Advertiser Disclosure: Many of the companies featured here provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Welcome to Taft Financial – Can’t They Stop The Scam On Christmas?

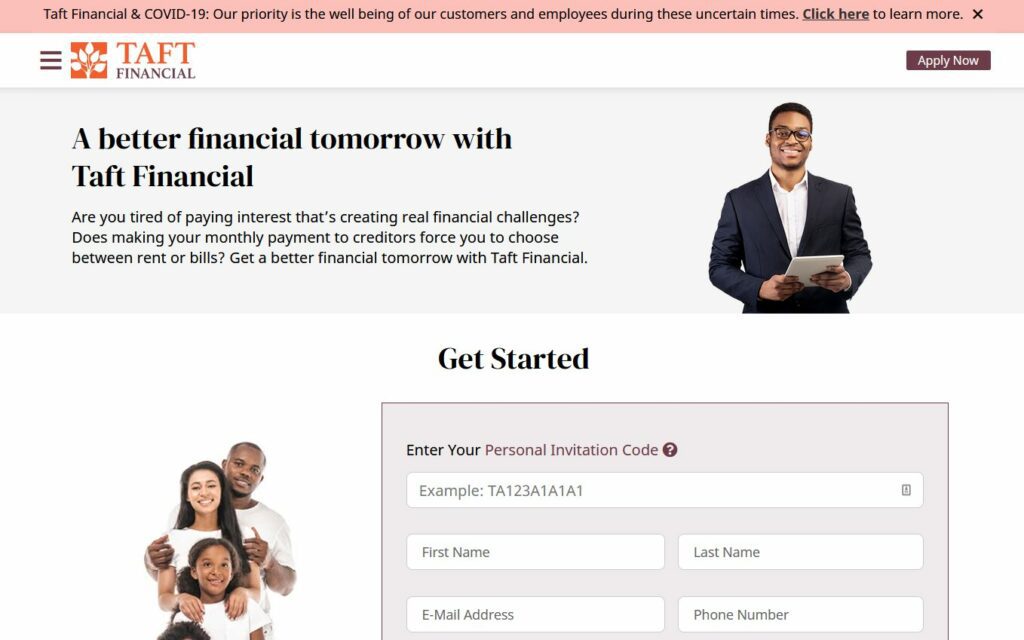

You landed on this page for a reason. You probably received a Taft Financial debt consolidation offer in the mail with with a “Personal Invitation Code” and super low interest rate (APR) of 3.09%. You decided to google “Taft Financial” to see if they are legit.

For those that are reading my column for the first time, you will see that I have been following the group behind Taft Financial and the hundreds of websites and names that they have been using for years (Georgetown Funding, Memphis Associates, Malloy Lending, Plymouth Associates, etc.).

The bottom line is that unless your credit score is 700 or above, you don’t have a chance of qualifying for this offer – but deep down you probably knew that already.

I get a lot of emails asking me the same two questions:

“Should I be concerned because I gave my social security number and date of birth over the phone to these people?”

To answer that question: I don’t think your identity is what these guys are after.

“Are there are legitimate companies out there that can help me get out debt?”

The answer is: ABSOLUTELY! While there are a lot of scammers running around, THERE ARE STRAIGHT SHOOTERS. I helped Crixeo design a comparison chart with different companies that can help you get out of debt through debt consolidation loans and custom debt relief programs to resolve your debt. You can find our top rated companies by clicking here.

I will pay $50 for any debt relief offer junk mail that I haven’t seen and ends up being published. So please contact me quickly and beat the rush! Even if its not for debt and for something else, send it over. I want to expose more scams to protect all Americans! Send me an email at:

[email protected]

I also want to once again thank those who have emailed me and continue to keep me in the loop. The response continues to be overwhelming. I still can not believe how many people responded and told me to keep the $50. I have never had such a hard time giving away money.

Sometimes it takes me a day or two to respond and I am sorry but these guys are everywhere. I imagine they are making millions off this and living the good life while the rest of us work hard to make an honest living. The jerk offs behind Taft Financial continue to change their websites and are even threatened me with a lawsuit for exposing them.

My publisher is behind me 100% and has told me to keep writing and protect other hard working Americans from these predators.

