Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

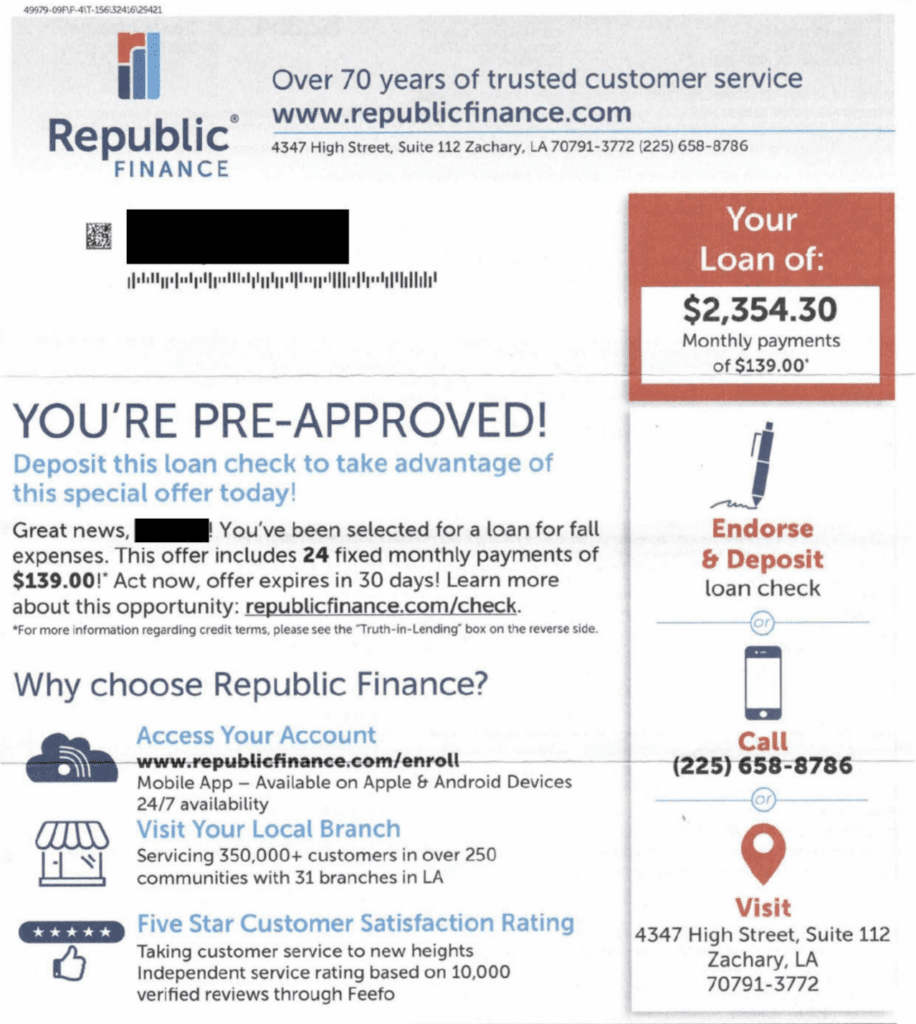

Republic Finance has established itself as a significant player in the lending industry since its inception in 1952. With decades of experience under its belt, the company has grown to service almost 300,000 customers, offering a variety of loan products tailored to meet the financial needs of its clients.

Located in the United States, Republic Finance operates across multiple states, providing personal loans, automobile loans, and bill consolidation loans, among others. Despite its extensive history and service offerings, potential borrowers should be aware of various factors, including the company’s APR rates and state availability, when considering Republic Finance for their lending needs.

Republic Finance Pros and Cons

Pros:

- Decades of Experience: Republic Finance has been a cornerstone in the lending industry since 1952, boasting over six decades of experience. This longevity offers consumers peace of mind, knowing they are dealing with an established lender with a deep understanding of the market.

- Wide Customer Base: Serving almost 300,000 customers since its inception highlights Republic Finance’s ability to meet the needs of a diverse client base. Their extensive experience is a testament to their role as a leader in the personal loans industry.

- Range of Loan Products: Republic Finance offers a variety of loan products, including personal loans, automobile loans, and bill consolidation loans. This range indicates their commitment to catering to different financial needs and scenarios.

Cons:

- High APR Rates: Despite not disclosing exact APR rates upfront, Republic Finance indicates that their average interest rate is below 35.99 percent APR. However, an example provided suggests a 27.33 percent APR for a $6,000 loan over 60 months for customers with good credit, which is considered high compared to other lenders.

- Limited State Availability: Services are only offered in Alabama, Georgia, Kentucky, Louisiana, Mississippi, Missouri, South Carolina, Tennessee, and Texas. This limited geographic availability may restrict access for potential borrowers outside these states.

- Lack of Transparent Information: The company’s website lacks detailed information regarding loan offerings, APR range, credit score requirements, and other pertinent details. Potential customers must fill out a form or contact Republic Finance directly to obtain this information, which can be a barrier for those researching their options.

