Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Rush Tax Resolution claims to be the go-to authority when it comes to taking care of your tax matters. They claim that their tax specialists have vast knowledge in all forms of relief, from liens and offers in compromise – allowing you to tackle any situation without a comprehensive understanding of tax laws and the IRS’s methods. The firm has top expert enrolled agents, CPAs and seasoned industry expert attorneys.

Rush Tax Resolution Services

Offer in Compromise

Struggling to pay your tax bill? An offer in compromise settlement with the IRS could be your financial salvation! This agreement is a brilliant way for taxpayers nationwide to get some relief from tax liabilities by paying off their debt for less than what’s actually owed. Don’t let money woes keep you up at night – explore an Offer in Compromise and reclaim control of your finances today.

Wage Garnishment

Fed up with sinking further and further into debt with the IRS? We know it’s hard to face a hefty wage garnishment alone . Rush’s team specializes in negotiating with the IRS wage garnish, aiming for complete or partial relief from wages being withheld.

Unfiled Tax Returns

Tax evasion can be a costly mistake, with potentially severe penalties enforced by the IRS. The IRS is serious about upholding our nation’s tax laws, so if you’ve been failing to file your income taxes it might be time to turn things around and start preparing missing returns. Tax evasion can result in costly penalties and put a strain on the American economy.

Payment Plans

Struggling to stay on top of your IRS payments? You need a payment or an IRS Installment Agreement tailored just for you to get your taxes bills settled in an affordable way.

State Tax Problems

Sometimes state tax issues create more stress than the IRS. The states utilize aggressive collection tactics. Getting tax relief is the first step in settling what’s owed and the best way to get great results.

Payroll Tax Problems

If you’re an employer, payroll taxes can be tricky – but they don’t have to be! Failing to pay Social Security, Medicare, and income tax withholding from your employees’ wages could result in serious consequences with the IRS. Proper filing and payment are essential for avoiding any IRS-related drama down the road.

Tax Lien

End the worry of unpaid taxes and tax issues.. A team of expert tax lawyers can provide you with assistance to remove or relieve your property’s tax lien. Get a free consultation to show you the best way forward and resolve IRS collection efforts.

Bank Levy

If you owe on your taxes, the government may take legal action to satisfy their debt by hitting your bank account. When it comes to tax debt, a bank levy and a lien can both come into play. A lien can be viewed as a claim against your property that acts as collateral for the amount owed in taxes; on the other hand, if you don’t settle up with Uncle Sam when he comes calling, then he may just take what’s yours–a bank levy is like legal repossession of your assets used by the government to satisfy any unpaid amounts due settlement in full.

Penalty Abatement

Dealing with a tax problem can be an overwhelming experience – interest and penalties add up quickly, making the amount due much more than was originally expected. You need assistance in filing your paperwork correctly so you don’t have to worry about additional fees added on top of what’s already owed. Get a fresh start!

IRS Audit Notification

Receiving an IRS audit letter can be stressful, but don’t panic! Everyone gets them eventually. Tax relief professionals can help you make sense of it and meet deadlines associated with this process so that your time is as stress-free as possible. Timely action on this matter is important since all IRS communication necessarily comes with deadlines that must be met.

IRS Seizures

Failure to pay taxes can have serious consequences- from the seizure of assets by the government to having a federal tax lien placed on all your property. A federal tax lien enables the U.S. legal system to claim all of a person’s possessions and rights over unpaid taxes If you’ve been impacted in any way by this issue, you should consider getting help from a tax relief professional.

Innocent Spouse

Married taxpayers reap important benefits by filing a joint tax return. But in the event of divorce, each party remains held accountable for taxes and any associated penalties or interest – even after separation!

Statute of Limitations

Navigating the IRS Statute of Limitations can be a daunting process, but you don’t have to go at it alone. Tax professionals can help make sense of the complexities and develop an effective strategy for your unique situation.

Tax Planning and Preparation

Tax season can be daunting. Tax experts can make tax season an easier, more stress-free experience- so that you don’t have to stress out come April 15th.

Currently Not Collectible

Are you struggling financially during these uncertain times? The IRS and some states have an incredible program to help those experiencing severe economic hardship. You could qualify for tax relief through an IRS and state-sponsored program designed specifically for those experiencing severe economic hardships. A tax relief service can assess whether or not this program is right for your individual situation.

Sales and Use Tax

The Sales Tax Law has become an increasingly complex and bureaucratic ordeal, making it difficult to stay in compliance. Having the right representation can be invaluable, as tax audit services come with a full suite of assistance – from initial consultations to helping ensure you meet all necessary criteria during audits. Don’t risk an unwelcome surprise; make sure your business is prepared for every stage of the sales tax process!

Rush Tax Resolution Free Tax Resources

IRS Transcript

Rush Tax Resolution offers a free IRS transcript which they claim others charge up to $1,500. With just one business day turnaround time, get peace of mind knowing exactly what information is held in your government files.

