Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

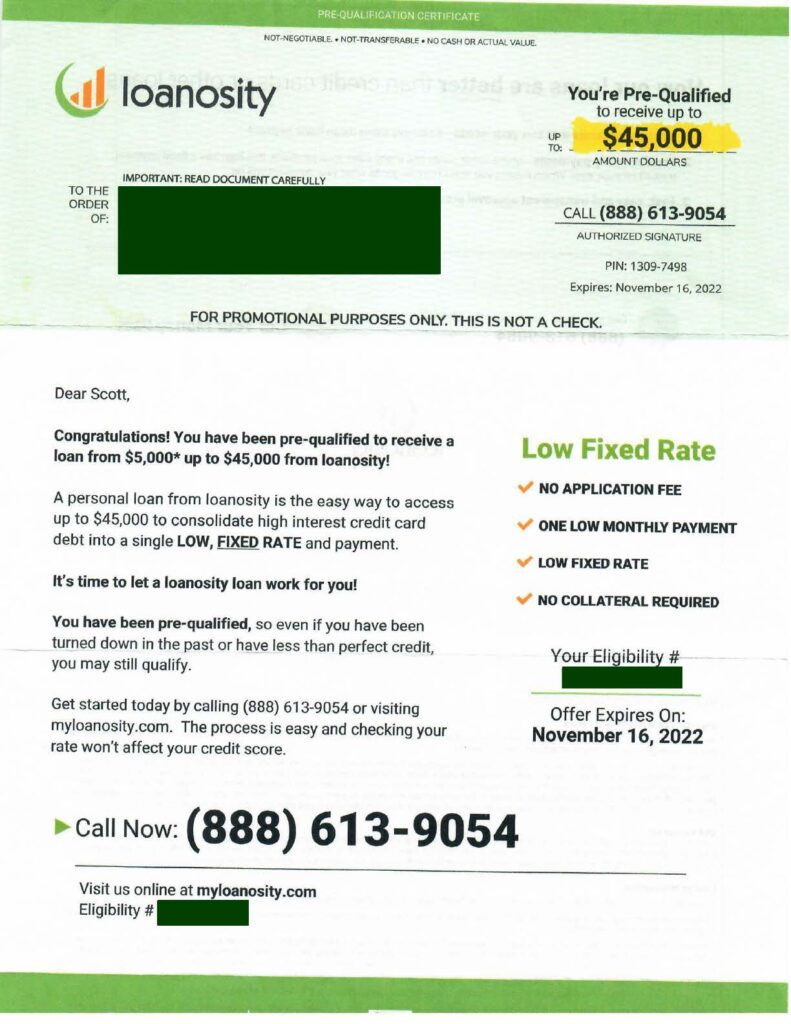

There are many personal lenders out there, each with its own unique terms and conditions. It can be difficult to know where to turn when you need a loan. Loanosity is one option that has been getting a lot of attention lately. They claim to help people payoff credit cards. But is this lender right for you? Here’s a closer look so you can make an informed decision.

At Loanosity all loans are made by Cross Riverbank, a New Jersey-Chartered Commercial Bank. The lending platform offers debt consolidation loans. They advertise their services at loanosity.com.

Loanosity Summary:

We recently did a deep dive into the website and terms and conditions of a Loanosity. What we found was quite interesting.

Here are just a few of the things that caught our attention.

- All loans are made by Cross River Bank, a New Jersey-Chartered Commercial Bank.

- Fixed rates range from 20.77% APR to 23.62% APR.

- debt consolidation loans can range from $5,000 to $30,000, with loan terms of 24, 36, or 48 months.

- Not all applicants will qualify for the lowest rate.

- Loan origination fees vary from 5.90% to 6.90% of your loan amount.

- Loanosity will provide the lender with the information you supply. There is no assurance that your application will be approved for a loan.

What is Loanosity.com?

Loanosity.com is a lending platform that helps you get the best possible loan for your needs. They work with Cross River Bank to provide you with the best possible terms and rates. The company has been in business for only a year and is located in Miami, FL. You can reach them by email at [email protected] or by phone at (800) 997-1670.

Loanosity has an A BBB rating and has been accredited since 6/10/2022. The company has 0 reviews and 0 complaints. We hoped to find a Trustpilot account but we weren’t able to find one.

How does Loanosity work?

A Loanosity loan is a personal loan that does not require collateral. This means that you do not need to put up any assets, such as your home or car, in order to secure the loan.

