Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

In today’s financial landscape, finding a trustworthy personal loan provider is more important than ever. With an overwhelming number of options available, the process can seem daunting. Personal Loan Provider stands out as a beacon for those navigating through the complexities of personal loans, offering a streamlined bridge between borrowers and an extensive network of lenders.

This review delves into the intricacies of Personal Loan Provider, aiming to illuminate its operations, services, and overall value to potential borrowers. Whether you’re consolidating debt, financing a large purchase, or covering unexpected expenses, understanding how Personal Loan Provider can meet your needs is the first step toward making an informed financial decision.

Overview of Personal Loan Provider

Personal Loan Provider serves as an intermediary in the financial industry, connecting individuals seeking personal loans with a network of potential lenders. Unlike direct lenders, Personal Loan Provider does not issue loans itself. Instead, it simplifies the loan-seeking process by aggregating offers from various lenders, allowing borrowers to find competitive rates and terms that best fit their financial situation. Founded on the principle of making personal finance more accessible, Personal Loan Provider leverages technology to offer a seamless application process, from initial inquiry to the final match with a lender.

This approach not only saves time but also introduces a level of customization and personalization previously unseen in the traditional loan application process. With a mission to empower borrowers by providing clarity, choice, and convenience, Personal Loan Provider has positioned itself as a valuable resource for those looking to navigate the complexities of securing a personal loan.

How Personal Loan Provider Operates

Personal Loan Provider revolutionizes the traditional loan application process through a structured, user-friendly approach, designed to connect borrowers with suitable lenders efficiently. Here’s a closer look at each step of the operation:

Application Submission

The journey with Personal Loan Provider begins with a simple, concise application form available on their platform. Prospective borrowers are required to fill out basic personal and financial information, which does not commit them to any loan but serves as a preliminary step to gauge their loan requirements and financial standing.

Lender Matching

After the initial application, Personal Loan Provider utilizes sophisticated algorithms to sift through its network of lending partners, matching borrowers with lenders based on the compatibility of the borrower’s financial profile and the lender’s loan offerings. This process ensures that borrowers are only presented with options that align with their specific needs and qualifications, optimizing the chances of loan approval.

Reviewing Offers

Borrowers are then presented with a variety of loan offers from different lenders. This stage is critical as it allows individuals to compare interest rates, repayment terms, and other key loan parameters side by side. Personal Loan Provider ensures transparency at this step, enabling borrowers to make informed decisions without having to navigate multiple lenders’ websites or negotiate terms independently.

Finalizing the Loan

Once a borrower selects an offer, the next steps involve finalizing the loan agreement with the chosen lender. This may include a more detailed review of the borrower’s financial information, a hard credit check, and the completion of any additional documentation required by the lender. Upon approval, the loan terms are finalized, and the funds are disbursed, marking the successful completion of the process through Personal Loan Provider.

This streamlined approach not only demystifies the loan application process but also saves borrowers time and effort, making Personal Loan Provider an attractive option for those seeking personal loans with terms that suit their unique financial situations.

Benefits of Using Personal Loan Provider

Personal Loan Provider offers a host of advantages designed to ease the personal loan application process, making it more accessible and tailored to individual financial needs. Here are some of the key benefits users can experience:

Wide Range of Lenders

By aggregating offers from a diverse network of lending partners, Personal Loan Provider ensures borrowers have access to a wide range of loan options. This variety enables applicants to find competitive rates and terms suited to their specific financial circumstances, all from a single platform.

Personalized Loan Matching

Utilizing advanced matching algorithms, Personal Loan Provider aligns borrowers’ financial profiles with the lending criteria of various partners. This personalized approach increases the likelihood of loan approval and ensures borrowers receive offers that match their needs, preferences, and eligibility.

Streamlined Process

The platform simplifies the loan application journey, consolidating it into a few straightforward steps. From initial application to receiving multiple loan offers, Personal Loan Provider eliminates the need to apply separately to numerous lenders, saving valuable time and reducing the hassle associated with traditional loan searching.

