Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Bronco Partners Review: Debt Consolidation Loans

Is BroncoPartners a scam? We will let you be the judge.

Bronco Partners lures you in by sending you direct mail with a “personalized invitation code” and a low 3%-4% interest rate to consolidate your high-interest credit card debt. You will be directed to BroncoFunding.com or myBroncoPartners.com. More than likely you will not qualify for one of their debt relief loans and they will try and flip you into a more expensive debt settlement product.

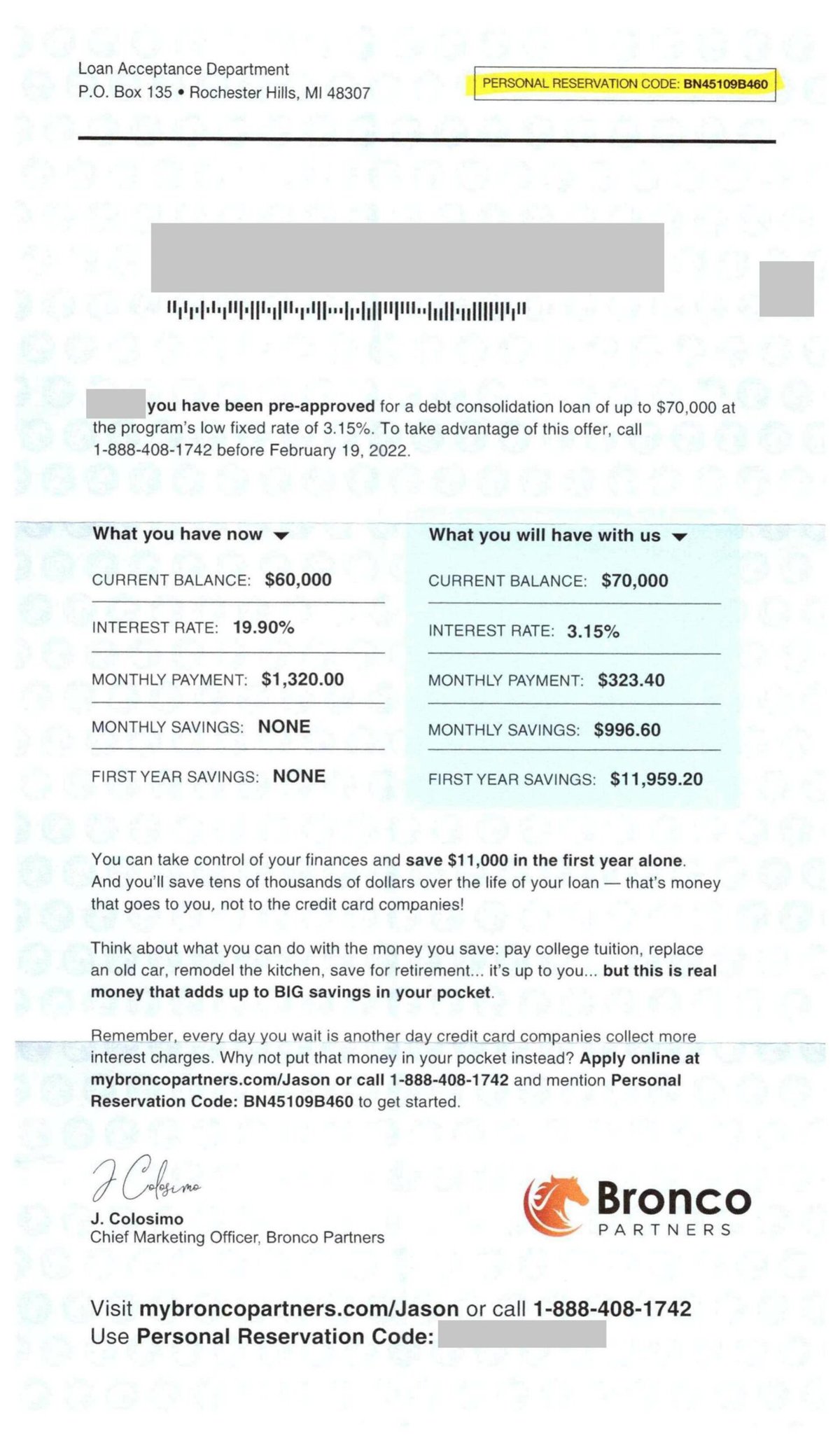

- Have you been “pre-approved” for a $70,000 loan?