Thanksgiving is over. I hope everybody enjoyed it. We still need Pfizer to deliver the vaccine. I can’t believe how bad it is getting out there again. The last thing we need is Taft Financial causing any more problems.

Please stay in touch with me. If you don’t have a mailer to send, just drop me a note and let me know my work has helped you out. That’s enough for me and it gives me the energy to keep on working hard for you!

THANK YOU TEDDY FOR ALERTING ME TO THE NEWEST ONE.

Taft Financial Scam: Offering Debt Relief Loans

Taft Financial, Georgetown Funding, Patriot Funding, Memphis Associates, Plymouth Associates, Safe Path Advisors, Silvertail Associates, Malloy Lending, Polo Funding, Jackson Funding, Dune Ventures, Braidwood Capital, Tiffany Funding, Nickel Advisors – and the scam goes on…and the list gets longer…

TALK TO A DEBT COUNSELOR TOLL FREE (888) 492-6145

1.0 out of 5.0 stars1.0

Find below some of my past articles:

November 18, 2020 – Georgetown Funding

November 10, 2020 – Patriot Funding

November 1, 2020 – Memphis Associates

October 20, 2020 – Tate Advisors

October 18, 2020 – Plymouth Associates

October 3, 2020 – Safe Path Advisors

September 28, 2020 – Silvertail Associates

September 23, 2020 – Malloy Lending Review

September 5, 2020 – Polo Funding Review

August 25, 2020 – Jackson Funding Review

August 18, 2020 – Dune Ventures Review

August 11, 2020 – Braidwood Capital Review

July 26, 2020 – Tiffany Funding Review

July 16, 2020 – Nickel Advisors Review

July 3, 2020 – Coral Funding Review

Taft Financial is the newest bait and switch trap brought to you by none other than the same slime that brought you Georgetown Funding, Patriot Funding, Memphis Associates, Tate Advisors, Plymouth Associates, Safe Path Advisors, Silvertail Associates, Malloy Lending, Polo Funding, Jackson Funding, Dune Ventures, Braidwood Capital, Tiffany Funding, Nickel Advisors, and Coral Funding, and about 50 other debt consolidation and personal loan web sites.

The story is the same. They lure you in by sending you direct mail with a “personalized invitation code” and a low 3%-4% interest rate to consolidate your high-interest credit card debt. You will be directed to Taft Financial com or My Taft Financial com. More than likely you will not qualify for one of their credit card consolidation loans and they will try and flip you into a more expensive debt settlement product.

The Taft Financial Review website says:

“a better financial tomorrow WITH Taft Financial”

Remember that Taft Financial doesn’t care about you!

Taft Financial wants you to keep quiet and not email me. They only need you to be quiet for one week until they launch the next website. Don’t let them win!

email me at [email protected]

This is nothing new. Many unscrupulous debt marketing companies have been using this as a business model for years. They lure you in with the low-interest rate, string you along for a week, and then let you know that you don’t qualify for a loan. They then offer you some very expensive alternative debt options.

Is Taft Financial Legit or a Scam?

Crixeo awarded Taft Financial a 1-star rating (data collected and updated as of November 15, 2020). We hope the information below will help you make an educated decision on whether to do business with Taft Financial.

- Taft Financial operates two websites, Taft Financial com & My Taft Financial com.

- Taft Financial is part of a collection of almost 50 web sites that we have discovered. All of which are affiliated and listed below.

- Our belief is that Taft Financial operates so many different web sites in order to escape the tremendous amount of negative complaints and articles on the internet.

- We advise caution when working with Taft Financial. The affiliated web sites have multiple negative reviews and scam complaints.

- Taft Financial operates under the sovereign protection of the Mandan, Hidatsa and Arikara Nation (a/k/ MHA Nation), a Native American Tribe.

- The MHA Nation is heavily involved in the business of internet payday lending.

Who Is Taft Financial Affiliated With?