- Limited Reviews: There’s a noticeable scarcity of customer reviews, making it challenging to assess the company’s customer service quality and overall satisfaction levels. The lack of transparent customer feedback may deter potential borrowers from choosing Republic Finance without further research.

These aspects provide a balanced view of Republic Finance, highlighting its experience and service range against concerns regarding transparency, cost, and accessibility.

Republic Finance Products and Services

Republic Finance has carved out a significant niche in the financial services industry, largely due to its broad array of loan products designed to cater to various consumer needs. Despite the lack of detailed information available directly on their website, the company’s loan offerings include, but are not limited to personal loans, automobile loans, and bill consolidation loans. These products highlight Republic Finance’s commitment to providing financial solutions that accommodate a range of personal financial scenarios.

Personal Loans: Tailored for individuals looking to finance major purchases, consolidate debt, or cover unexpected expenses, personal loans from Republic Finance are positioned as flexible financial solutions. However, potential borrowers should note the high APR rates that could accompany these loans, as indicated by examples provided by the company.

Automobile Loans: For customers looking to purchase or refinance vehicles, Republic Finance offers automobile loans. This service suggests a recognition of the essential role that transportation plays in the lives of many consumers, providing them with opportunities to secure financing for this specific need.

Bill Consolidation Loans: Aimed at consumers seeking to streamline their finances, bill consolidation loans allow for the combining of multiple debts into a single loan. This could potentially offer a more manageable repayment structure and possibly reduce the overall interest paid on the combined debt.

While Republic Finance’s offerings seem comprehensive, the notable lack of detailed information and transparency on their website regarding APR rates, loan terms, and eligibility criteria means that potential borrowers will need to initiate contact with the company to gain a clearer understanding of the products suitable for their needs. This step is crucial for making an informed decision, especially in light of the company’s high APR rates and limited state availability, which could significantly impact the overall cost of borrowing..

Republic Finance Reviews

Republic Finance’s reputation in the lending industry is shaped by its long history and extensive service offerings. However, understanding the company’s customer satisfaction levels and service quality requires a closer look at available reviews, which are notably sparse.

- Limited Customer Feedback: One of the significant challenges in evaluating Republic Finance is the limited number of customer reviews available online. This scarcity makes it difficult for potential customers to gauge the company’s service quality and customer satisfaction levels. The lack of reviews may stem from the company’s targeted geographic presence or the nature of its service offerings.

- Customer Experiences: Among the few reviews that are available, feedback varies widely. Some customers appreciate the company’s range of products and its ability to serve their financial needs over many years. In contrast, others express concerns about high APR rates and the lack of transparent information on loan products.

- High APR Concerns: A recurring theme in customer feedback is concern over the high APR rates offered by Republic Finance. For example, an APR of 27.33% for a $6,000 loan over 60 months for customers with good credit is cited as high, especially when compared to rates offered by other lenders. This aspect of Republic Finance’s service may affect customer satisfaction, particularly for those who are cost-conscious or have good to excellent credit scores.

- Service and Trustworthiness: In terms of service quality and trustworthiness, the limited reviews make it challenging to form a definitive opinion. However, any potential borrower should consider the importance of transparency and comprehensive information when choosing a financial service provider. The lack of detailed information on Republic Finance’s website about its loan offerings and requirements necessitates direct contact for clarification, which might not suit every customer’s preference.

Given these insights, prospective borrowers may benefit from conducting thorough research and considering multiple lenders before making a decision. It’s crucial to weigh the pros and cons, including service experiences shared by others, to find a financial solution that best meets individual needs and circumstances.

Republic Finance BBB (Better Business Bureau) Profile

Republic Finance’s engagement with the Better Business Bureau (BBB) offers insights into its business practices and customer interactions. According to the BBB:

- Years in Business: Republic Finance has a substantial history, having been in business for 68 years since its inception in 1955. This longevity in the industry underscores its established presence and experience in the financial services sector.

- BBB Accreditation: The company’s profile on the BBB website indicates it has been accredited, which suggests a commitment to resolving customer complaints and adhering to the BBB’s accreditation standards. This accreditation can provide potential customers with a level of trust and confidence in the company’s business practices.

- Customer Reviews and Complaints: While the BBB is a platform where customers can file complaints and leave reviews, it’s important to note that customer reviews are not used in the calculation of the BBB rating. However, the presence of any complaints and the company’s responses can offer valuable insights into how Republic Finance addresses customer concerns and its dedication to customer satisfaction.

- Licensing Information: The BBB profile for Republic Finance also highlights its licensing information, indicating that the business meets certain industry standards and regulatory requirements. This aspect is crucial for customers seeking assurance about the company’s legitimacy and compliance with financial service regulations.