- Have you been told your interest rate will drop from 19.90% to 3.15%?

- Have you been promised that your monthly payment will drop from $1,320 to $323.40?

- Have you been sold a monthly savings of $996.60?

- Did you get a letter in your mailbox from Loan Acceptance Department?

- Did your letter look something like this?

1.0 out of 5.0 stars1.0

This is nothing new. Many unscrupulous debt marketing companies have been using this as a business model for years. They lure you in with the low-interest rate, string you along for a week, and then let you know that you don’t qualify for a loan. They then offer you some very expensive debt settlement options.

Is Bronco Partners Legit or a Scam?

crixeo.com awarded Bronco Partners a 1-star rating (data collected and updated as of Feb 19, 2021). We hope the information below will help you make an educated decision on whether to do business with We hope the information below will help you make an educated decision on whether to do business with Knights Funding.

- Bronco Partners operates two websites, BroncoPartners.com & myBronco Partners.com.

- Bronco Partners is part of a collection of almost 50 websites that we have discovered. All of which are affiliated and listed below.

- Our belief is that Bronco Partners operates so many different websites in order to escape the tremendous amount of negative complaints and articles on the internet.

- We advise caution when working with Bronco Partners. The affiliated websites have multiple negative reviews and scam complaints.

- Bronco Partners operates under the sovereign protection of the Mandan, Hidatsa, and Arikara Nation (a/k/ MHA Nation), a Native American Tribe.

Who Is Bronco Partners Affiliated With?

Bronco Partners may likely be affiliated with the following websites:

- Hawkeye Associates

- Brice Capital

- Bruins Capital

- Dale Lending

- Yellowhammer Associates

- Big Apple Associates

- Cornhusker Advisors

- Badger Advisors

- Rockville Advisors

- Snowbird Partners

- Gulf Street Advisors

- Sooner Partners

- Old Dominion Associates

- Harrison Funding

- Johnson Funding

- Taft Financial

- Georgetown Funding

- Memphis Associates

- Tate Advisors

- Patriot Funding

- Malloy Lending

- Plymouth Associates

- Silvertail Associates

- Safe Path Advisors

- Coral Funding

- Neon Funding

- Cobalt Advisors

- Saxton Associates

- Hornet Partners

- Colony Associates

- First State Associates

- Polk Partners

- Ladder Advisors

- Corey Advisors

- Pennon Partners

- Jayhawk Advisors

- Clay Advisors

- Great Lake Associates

- Pine Advisors

- Alamo Associates

- Punch Associates

- Steele Advisors

- Grand Canyon Advisors

- Glider Lending

- Lucky Marketing

- Golden State Partners

- Pine Advisors

- Derby Advisors

- Graylock Advisors

- Tuck Associates

- Punch Associates

- Keel Associates

- Ballast Associates

- Tweed Lending

- Concourse Lending

- Graphite Funding

- August Funding

- Broadstar Financial

- Salvation Funding

- Stallion Lending

- Pebblestone Financial

- Sussex Funding

- Lafayette Funding

- Guardian Angel Funding

- Bridgeline Funding

Bronco Partners Reviews and Ratings

Bronco Partners and its affiliated websites are not accredited by the BBB and have been the subject of numerous complaints and negative press under different names.

MEC Distribution LLC

At one time, Bronco Partners and its affiliated website operated under the name MEC Distribution, LLC. The Better Business Bureau put out its first alert about this enterprise in February 2018:

In February 2018, BBB staff visited the Fargo ND addresses provided by MEC Distribution and found that all locations were vacant and the building management explained that although the rent was paid by MEC Distribution, the office spaces were not used. MEC Distribution LLC provided BBB with a mailing address for complaint handling in Bloomfield Township Michigan. BBB’s mail to that address has been returned as ‘not deliverable as addressed- unable to forward. At this time, BBB does not have a physical location for this business.