Pre-qualify for Offer In Compromise

Rush Tax Resolution claims they have negotiated offers in compromises that saved their clients hundreds of thousands. Their clients have received a fresh start through their successful negotiation program.

Covid-19: Small Business Payroll 941

Rush Tax Resolution suggests contacting them before reaching out to the IRS alone. The COVID-19 pandemic had been a trying time for many business owners and self-employed individuals, especially when it comes to owing taxes. Running a business during the current pandemic was stressful enough, without having to worry about owing taxes. Many entrepreneurs and self-employed individuals were affected by Covid-19 and find themselves in debt with payroll tax, corporate, or sales tax.

Free IRS Report

Rush Tax Resolution offers a free report, “7 Secrets the IRS Doesn’t Want You To Know!” This free report reveals the top audit strategies and how to legally reduce any tax debt you owe. Uncover these precious gems, which are sure to give taxpayers an edge in their battle with America’s biggest government agency! Other firms don’t offer this.

Rush Tax Resolution in the Press

The Rush Tax Solutions website boasts how it has received endorsements from Larry Elder, Dan Bongino, Jennifer York (KNX 1070 Traffic Anchor), Mike Simpson (KNX 1070 News Anchor), Heidi Hamilton (The Heidi, Frosty & Frank Show’ 95.5 KLOS Los Angeles), Randy Kerdoon (KNX 1070 Sports Anchor).