Taft Financial may likely be affiliated with the following web sites:

- Georgetown Funding

- Patriot Funding

- Memphis Associates

- Tate Advisors

- Plymouth Associates

- Safe Path Advisors

- Silvertail Associates

- Malloy Lending

- Polo Funding

- Jackson Funding

- Dune Ventures

- Braidwood Capital

- Snowbird Partners

- Tiffany Funding

- Nickel Advisors

- Coral Funding

- Neon Funding

- Cobalt Advisors

- Saxton Associates

- Hornet Partners

- Colony Associates

- First State Associates

- Polk Partners

- Ladder Advisors

- Corey Advisors

- Pennon Partners

- Jayhawk Advisors

- Clay Advisors

- Great Lake Associates

- Pine Advisors

- Alamo Associates

- Punch Associates

- Steele Advisors

- Grand Canyon Advisors

- Glider Lending

- Lucky Marketing

- Golden State Partners

- Pine Advisors

- Derby Advisors

- Graylock Advisors

- Tuck Associates

- Punch Associates

- Keel Associates

- Ballast Associates

- Tweed Lending

- Concourse Lending

- Graphite Funding

- August Funding

- Broadstar Financial

- Salvation Funding

- Stallion Lending

- Pebblestone Financial

- Sussex Funding

- Lafayette Funding

- Guardian Angel Funding

- Bridgeline Funding

Taft Financial Reviews and Ratings

Taft Financial and its affiliated web sites are not accredited by the BBB and have been the subject of numerous complaints and negative press under different names.

Sinew Management LLC BBB Reviews & Complaints

Now Taft Financial is apparently operating under the name Sinew Management Group LLC

Here is what the BBB has to say about Sinew Management LLC:

Pattern of Complaint: BBB files indicate that this business has a pattern of complaints concerning consumers received information, called and received different information and debt consolidation was agreed upon/changed to another or not fulfilled. On 2/8/19, BBB submitted a written request to the company encouraging them to address the pattern of complaints. As of 3/6/19, BBB has had no response

Complaint Type: Problems with Product/Service

Status: Unanswered

Date: 01/22/2019

On September 21, 2018 I applied for a loan with TWEED LENDING, I was contacted by Michael M. and offered a debt consolidation offer instead, I was promised all my credit card debt and loans will be taking care in a couple months if I pay them 723.91 monthly; I signed a contract and I was asked to cancel all my automatic payments, Michael promised he will contact the companies and settle with them after they receive the first payment; 4 months have passed and no settlement have been agreed, the credit card companies keep calling me daily threatening me with taking me to collection,

I tried to reach Michael for the past 2 months but he is not picking his phone or returning my calls; I tried to call TWEED LENDING directly and they put me on hold for a couple minutes then hang out, at this point, I’m desperate and don’t know what to do, my credit is ruined already and I don’t think I will recover soon, I just want them to fullfil their contract so I can start rebuilding it

Complaint Type: Problems with Product/Service

Status: Unanswered

Date: 01/22/2019

I was lured into Concourse Lending to do a debt consolidation loan. In which changed to another type of program. I have been promised a number of different things and to no avail neither has been done or even happened.

Complaint Type: Problems with Product/Service

Status: Unanswered

Date: 8/07/2018

I received a mail advertisement for a debt consolidation loan stating I was preapproved for up to 70,500 with 3.99% interest. The letter included a reservation number and directed me to call or proceed online I went to the website, put in my code, and got a pop up saying that a loan consultant would be in touch with me in 1-2 business days The next morning (8/15/18) at 10:30am EST, I received a call from Brandt * with “Finance Solutions,” asking me to return his call regarding my loan request.

I called him back – and we spoke for about 10-15 minutes. I gave him lots of sensitive personal information – and gave him authorization to run my credit. He said he would call me back before end of business and let me know what they could offer me. No call back. I waited until about noon the following day (8/16/18) – and called Brandt * again. Of course he didn’t answer, so I left a message. I asked him to please return my call by the end of the day. Even if he had bad news, I really wanted a call back. I explained that I had given him lots of sensitive information – and now I was growing concerned to whom did I just divulge all of this information to… No call back.

That evening, I called the number on the letter that I was mailed – of course it is a call center, and they had no way of transferring me to the “loan center” but the man I spoke with said he would email the finance department and request someone call me ASAP No call back. The following morning (8/17/18) I called the call center again – and begged to speak to a supervisor.

They put me in touch with a supervisor at the CALL CENTER – who said that she had no way of reaching anyone in the “loan center” except via email (which had already been done). I again explained my concern to her. She listened, but couldn’t really do anything. She sent another email to the “loan center” requesting someone call me. I STILL have not heard from anyone. WHO DID I JUST GIVE ALL MY PERSONAL INFO TO???

