Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

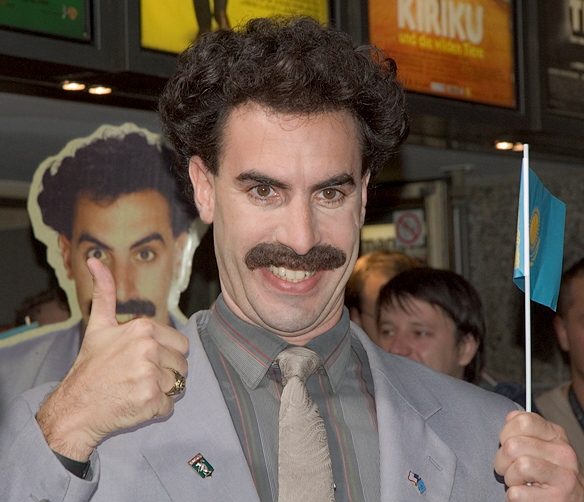

Sacha Baron Cohen recently announced that a sequel to Borat; Borat 2 is coming out this year. Now, in a surprising announcement the film is set to debut in just a few days on Amazon Prime Video. Like most low-budget films which aren’t part of a massive franchise, Borat 2 is going to come out on a streaming service. Whether it will be as great as its predecessor remains to be seen. Borat 2 Hopes To Be A Sequel Success While Ali G pre-dates Borat, the latter is what made Sacha Baron Cohen famous throughout the world. The character was…