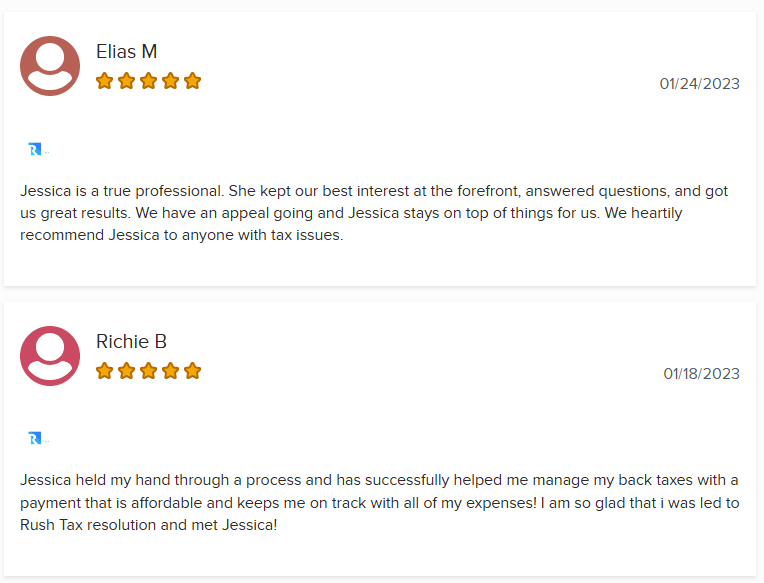

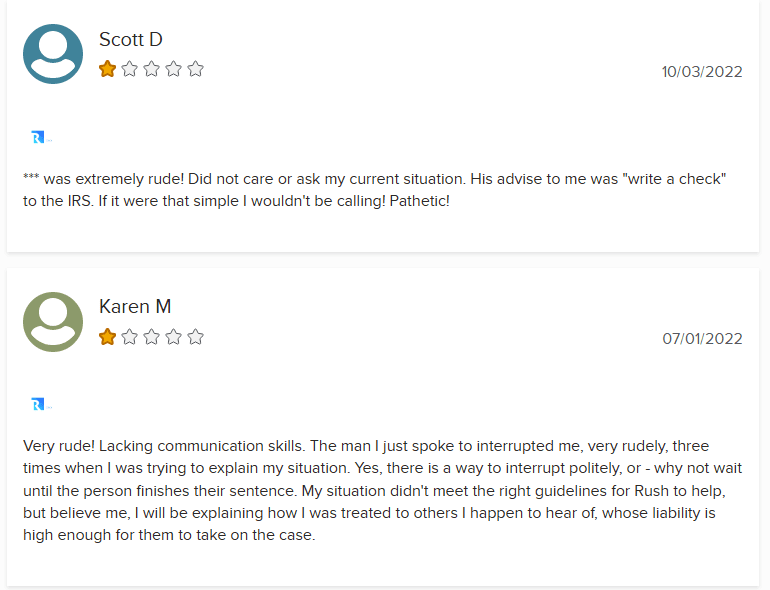

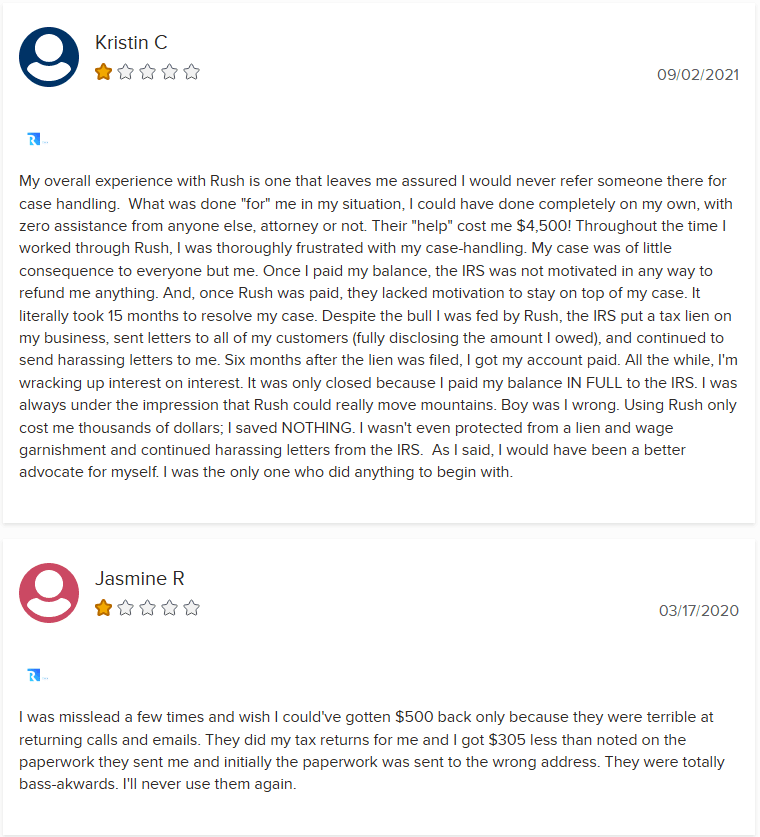

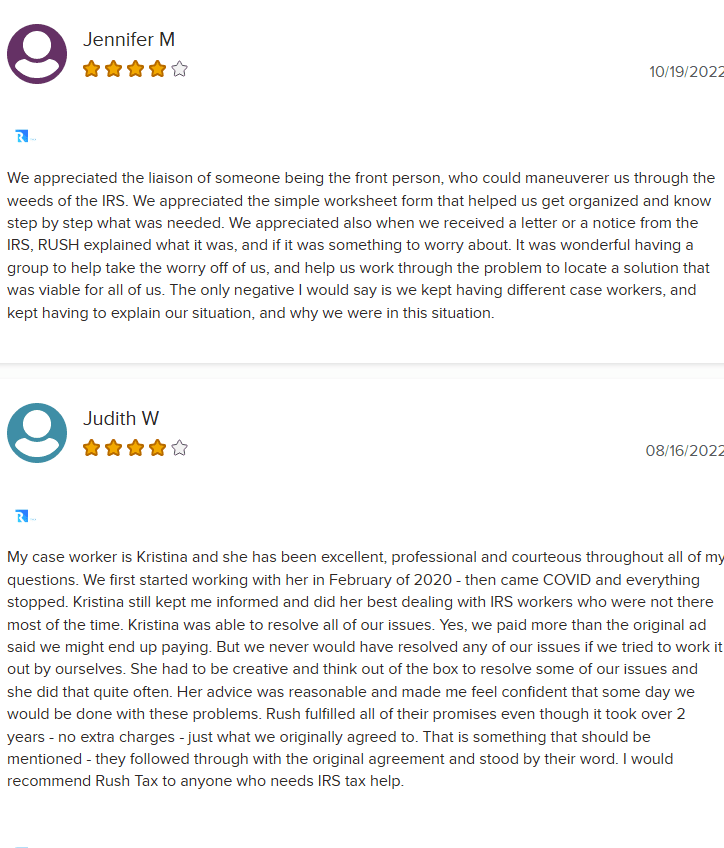

Rush Tax Resolution BBB Reviews

Overall, Rush Tax Resolutions’ BBB reviews are quite positive. They have been accredited by the Better Business Bureau since 2015 and have been in business for 8 years. Below we have selected random reviews – both positive and negative – to display some customer experiences.

The BBB lists company managers as:

- Ms. Savanah Solomon, Client Engagement Director

- Mr. BJ Pourteymour, COO

- Mr. Zane Schulte, President/CEO

- Mr. Ian Clark, Director of Client Services

Rush Tax Resolution Affiliations

Rush Tax Resolution is affiliated with Heartland Tax Group, Amend Treatment Center, the Zane Schulte Award, Schulte Investment Group, and the National Cutting Horse Association. They also offer an annual general education scholarship at rushtaxresolution.com.

Rush Tax Resolutions Social Media

Twitter – https://twitter.com/Rush_tax, Facebook – https://www.facebook.com/RushTaxResolution, Instagram – https://www.instagram.com/rushtaxresolution/, YouTube – https://www.youtube.com/channel/UCRm6j83lv8mrLut2a4O6VRQ

Rush Tax Resolution Locations

Corporate Headquarters

445 S. Figueroa Street, 31st Floor

Los Angeles, CA 90071

OTHER LOCATIONS

6320 Canoga Avenue, 15th Floor

Woodland Hills, CA 91367

4695 MacArthur Court, 11th Floor

Newport Beach, CA 92660

BBB Contact Information

25350 Magic Mountain Pkwy STE 300

Valencia, CA 91355-1356