0The customer service at Red River Credit is completely nonexistent. Natasha is rude and condescending. She should be fired, her negative behavior completely ruined the experience of doing business with this company. I have been a customer of Red River Credit for over 5 years and I will try my dead level best to pay them off ASAP and never go back.

Is Texan Credit Corporation legit or a scam?

Texan Credit Corporation has been accused by many customers of using bait and switch tactics to lure them in with the promise of low-interest rates but then charging much higher rates once they have signed up for the loan. Allegedly, they also use predatory lending practices, such as charging hidden fees, which can trap borrowers in a cycle of debt.

There are a lot of negative reviews about texancredit.com online, so it’s important to do your research before doing business with them.

Have you had any experiences with Texan Credit Corporation? Share them in the comments below!

Thank you for reading!

Compare Texan Credit Corporation