BBB has confirmed with the North Dakota Department of Financial Institutions that Lafayette Funding is not licensed in North Dakota as a debt settlement firm. Furthermore, BBB has contacted building management at the address Lafayette Funding claims in Bismarck, North Dakota, and learned that Lafayette is not located at that address. BBB advises extreme caution when dealing with this entity.

In February 2018, BBB staff visited the Fargo ND addresses provided by MEC Distribution and found that all locations were vacant and the building management explained that although the rent was paid by MEC Distribution, the office spaces were not used. MEC Distribution LLC provided BBB with a mailing address for complaint handling in Bloomfield Township Michigan. BBB’s mail to that address has been returned as ‘not deliverable as addressed- unable to forward. At this time, BBB does not have a physical location for this business.

HaKnights Funding BBB Reviews

You won’t find a BBB file on Knights Funding because the complaints haven’t started rolling in yet. However, we examined some complaints from its affiliated websites:

Cathy M. – 1 Star Review

They have changed their name to Salvation Funding. After seeing this rating I see why. I don’t know how they got my info but they need to be stopped.

Terry W. – 1 Star Review

Beware of bait and switch mailers. Terms are “extremely different” than advertised! It’s a waste of time.

My purpose is to help others realize this is a waste of time! Pebblestone Financial advertising is definitely deceptive in my opinion. After my conversation with Fred, his response was, “we can definitely help… I will call you tomorrow morning with the details…have pen and paper ready to write down the numbers.” The mailer does include in fine print…This notice is not guaranteed if you do not meet select criteria.”

It also further states: “This notice is based on information in your credit report indicating that you meet certain criteria.” In my case, I am not late on any payments, nor will I be. I am current on all outstanding debt and my credit history demonstrates this. When Fred call the next morning…his terms were totally ridiculous and in my opinion “predatory lending”. When I ask Fred… are these the terms of the Pebblestone offer, he replied yes. I replied, I’m not interested in those terms and he hung up the phone immediately without further conversation.

The reason I responded to the Pebblestone Financial offer was to consolidate and simplify with one payment and take advantage of the low pre-approved rate averaging 3.67%. While I’m currently paying between 10.9% and 12.9% to the credit card companies…this offer was attractive. The mailer stated in LARGE BOLD PRINT: You have been pre-approved for a Debt Consolidation Loan with a rate as low as 3.67%. The pre-approved loan amount was actually $11,500 more than my total debt consolidation.

In summary…this is definitely a “Bait and Switch” scheme in my opinion. I checked BBB comments before responding to this offer and did not see negative feedback. Now I’m seeing other very similar responses with the same “Bait and Switch” experience. Hopefully, this will help others avoid the wasted time in discovering these unethical practices of Pebblestone Financial.

The Rent-A-Tribe Scheme

In recent years, hiding behind the protection of a Native American tribe was made popular by internet payday lenders. In July 2018, Charles Hallinan, “the godfather of payday lending” was sentenced to 14 years in prison for issuing payday loans through the Mowachaht/Muchalaht First Nation in British Columbia. In January 2018, Scott Tucker was sentenced to more than 16 years in prison for running a $3.5 billion unlawful internet payday lending enterprise while operating under the “sovereign immunity” of the Modoc Tribe of Oklahoma and the Santee Sioux Tribe of Nebraska.

Why Do We Focus On Bronco Partners‘s Negative Reviews?

We urge you to do your own research and due diligence on Bronco Partners, especially when dealing with your personal finances. We urge you to pay attention to what you find on the internet. Compare the good vs. the bad and make an educated decision. From our experience, where there is smoke…there is fire. But you make the call.

No Comments

Visitor Rating: 3 Stars

Visitor Rating: 1 Stars