Educational Resources

Beyond matching services, Personal Loan Provider is committed to empowering borrowers with knowledge. The platform offers educational resources that cover important aspects of personal finance, including managing debt, improving credit scores, and understanding loan terms. This commitment to borrower education fosters informed decision-making and financial wellness.

Transparent Loan Terms

Transparency is a cornerstone of Personal Loan Provider’s service. The platform ensures all loan offers are presented with clear, comprehensible terms, including APRs, fees, and repayment schedules. This level of transparency allows borrowers to fully understand their loan options and make decisions with confidence.

These benefits underscore Personal Loan Provider’s dedication to providing a user-friendly, efficient, and informative platform for securing personal loans. By prioritizing borrower needs and offering a seamless connection to a range of lenders, Personal Loan Provider stands out as a valuable tool for anyone looking to navigate the personal loan landscape.

Considerations and Challenges

While Personal Loan Provider offers numerous advantages for individuals seeking personal loans, it’s important to be aware of certain considerations and challenges that may arise. Here are some key factors to keep in mind:

Credit Impact

One of the initial steps in the process with Personal Loan Provider involves credit checks. Initially, a soft inquiry might be made, which doesn’t affect your credit score. However, once you proceed with a loan application from a matched lender, a hard inquiry will likely occur, potentially impacting your credit score temporarily. It’s essential to consider the timing and number of applications due to the cumulative effect of multiple hard inquiries.

Terms Variability

Although Personal Loan Provider facilitates access to various lenders, the terms and conditions of loans can vary significantly among these partners. Borrowers must carefully review and compare these terms, including interest rates, repayment schedules, and any associated fees, to ensure they align with their financial goals and capabilities.

Privacy Concerns

Engaging with any online platform requires sharing personal and financial information. Despite Personal Loan Provider’s commitment to privacy and data security, users should understand how their information is used, stored, and protected. It’s advisable to review the platform’s privacy policies and security measures to ensure your data is handled responsibly.

Dependence on Creditworthiness

The loan offers and terms presented by lenders through Personal Loan Provider are heavily influenced by the borrower’s creditworthiness. Individuals with higher credit scores are likely to receive more favorable terms. Consequently, those with lower credit scores may find their options more limited, underscoring the importance of credit health in the loan application process.

Being mindful of these considerations and challenges can help prospective borrowers navigate the process more effectively, ensuring they make informed decisions that align with their financial well-being. While Personal Loan Provider aims to simplify and improve the loan application experience, borrowers should remain diligent in evaluating offers and understanding the implications of their choices.

Service Features

Personal Loan Provider differentiates itself through a suite of service features designed to cater to the varied needs of borrowers. These features not only enhance the user experience but also ensure a high level of satisfaction by addressing key aspects of the personal loan process. Here are some of the standout features of Personal Loan Provider:

Loan Amounts and APRs

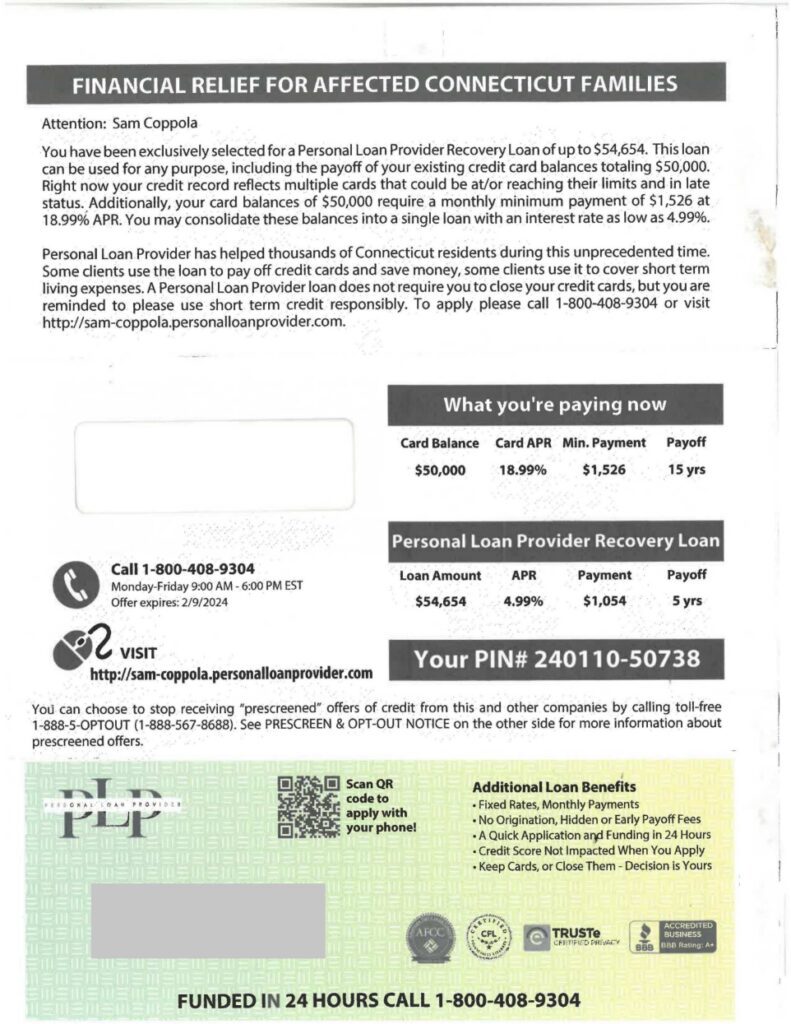

- Personal Loan Provider offers a wide range of loan amounts, typically from $5,000 to $100,000, accommodating a variety of financial needs, from debt consolidation to major purchases.

- APRs (Annual Percentage Rates) vary between 4.99% and 34.99%, depending on the lender and the borrower’s creditworthiness, providing options for both high and low-credit score applicants.

Application Process

- The platform simplifies the application process by requiring borrowers to fill out only one form to access multiple loan offers, eliminating the need to apply individually to different lenders.

- This streamlined process not only saves time but also reduces the complexity and stress associated with loan applications.

Customer Support

- Personal Loan Provider places a strong emphasis on customer support, offering assistance throughout the loan application process to ensure a smooth and informed experience for users.

- Support is available for any inquiries or issues, from application submission to loan finalization, highlighting the platform’s commitment to user satisfaction.

User Experience

- The platform is designed with user experience in mind, featuring an intuitive interface and easy navigation to facilitate quick and hassle-free loan applications.

- Educational resources and tools are readily available, helping users understand their loan options, improve their financial literacy, and make informed decisions.

Educational Resources

- Beyond connecting borrowers with lenders, Personal Loan Provider is committed to empowering users with knowledge about personal finance.

- The platform provides articles, guides, and calculators to help borrowers understand the implications of loans, manage debt effectively, and improve their credit scores.

These service features underscore Personal Loan Provider’s dedication to providing a comprehensive, user-friendly platform that not only connects borrowers with potential lenders but also supports them in making educated financial decisions. By focusing on ease of use, transparency, and customer education, Personal Loan Provider sets itself apart in the competitive landscape of personal loan services.

Qualification Criteria

Navigating the application process with Personal Loan Provider requires understanding the basic qualifications needed to access its network of lenders. These criteria are essential for ensuring that borrowers meet the minimum requirements set by lenders, facilitating a smoother loan matching and approval process. Here are the primary qualifications necessary for prospective borrowers:

Age and Residency

- Applicants must be at least 18 years old, confirming they are of legal age to enter into a loan agreement.

- A valid Social Security Number (SSN) is required, establishing proof of residency and eligibility to apply for a loan in the United States.

Banking Requirements

- Possession of an active checking account is mandatory. This account is crucial for the disbursement of loan funds and the management of repayments, serving as a basic financial prerequisite.

Credit Review and Approval

- A credit check is a significant part of the qualification process. Personal Loan Provider and its lending partners will review the applicant’s credit history and score to determine their creditworthiness and eligibility for a loan.