Complaint Type: Problems with Product/Service

Status: Unanswered

Date: 6/26/2018

I received an offer for debt consolidation when I researched the business on the internet the contact information was different than the letter contact information. The 1800 number was different on the mailing than the website listed. The website did not come up on a google search I had to use the .com address provided on the letter. When I called the contact number on the website and questioned the customer service representative she had no answer and became snarky on the phone.

She would not do anything other than say “May I begin your intake now”. I informed her I considered this company fraudulent due to the inconsistency and lack of professionalism on her part. She responded “okay Maam if that is what you want” and hung up on me. I am concerned this company is not a legitimate business, I would have liked a debt consolidation but I must be reassured in some way that a company is not fraudulent.

MEC Distribution LLC

At one time, Taft Financial and its affiliated web site operated under the name MEC Distribution, LLC. The Better Business Bureau put out its first alert about this enterprise in February 2018:

In February 2018, BBB staff visited the Fargo ND addresses provided by MEC Distribution and found that all locations were vacant and the building management explained that although the rent was paid by MEC Distribution, the office spaces were not used. MEC Distribution LLC provided BBB with a mailing address for complaint handling in Bloomfield Township Michigan. BBB’s mail to that address has been returned as ‘not deliverable as addressed- unable to forward’. At this time, BBB does not have a physical location for this business.

BBB has confirmed with the North Dakota Department of Financial Institutions that Lafayette Funding is not licensed in North Dakota as a debt settlement firm. Furthermore, BBB has contacted building management at the address Lafayette Funding claims in Bismarck, North Dakota, and learned that Lafayette is not located at that address. BBB advises extreme caution when dealing with this entity.

In February 2018, BBB staff visited the Fargo ND addresses provided by MEC Distribution and found that all locations were vacant and the building management explained that although the rent was paid by MEC Distribution, the office spaces were not used. MEC Distribution LLC provided BBB with a mailing address for complaint handling in Bloomfield Township Michigan. BBB’s mail to that address has been returned as ‘not deliverable as addressed- unable to forward’. At this time, BBB does not have a physical location for this business.

Taft Financial BBB Reviews

You won’t find a BBB file on Taft Financial because the complaints haven’t started rolling in yet. However, we examined some complaints from its affiliated web sites:

Cathy M. – 1 Star Review

They have changed their name to Salvation Funding. After seeing this rating I see why. I don’t know how they got my info but they need to he stopped.

Terry W. – 1 Star Review

Beware of bait and switch mailer. Terms are “extremely different” than advertised! It’s a waste of time.

My purpose is to help others realize this is a waste of time! Pebblestone Financial advertising is definitely deceptive in my opinion. After my conversation with Fred, his response was, “we can definitely help… I will call you tomorrow morning with the details…have pen and paper ready to write down the numbers.” The mailer does include in fine print…This notice is not guaranteed if you do not meet select criteria.”

It also further states: “This notice is based on information in your credit report indicating that you meet certain criteria.” In my case, I am not late on any payments, nor will I be. I am current on all outstanding debt and my credit history demonstrates this. When Fred call the next morning…his terms were totally ridiculous and in my opinion “predatory lending”.

When I ask Fred… are these the terms of the Pebblestone offer, he replied yes. I replied, I’m not interested in those terms and he hung up the phone immediately without further conversation.

The reason I responded to the Pebblestone Financial offer was to consolidate and simplify with one payment and take advantage of the low pre-approved rate averaging 3.67%. While I’m currently paying between 10.9% and 12.9% to the credit card companies…this offer was attractive. The mailer stated in LARGE BOLD PRINT: You have been pre-approved for a Debt Consolidation Loan with a rate as low as 3.67%. The pre-approved loan amount was actually $11,500 more than my total debt consolidation.

In summary…this is definitely a “Bait and Switch” scheme in my opinion. I checked BBB comments before responding to this offer and did not see negative feedback. Now I’m seeing other very similar responses with the same “Bait and Switch” experience. Hopefully, this will help others avoid the wasted time in discovering these unethical practices of Pebblestone Financial.

8002242927:

Beware Of Taft Financial

Why Do We Focus On Taft Financial’s Negative Reviews?