Your loan application will be reviewed and, upon approval, you will be asked to sign a Loan Agreement. This document will be sent to you electronically for your signature. After they receive confirmation of your signature, your loan funds will generally be available within a few days.

The terms of your loan will depend on the amount you request, your credit score and history, as well as how you plan to use the loan. They will verify your credit history before finalizing any loan agreement.

Please note that loans are not available in all states and conditions and limitations may apply.

How to qualify for Loanosity Debt Consolidation?

To be eligible for a Loanosity debt consolidation loan, applicants must:

- Be at least the age of majority in their state and able to enter into a binding contract

- Be employed, have sufficient income from other sources, or have an offer of employment to start within the next 90 days

- Meet our underwriting criteria, which take into account factors like credit score and monthly income vs. expenses

Getting approved for a loan doesn’t mean you’re guaranteed the best rates and terms. Your creditworthiness, the length of the loan, and other factors will all play a role in what kind of rates and terms you’re offered.

Loanosity BBB Reviews

Are you looking for the Loanosity BBB Rating? Loanosity is an accredited company with an A BBB rating. They have been accredited since 6/10/2022 and have had 0 reviews or complaints. We were unable to find a Trustpilot account for them.

Loanosity FAQs

How much does Loanosity charge?

Loanosity is a loan company that offers loans up to 30,000 with APRs ranging from 20.77% to 23.62%. The origination fee for the loan ranges from 5.90% to 6.90% of the loan amount.

Here is an example: assuming a $10,000 debt consolidation personal loan with a 4-year repayment term and a fixed rate between 20.77% and 23.62% APR, monthly payments would range from $492.17 to $497.46, totaling $23,624.16 to $23,878.08 over 48 months.

Are there any pre-payment penalties?

At Loanosity, there are no prepayment penalties for those who choose to pay off their loan faster than originally scheduled.

Will Loanosity Hurt My Credit?

Will Loanosity hurt my credit? When you’re considering taking out a loan, lenders will often do a soft credit pull to give you an idea of the interest rates and loan terms you may qualify for. This doesn’t affect your credit score in any way.

However, once you decide to go ahead with the loan application, they’ll need to do a hard credit inquiry to get a full view of your credit history and offer you final rates. These hard inquiries are common when applying for loans and can lower your credit score and affect your credit.

How to cancel Loanosity?

Applying for a personal loan is a big decision. Once you’ve been approved and the funds have been dispersed into your bank account, it’s not possible to cancel or reverse the transaction. So, be sure you’re certain of your decision before applying. This way, you can avoid any cancellations or changes down the line.

Do you find it difficult to make ends meet? Here’s some advice that might help you get back on track.

- Creating and sticking to a budget is a great way to stay on track.

- Another option is to speak with a financial advisor who can help you understand your options and develop a plan that works for your unique circumstances.

- And finally, don’t worry too much if you’re already in debt. Many companies are willing to work with customers to create a more manageable payment plan. So reach out to their customer service team for more information.

Is Loanosity Legit?

Is Loanosity Legit? Loanosity is a lending platform that is associated with Cross River Bank. They have an A BBB rating, but there are no reviews or complaints about the company online. This makes it difficult to determine whether or not they are good to their customers.

When considering taking out a loan, it is important to explore all of your options and compare rates. Be sure to read customer reviews before making a decision, so that you can choose the best option for you. This way, you can avoid taking out a loan that you cannot afford.

Do you know Loanosity.com? Leave your experience and review below!

Thank you for reading!

1 Comment

Visitor Rating: 4 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 2 Stars

Visitor Rating: 3 Stars

Loanosity is a scam, they tell you they are going to run a soft pull and come back with your loan. Despite my scores being Good they come back and say I don’t qualify and I should go into their debt program where I should stop paying all my credit cards while they ‘negotiate’ the balances. I have not missed a payment on anything in 6 years why would I torpedo my credit to work with a company like this? STAY AWAY!!

Visitor Rating: 4 Stars

Visitor Rating: 1 Stars

Visitor Rating: 2 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars

Visitor Rating: 1 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars

Visitor Rating: 2 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars

Visitor Rating: 1 Stars

Visitor Rating: 1 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars

Visitor Rating: 4 Stars

Visitor Rating: 2 Stars

Visitor Rating: 5 Stars

Visitor Rating: 3 Stars

Visitor Rating: 4 Stars

Visitor Rating: 3 Stars

Visitor Rating: 5 Stars