- The outcome of this credit review influences the loan terms offered, including the APR and the loan amount, highlighting the importance of a positive credit history.

Employment and Income Verification

- Steady employment and a verifiable source of income are required. These factors demonstrate the borrower’s ability to fulfill repayment obligations, making them critical for loan approval.

- Lenders look for evidence of financial stability and consistency in income, which reassures them of the borrower’s capacity to manage loan repayments.

State-Specific Considerations

- It’s important to note that loan amounts, APRs, and specific eligibility criteria may vary by state due to local regulations and legal requirements. This reflects the platform’s adherence to regional financial practices and norms.

Understanding and meeting these qualification criteria are the first steps toward successfully applying for a loan through Personal Loan Provider. By ensuring that these basic requirements are met, borrowers can enhance their chances of finding a suitable loan option and navigating the application process with greater ease and confidence.

Customer Experiences and Reviews

Understanding the experiences of previous customers is crucial for evaluating the effectiveness and reliability of Personal Loan Provider. While direct customer feedback may vary, it provides valuable insights into the platform’s service quality, user satisfaction, and areas for improvement. Here’s how prospective borrowers can navigate and interpret customer experiences and reviews:

Availability of Reviews

- Direct customer reviews of Personal Loan Provider might be found on various online platforms, including financial forums, review websites, and social media. These reviews offer first-hand accounts of user experiences, highlighting the strengths and potential drawbacks of the service.

- It’s important to seek out a diverse range of reviews to get a balanced view of the platform’s performance. Keep in mind the context and specificity of each review to understand its relevance to your own needs.

Common Themes in Feedback

- Pay attention to recurring themes within the reviews, such as ease of use, customer service quality, speed of loan processing, and satisfaction with loan terms. Positive trends in these areas can indicate a reliable and user-friendly service.

- Conversely, repeated complaints or issues raised by multiple users could signal areas where Personal Loan Provider may fall short, such as delays in loan approval, lack of transparency in loan terms, or difficulties with customer support.

Interpretation of Reviews

- While reviews can provide a glimpse into the experiences of past users, it’s important to interpret them critically. Consider the date of the review, the specific circumstances described, and how the company responded to any criticisms. A proactive and thoughtful response from Personal Loan Provider to customer feedback can demonstrate a commitment to improving service and addressing user concerns.

Impact on Decision-Making

- Use customer reviews as one of several factors in your decision-making process. While they can offer useful insights, balance this information with other considerations, such as the platform’s features, qualification criteria, and your own financial situation and needs.

Customer reviews and experiences are a valuable resource for understanding what it’s like to use Personal Loan Provider. By carefully considering this feedback alongside other important factors, prospective borrowers can make an informed decision about whether the platform is the right choice for their personal loan needs.

Comparing Personal Loan Provider to Competitors

In the crowded landscape of personal loan services, it’s crucial for borrowers to understand how Personal Loan Provider stacks up against its competitors. This comparison can help highlight the unique features and potential advantages or disadvantages of choosing Personal Loan Provider for your loan needs. Here’s a focused comparison based on key aspects:

Range of Lenders and Loan Options

- Personal Loan Provider often prides itself on a wide network of lending partners, which translates to a diverse range of loan options for borrowers. This variety can be particularly beneficial for those with unique financial situations or needs.

- Competitors might offer a more limited selection of lenders or specialize in specific types of loans or borrower profiles, potentially restricting options for some applicants.

Application Process and Efficiency

- Personal Loan Provider streamlines the loan application process, allowing borrowers to fill out a single application to receive multiple loan offers. This efficiency can save significant time and hassle.

- Competitors may have varying levels of application efficiency, with some requiring more extensive paperwork or individual applications to each lender, potentially making the process more cumbersome.

Transparency and Educational Resources

- Personal Loan Provider is notable for its commitment to transparency and borrower education, providing clear information on loan terms and offering resources to help borrowers make informed decisions.

- Competitors vary in their approach to transparency and education, with some excelling in this area and others providing less upfront information or support for borrowers.