We urge you to do your own research and due diligence on any company, especially when dealing with your personal finances. We urge you to pay attention to what you find on the internet. Compare the good vs. the bad and make an educated decision. From our experience, where there is smoke…there is fire. But you make the call.

Enough about Taft Financial – let’s learn something today!

Has Your Credit Score Dropped During the Coronavirus Pandemic?

Has the COVID-19 pandemic left you in a difficult financial position? You are not alone. Taking on debt to pay off your bills can cause your credit score to drop quickly.

If your credit has been affected by the pandemic, you must start rebuilding it right away. The longer you wait, the worse your credit score problem will become. A poor credit score will limit your options and prevent you from improving your financial situation in the long run. A low credit score, for example, can stop you from paying off your debt with zero-interest offers or consolidating it by taking a larger FL debt consolidation loan.

You need to carefully diagnose the problem behind your credit score to fix it. Let’s look at how you can go about doing so:

You Must Find Out Why Your Credit Score Dropped

You need to know what s impacting your credit score negatively before you start rebuilding it. There are two common factors that have been impacting credit scores during the Coronavirus pandemic:

- High credit utilization: The ratio of how much you owe in debt compared with how much credit you have is called the credit utilization ratio. This ratio is a critical part of your credit score. You must use less than 20% of your total credit to keep a high score in an ideal situation. If due to the pandemic, you spent more, causing the card authority to cut your limit, your credit utilization ratio could be very high.

- Neglect of one or more due payments: If you have not paid one or more of your due bills for 30 days or longer, it is definitely the reason why your credit score is hurt so badly. Your payment history is the most important factor taken into consideration when calculating your credit score.

Sadly, both of these issues can occur simultaneously. If you don’t have the funds to pay your bills on time, your credit card balance will increase, and when you are unable to pay that balance, your credit score drops significantly.

In cases where you are unsure of what is affecting your credit score, use a credit score tool that can help. Many credit card companies offer tools to their customers. You can also make use of several online, free credit card tools to find out.

Let’s look at what you can do to improve your credit score and rebuild it, given each of the two situations explained above.

When You Are Delinquent on One or More Payments

The first thing you need to do is at least start making minimum payments towards your debts as soon as possible. Start by paying off higher interest debts first. This will not undo the harm caused to your credit score but will prevent it from any further damage. Don’t let your payments get later than they already are. A payment late by 60 or 90 days is much worse than one late by 30 days.

If you have not yet reached 30 days after due payment, you can still prevent the payment from harming your credit score. Creditors are only authorized to report payments that have been late for more than 30 days on your credit history. Even if you make a payment on the 29th day, your credit score will not be affected. However, you might incur a late fee charge.

What if you are unable to make even the minimum payments? The pandemic has hit everyone hard. Thus, creditors have created hardship plans that you can take benefit of. Contact a creditor to get assistance regarding hardship plans. You might be able to get lower monthly payments or put your payments on hold altogether.

You can also consider refinancing your debts via debt consolidation if you cannot make minimum monthly payments. CA Debt consolidation loans can get you lower monthly payments and lower interest rates than those you would incur making individual debt payments. Balance transfer of credit cards is another great option to pay off your debts. However, both these options require you to have a somewhat fair credit score but not entirely bad.

When your Credit Utilization Ratio is Very High

Some credit card companies have reduced cardholder credit limits during the pandemic. If your card issuer has done so, it means you have less total credit. This will cause your credit utilization ratio to increase. You should try calling your card issuer and ask them to restore your original line of credit. That’s what many consumers have been doing to ensure their utilization ratio does not increase.

However, if your credit card’s balance has been continuously rising, it’s not easy to just pay it off. It would be best if you first found ways to reduce your credit utilization ratio, such as:

- Getting a credit line increase from a credit card issuer.

- Making payments as soon as they are due. Companies report balances after the statement closing date, so if you pay your bill before this date, the company will report a lower balance.

- Opening a new credit card to increase your total credit. Go for a balance transfer card if you qualify for it.

- Getting a personal loan to pay off credit card debt.

Rebuilding Your Credit Score

There is no issue you cannot fix. It might take some time, but you can defiantly fix any credit issue you have. Whether you are dealing with a high credit utilization ratio or have pending delinquent payments, you will soon notice your credit score going back up if you make an effort to recover it.

No Comments

Visitor Rating: 2 Stars