Although the BBB profile provides some foundational information about Republic Finance, including its years in business and accreditation status, potential customers may still need to seek out more detailed reviews and feedback to fully understand the company’s customer service quality and satisfaction levels.

Republic Finance Trustpilot

In this section, we aim to explore Republic Finance’s presence on Trustpilot, a popular platform for customer reviews and feedback. Trustpilot serves as a significant indicator of a company’s reputation among its customers, offering insights into service quality, customer satisfaction, and trustworthiness. However, based on the information gathered from the sources:

- Lack of Specific Trustpilot Reviews: There appears to be a notable absence of specific references to Republic Finance reviews on Trustpilot from the resources reviewed. This absence makes it challenging to provide a detailed analysis of the company’s performance and customer experiences on this platform.

- Importance of Diverse Review Platforms: The lack of specific Trustpilot reviews underscores the importance of consulting a variety of platforms when researching a company’s reputation. Potential customers should look for feedback across multiple review sites to get a comprehensive understanding of the company’s service quality and customer satisfaction levels.

- Gap in Online Customer Feedback Presence: The apparent gap in Republic Finance’s online customer feedback presence, particularly on a widely used platform like Trustpilot, suggests potential areas for improvement in transparency and engagement with customer feedback. For companies in the financial services industry, actively managing and responding to online reviews can enhance their reputation and trustworthiness.

Given the absence of specific Trustpilot reviews for Republic Finance in the sources consulted potential customers and researchers are encouraged to seek information from various other review sites and platforms. Exploring a wide range of customer feedback can provide a more rounded view of the company’s reputation, service quality, and how it addresses customer concerns.

Republic Finance Cost

Understanding the cost implications of borrowing from Republic Finance is crucial for potential customers considering their loan services. The cost of a loan from Republic Finance is influenced by several factors, including the APR (Annual Percentage Rate), loan terms, and potential fees. From the information gathered:

- High APR Rates: Republic Finance’s APR rates are a significant factor in the overall cost of borrowing. Although the company does not disclose specific APR rates upfront, they indicate that the average interest rate is below 35.99% APR. For example, a loan of $6,000 with a 27.33% APR over a 60-month term results in payments of approximately $300.46 per month. Such a rate is considered high, especially for customers with good credit, suggesting that better rates might be available through other lenders.

- Impact of APR on Borrowing Costs: The APR rate directly impacts the total amount a borrower will pay over the life of the loan. High APRs can significantly increase the cost of borrowing, making it imperative for potential borrowers to consider this when comparing loan options.

- Lack of Transparent Information: The absence of detailed information on Republic Finance’s website regarding APR ranges, loan fees, and other cost-related details makes it challenging for consumers to estimate the total cost of a loan without direct inquiry. This lack of transparency can hinder borrowers’ ability to make informed decisions.

Potential borrowers should carefully consider these cost factors and possibly seek more competitive rates and terms elsewhere if they have good to excellent credit scores. It’s also advisable to contact Republic Finance directly for detailed and personalized loan cost information, ensuring a thorough understanding of the financial commitments involved.

In conclusion, while Republic Finance offers a range of financial products to meet various needs, the costs associated with their loans, particularly the high APR rates, warrant careful consideration and comparison with other lending options.

Conclusion

Republic Finance has been a longstanding provider in the lending industry since 1952, offering a range of loan products to nearly 300,000 customers. While its decades of experience and broad service offerings stand out as significant advantages, potential borrowers must carefully consider the high APR rates and the lack of transparent information available online before making a decision. The limited availability of customer reviews further complicates the ability to gauge overall customer satisfaction and service quality. Prospective customers are encouraged to conduct thorough research, compare options across lenders, and consider all aspects of the loan costs and terms to ensure they make the most informed decision possible. In doing so, they can find a loan solution that best fits their financial needs and circumstances.

Frequently Asked Questions

What types of loans does Republic Finance offer?

Republic Finance offers a variety of loan products, including personal loans, automobile loans, and bill consolidation loans, to cater to different financial needs and circumstances.

Can applying for a loan with Republic Finance affect my credit score?

Applying for a loan involves a pre-qualification process that does not affect your credit score. However, as with any loan application, a formal loan application may require a hard credit pull that could impact your score.

What is the average APR for a loan from Republic Finance?

While Republic Finance does not disclose specific APR rates upfront, they indicate that their average interest rate is below 35.99% APR. An example provided for a personal loan suggests a 27.33% APR for customers with good credit.

In which states is Republic Finance available?

Republic Finance offers services in Alabama, Georgia, Kentucky, Louisiana, Mississippi, Missouri, South Carolina, Tennessee, and Texas. Availability may vary, so it’s advisable to check with Republic Finance directly for the most current information.

How can I find out more about the loan terms and conditions at Republic Finance?

Due to the lack of detailed information on their website, potential borrowers are encouraged to contact Republic Finance directly or fill out a form on their website to receive more information about loan offerings, terms, and conditions.`1