User Experience and Customer Support

- Personal Loan Provider generally receives positive feedback for its user-friendly platform and responsive customer support, enhancing the overall borrower experience.

- Competitors may differ significantly in the quality of user experience and the availability and helpfulness of customer support, impacting borrower satisfaction.

Fees and Loan Terms

- Personal Loan Provider facilitates access to a range of loan terms and interest rates, with fees and costs made clear upfront. Borrowers can compare offers to find the most favorable terms.

- Competitors may have different fee structures and loan terms, with some offering more competitive rates but possibly less flexibility in terms or higher fees.

In choosing between Personal Loan Provider and its competitors, borrowers should consider their specific needs, preferences, and financial situations. The key is to weigh the benefits of a wide lender network, streamlined application process, and strong support against personal priorities and the offerings of other services in the market.

Conclusion

Personal Loan Provider distinguishes itself in the competitive landscape of personal finance as a formidable intermediary that bridges the gap between borrowers and a wide network of lenders. By streamlining the application process, offering a diverse array of loan options, and prioritizing transparency and borrower education, Personal Loan Provider stands out as a valuable resource for those navigating the complexities of securing a personal loan.

The platform’s commitment to simplifying the loan acquisition process, coupled with its focus on user experience and customer support, provides a seamless, informative journey for borrowers. While considerations such as the potential impact on credit scores and the variability of terms among lenders warrant careful attention, Personal Loan Provider’s advantages, including its efficient application process and broad lender network, make it a compelling option for individuals seeking financial assistance.

In choosing Personal Loan Provider, borrowers are equipped with the tools and information necessary to make informed decisions, compare competitive loan offers, and select terms that best suit their financial goals. As with any financial decision, prospective borrowers should conduct thorough research, consider their own financial situation, and weigh the pros and cons to determine if Personal Loan Provider aligns with their personal loan needs.

Ultimately, Personal Loan Provider exemplifies a modern approach to the personal loan process, emphasizing convenience, choice, and empowerment for borrowers across the financial spectrum. Potential borrowers should make sure they have a clear understanding of all the terms and conditions and review customer feedback before agreeing to take out a loan.

Frequently Asked Questions

What types of loans can I find through Personal Loan Provider?

Personal Loan Provider connects borrowers with a network of lenders offering a variety of personal loans, including debt consolidation, home improvement, major purchase financing, and more, catering to a wide range of financial needs.

Is there a fee to use Personal Loan Provider’s service?

Personal Loan Provider typically does not charge borrowers a fee for using its platform to connect with lenders. However, it’s important to review the terms of any loan offer for potential fees directly associated with the loan itself, such as origination fees.

How does Personal Loan Provider affect my credit score?

Initially, Personal Loan Provider may perform a soft credit check to match you with potential lenders, which does not affect your credit score. However, proceeding with a loan application through a lender may result in a hard credit inquiry, which could temporarily impact your credit score.

Can I use Personal Loan Provider with bad credit?

Yes, Personal Loan Provider works with a variety of lending partners, some of which specialize in lending to individuals with less-than-perfect credit. While options may vary, the platform aims to match borrowers with suitable lenders based on their credit profiles.

How quickly can I receive my loan funds through Personal Loan Provider?

The time from application to fund disbursement varies depending on the lender and specific loan details. After loan approval, funds are typically disbursed within a few business days, although some lenders may offer faster processing times.

Are the loan offers from Personal Loan Provider’s partners binding?

Loan offers presented to you are generally not binding until you formally accept the loan terms and complete any required agreements with the lender. It’s crucial to review all terms carefully before accepting a loan offer.

How does Personal Loan Provider select its lending partners?

Personal Loan Provider partners with a range of lenders based on criteria such as reliability, competitive rates, and the ability to serve a diverse set of borrower needs. The platform aims to include lenders that adhere to its standards for quality and service.

Can I apply for a loan through Personal Loan Provider more than once?

Yes, you can use Personal Loan Provider’s services to apply for multiple loans over time. However, it’s essential to consider your financial situation and credit health before taking on additional debt.